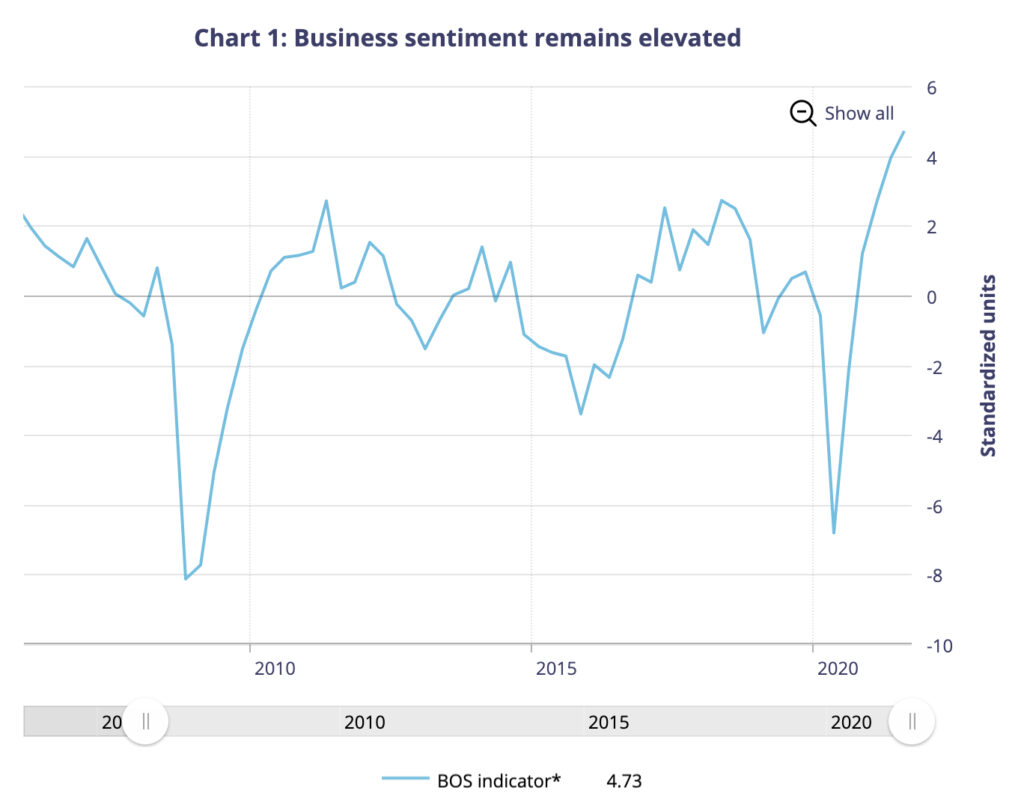

Business sentiment across Canada rose to a record-high in the third quarter, amid a strong improvement in domestic and foreign sales, However, an increased number of businesses are forecasting elevated inflation levels that will persist well into next year, as well as worsening labour shortages.

According to the Bank of Canada’s third quarter Business Outlook Survey, overall sentiment across Canadian firms soared to the highest on records dating back to 2003, amid a broad anticipation that demand growth from both domestic and foreign markets will remain strong. As a result, a large proportion of firms revealed that they plan to raise staffing and capacity levels over the next 12 months.

