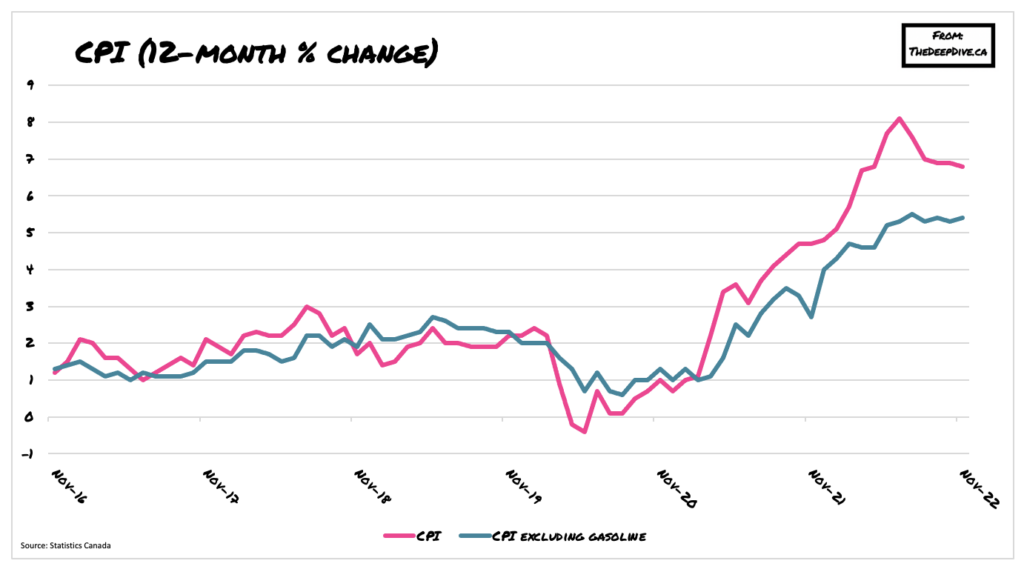

Consumer prices across Canada remained elevated in November, as core inflation fails to cool. Particularly, Canadians’ wallets continue to face unprecedented hardship when it comes to food and shelter costs.

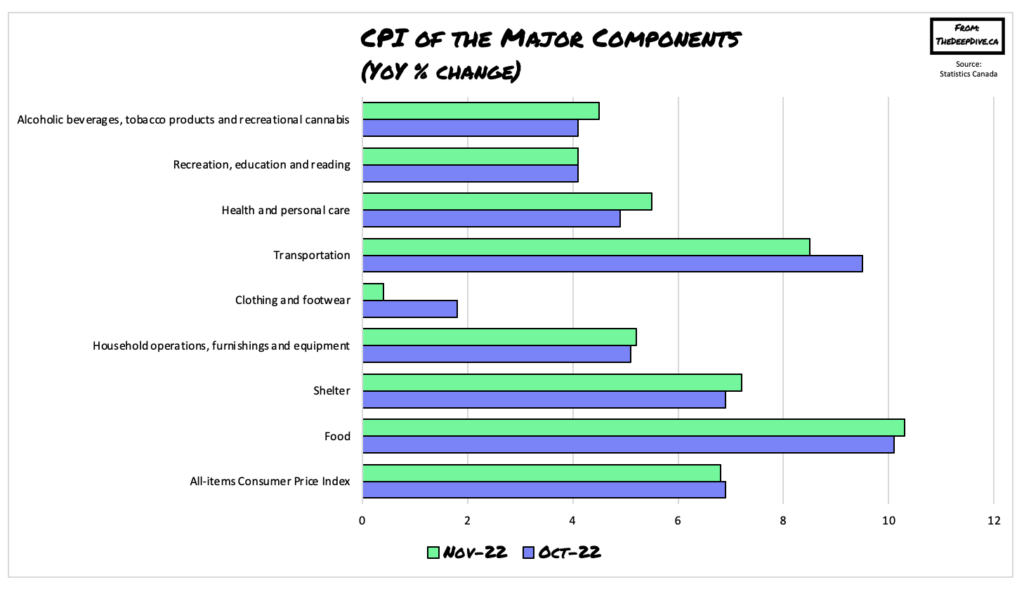

Latest data from Statistics Canada shows consumer prices rose 6.8% year-over-year last month, a slight drop from October’s 6.9% reading and above the 6.7% forecast by economists. Food and energy aside, core CPI jumped 5.4% on an annual basis, following a 5.3% increase in October.

Canadians paid 3.6% less for gasoline last month, following a 9.2% increase in October due to the reopening of refineries in the western US. Still, gasoline prices were 13.7% higher compared to the same period one year ago. Food inflation, meanwhile, continued to create undue hardship on Canadians’ wallets, with grocery prices rising faster than overall CPI for the 12th consecutive month.

With the Bank of Canada aggressively hiking borrowing costs, the shelter index continued to rise at a faster pace in November, increasing 7.2% year-over-year— the largest such increase since February 1983. Mortgage interest costs jumped 14.5% from 12 months ago, compared to an 11.4% increase in October. With rising interest rates creating a barrier to homeownership, rent prices also underwent upward pressure last month, increasing 5.9% from November 2021.

Conversely, growth in the the homeowners’ replacement cost index slowed last month, increasing only 5.8%. The owned accommodation expenses index— which accounts for realtor commission fees, increased only 3.7%, suggesting an overall cooling in Canada’s housing market.

Information for this briefing was found via Statistics Canada. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.