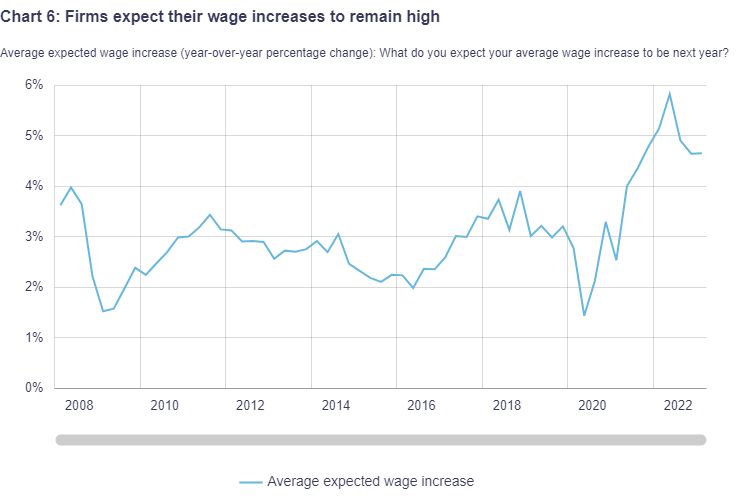

Canadian businesses are feeling the pinch of rising interest rates and tighter monetary policy. However, firms project rising wage pressures, and inflation to remain above the Bank of Canada’s target range of 2% until at least 2025.

The central bank’s first quarter Business Outlook Survey showed business sentiment remained stagnant, in line with expectations of a slower sales growth period otherwise typical of an economic contraction and normalization to pre-pandemic supply and demand activity. However, respondents indicated that labour shortages are the second most important predicaments they’re facing, with the average size of forecasted wage increases sitting well above historical levels.

Firms’ inflation expectations also eased somewhat last quarter, but still feel that persistent energy prices will continue to fuel future inflation. Still, even though an increased number of businesses’ short-term inflation forecasts have trended lower, most respondents said they foresee price pressures remaining “well above the Bank of Canada’s 2% target range until at least 2025.” For the firms believing inflation will fall into the range within two years, they attest the decline to monetary actions over the past 12 months.

Information for this briefing was found via the Bank of Canada. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.