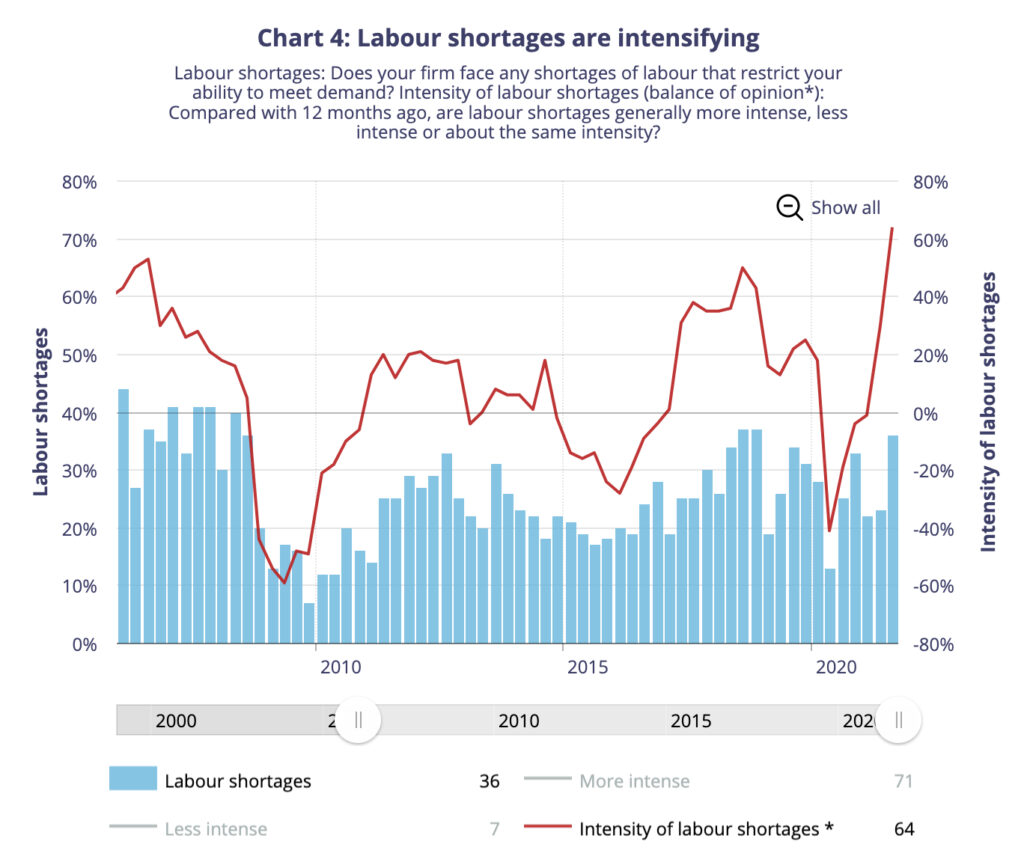

However, those same businesses also said that a lack of available labour and supply bottlenecks will likely create obstacles in the event of an unexpected surge in demand. As a result, an increasing number of firms indicated that they plan on making greater investments in capital compared to before the pandemic, as well as boost hiring intentions— a positive move for the country’s recovering labour market.

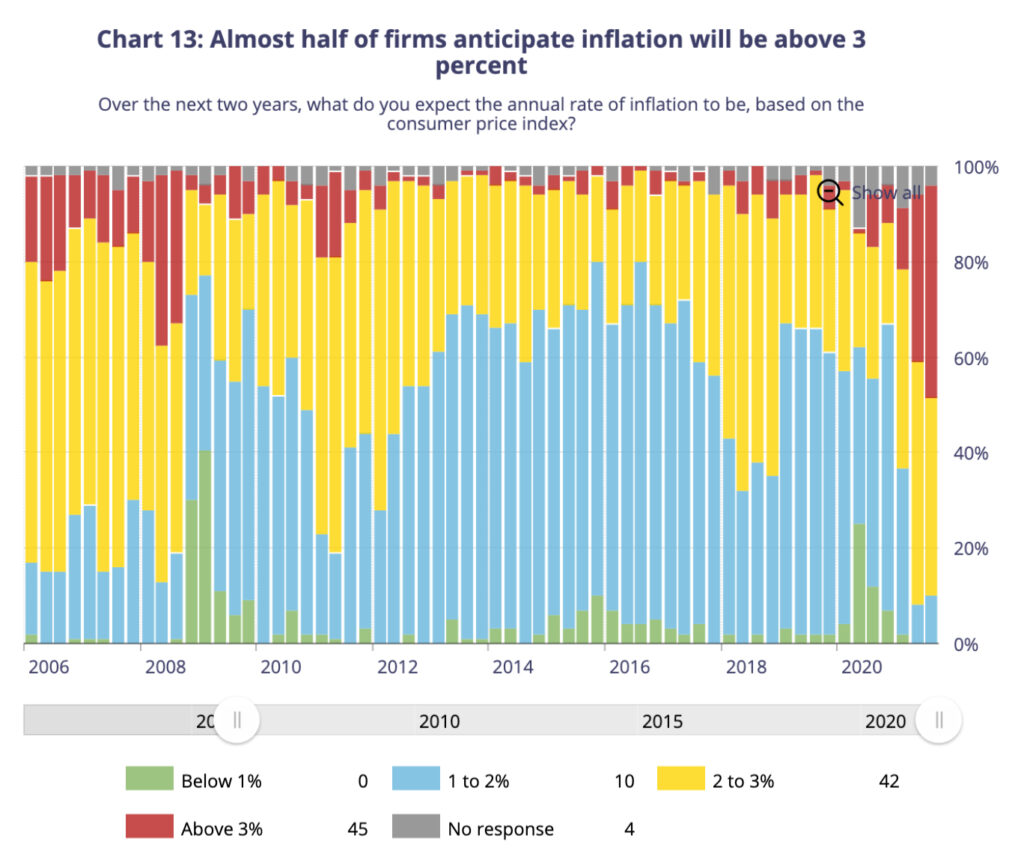

Still, capacity pressures remain, which has forced some businesses to increase wage growth in an effort to retain and hire new workers. In response to rising labour costs, firms have revealed they will raise their selling prices, pushing inflation expectations even further. Nearly half of the respondents surveyed said they anticipate inflation will remain above 3% for the next two years, largely due to supply chain disruptions, food and energy price pressures, and monetary and fiscal stimulus spending.

Information for this briefing was found via the Bank of Canada. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.