As the economy slowly begins to climb out from April’s rock bottom, many Canadians continue to struggle with finding a stable form of employment following the coronavirus economic collapse. Although the federal government has several income subsidies in place such as the Canada Emergency Response Benefit, the October phase-out date is only a mere months away.

As a result of continued uncertainty surrounding employment prospects for millions of Canadians, advocates along with various MPs and senators have called on the parliamentary budget office to research several scenarios for the implementation of a guaranteed minimum income. The UBI is being viewed as a way of filling in the gaps where other government benefits and subsidies experience shortcomings.

In response to the increased interest in the implementation of a basic income for Canadians, the budget watchdog released a report outlining the resulting costs for the federal government. According to Yves Giroux’s research, such a program could cost anywhere between $47.5 billion to $98.1 billion for a six-month duration. That would translate to an average benefit between $4,500 and $4,800 for qualifying Canadians aged 18 to 64.

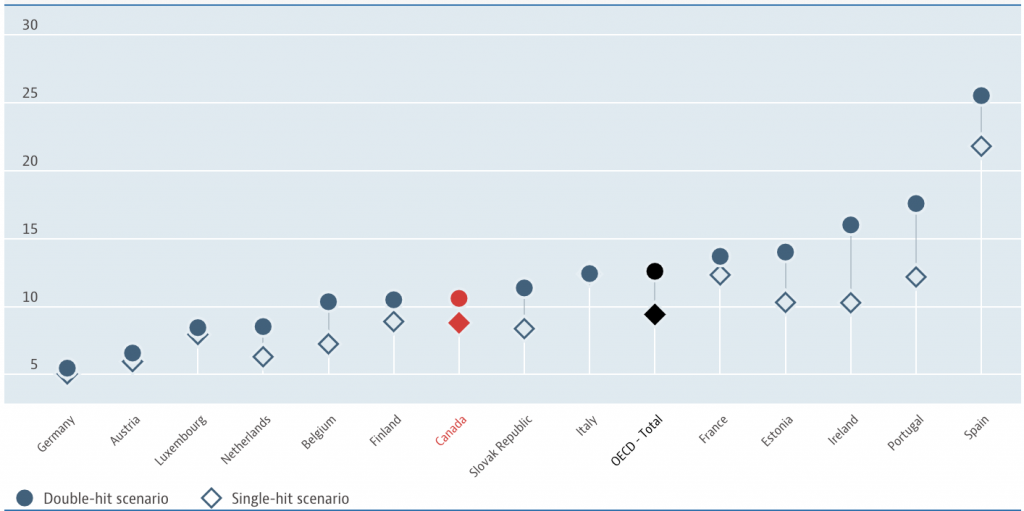

With such a hefty price tag, a basic-income program for Canadians would certainly be met with opposition. However, according to Giroux’s estimates, up to $15 billion worth of tax measures could be used to offset the resulting financial impact. In addition, the actual cost of the program would rely heavily on the rate at which businesses are rehiring employees following the pandemic’s economic collapse. According to the Organization for Economic Co-operation and Development (OECD), the estimated Canadian unemployment rate was at 11% in the second quarter of 2020, with a decline to 7.7% by the end of the year.

Information for this briefing was found via Bloomberg and OECD. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.