With Canada’s latest grocery inflation figure for May coming in at 9.0% and its food banks seeing record usage over the past several months, Canadian consumers have been struggling to feed themselves. In spite of this struggle, Empire Companies Limited (TSX: EMP), which owns several grocery chains including Sobeys and Longos, and is considered one of Canada’s “Big 3” grocers alongside Loblaws and Metro, indicated this past week that they would be expanding their stock buyback program.

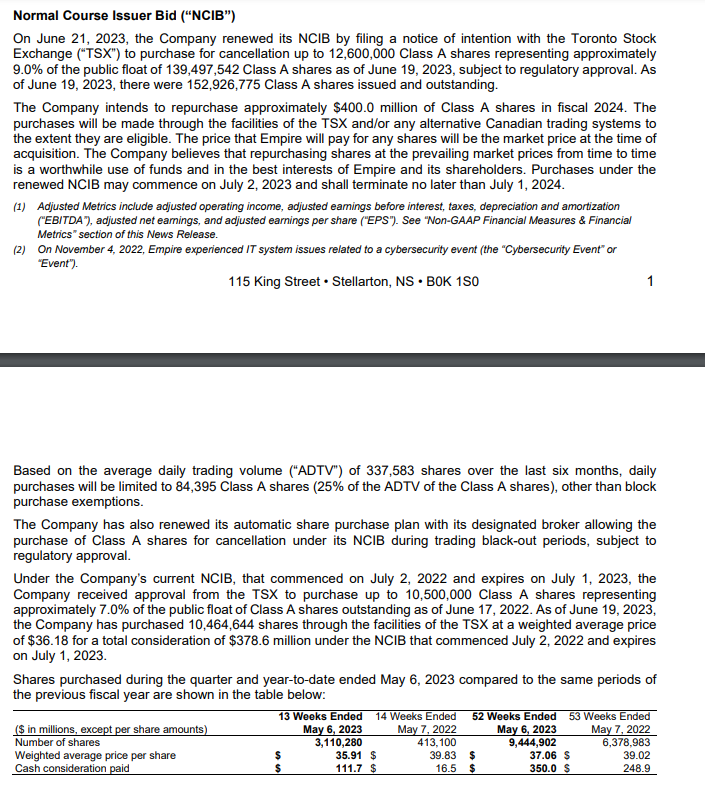

In Empire’s fiscal 2023, which ended on May 6, 2023, the company purchased 9,444,902 of their Class A Shares for cash consideration of $350 million. This represented a more than 40% increase over the company’s previous fiscal year ending on May 7, 2022, where the company spent only $248.9 million on buybacks.

The company’s current buyback program, which began on July 2, 2022, and expires this coming July 1, 2023, gave the company approval to repurchase 10.5 million of their Class A Shares, representing approximately 7.0% of their public float. The company’s new buyback program is seeking to purchase for cancellation up to 12.6 million Class A Shares which would represent approximately 9.0% of the public float of 139,497,542.

For the company’s coming fiscal 2024, Empire stated their intention to repurchase approximately $400 million of their Class A shares. Combined with the previous 2 years of buybacks, this would net out to just under $1 billion in stock buybacks over a 3-year period.

The Oligopolies Who Run our Grocery Stores

Empire’s actions aren’t unique for a Canadian grocer, as both Loblaws and Metro have also been continuing to buyback their shares throughout the high inflationary environment. While these companies may genuinely believe that their shares are undervalued and that these purchases represent a prudent use of capital, they run the risk that expanding these buyback programs when consumers are being squeezed as badly as they are could result in regulatory ire.

We recently covered a similar story, in regards to Galen Weston over on our YouTube channel. Where we discover that Galen, the largest shareholder of Loblaw (TSE: L), via his ownership in George Weston (TSE: WN), has seen his wealth increase by billions of dollars in equity and made hundreds of millions in dividends since the start of the pandemic.

And Then There is the Food Banks…

Of course, there is no shortage of headlines for food banks across Canada that are on the brink.

The Durham Region is catching the food bank fever.

Ditto for Toronto.

Food banks across Canada are expected to serve 60% more people per month in 2023 compared to the previous year, according to a report by Second Harvest. Second Harvest is a national food rescue organization that redistributes food, which otherwise would end up in landfills, to those in need.

In 2022, food banks and similar programs served about 5.14 million people per month, but this number is expected to surge to over 8.2 million in 2023. Moreover, this escalating demand follows a year that witnessed a staggering 124% increase in people accessing non-profit food services. Lori Nikkel, CEO of Second Harvest, has been vocal to the media that the increase is not only among the unemployed, but also among those who are employed but struggling to make ends meet due to rising food costs and inflation.

We hope Sobeys, Loblaws and Metro’s shareholders are all enjoying their share buybacks during such a difficult time.

Information for this story was found via Sedar, CBC, Durham Region News, Twitter and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.