Two-thirds of Canadian businesses expect their costs to rise and most would increase selling prices if widespread tariffs are implemented, according to the Bank of Canada’s Business Outlook Survey for the first quarter of 2025 released on Monday.

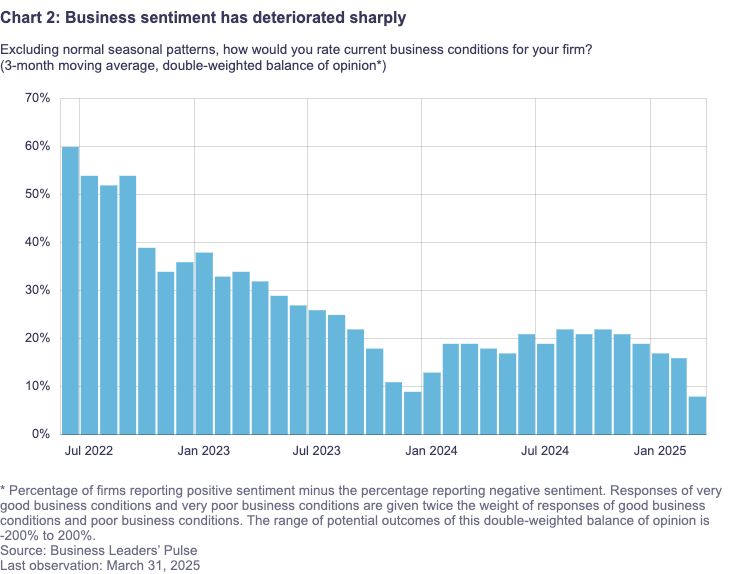

The survey reveals a sharp deterioration in business sentiment driven by trade conflict with the United States, with 32% of firms now assuming a recession will occur in Canada over the coming year, up from 15% in previous quarters.

“This survey and consultation period was characterized by pervasive uncertainty created by the sudden and unpredictable shifts in US trade policy,” the report said.

Around 40% of firms expect lower sales growth if tariffs are implemented, with exporting companies particularly concerned. The survey found that sales outlooks have softened significantly, especially for exporters who anticipate a sharp slowdown as US tariffs make Canadian goods more expensive in American markets.

Two-thirds of businesses believe their costs would rise if widespread tariffs are implemented, with most firms indicating they would increase their selling prices as a result. Companies cited several factors already pushing costs higher, including the depreciation of the Canadian dollar, pivoting to more expensive non-US suppliers, and tariffs on other countries working through supply chains.

Investment intentions have also declined to their lowest level since the COVID-19 pandemic, with tariff uncertainty weighing heavily on decision-making. Around 32% of firms now assume a recession will occur in Canada over the coming year, up from 15% in the previous two quarters.

“In the current economic environment, many businesses are delaying important decisions, such as those related to investment and hiring, until they have a clearer outlook,” the report noted.

Hiring plans are similarly constrained, with employment intentions at their lowest point since the pandemic. Firms attributed this to soft demand, tariff uncertainty, and minimal capacity pressures.

Despite these concerns, the survey found some positive indicators. Labor shortages have eased, with firms reporting it is easier to find workers now than at this time last year. Additionally, some businesses noted strong domestic demand for commodities like oil, gas, and lumber could potentially offset some negative impacts from US tariffs.

The Bank of Canada survey is based on interviews with senior management from about 100 firms selected to reflect the composition of Canada’s gross domestic product.

Information for this story was found via the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.