The Canadian economy might be headed for a “mild recession” should the Bank of Canada hike the interest rate more aggressively to 3.5%, according to the Canada Mortgage and Housing Corporation.

Bob Dugan, CMHC’s chief economist, explained the two possible interest rate scenarios and how they would affect the country’s economy, specifically the housing market.

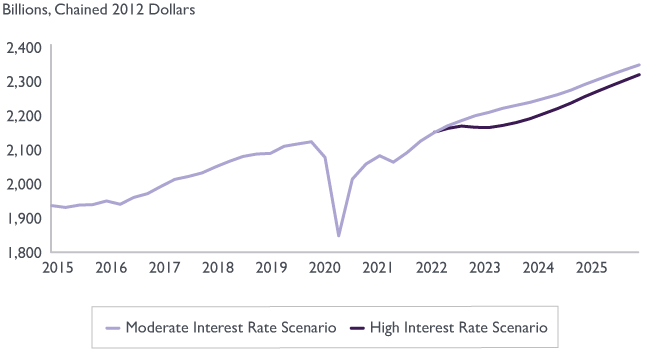

The so-called neutral policy rate sees the borrowing cost reaching 2.5% while the high interest rate scenario projects the central bank hiking the rate to 3.5%. In both scenarios, an economic slowdown is projected.

“The moderate scenario sees Canadian GDP (Gross Domestic Product) grow by 4.1% in 2022 and 2.2% in 2023,” Dugan wrote. “On the other hand, the higher rise in the policy interest rate in the high interest rate scenario results in lower growth. Here, GDP is predicted to grow by 3.4% in 2022 and 0.7% in 2023.”

“These two quarters register marginal negative growth, signifying a mild recession in the high interest rate scenario,” he added.

Source: CMHC

| Comparison of interest rate scenarios | Current | Neutral Policy Rate Scenario | High Interest Rate Scenario |

| Interest Rate | 1.5% (June 2022) | 2.5% | 3.5% |

| GDP | 0.8% (Q1 2022) | 4.1% (2022) 2.2% (2023) | 3.4% (2022) 0.7% (2023) |

| Unemployment Rate | 4.9% (June 2022) | 6.2% | 7% |

| MLS® Home Price Index | 19.8% increase year-on-year | 3% decline | 5% decline |

| Average Home Sales | 21.7% decline year-on-year (May 2022) | 29% decline | 34% decline |

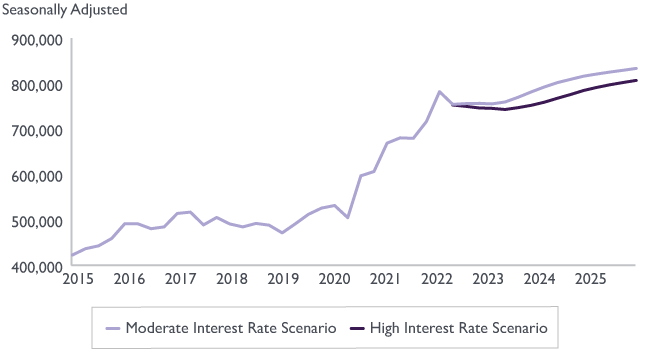

As it relates to the housing market, the hike in interest rates is seen to effect a decline in home prices down the line, contracting by as much as 5% in the higher scenario and 3% in the neutral rate scenario.

“The expected increases in borrowing costs contribute to a further slowdown in house price growth in 2022 and 2023,” Dugan wrote.

Similarly, home sales are expected to decline by 34% should the high interest rate hike route take place, and by 29% if the hike is based on the neutral rate scenario.

Latest statistics from the Canadian Real Estate Association show home sales continuing the downward trend, falling 8.6% month-on-month and 21.7% year-on-year in May. Price point has also marginally declined by 0.8% from the previous month.

Source: CMHC

After Canadian inflation soared to a 39-year-record high of 7.7%, most economists believe that the Bank of Canada will be forced to raise the interest rates once more by 0.75%.

The Bank of Canada is set to release its interest rate decision on Wednesday.

Information for this briefing was found via Canada Mortgage and Housing Corporation. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.