Canadian Copper (CSE: CCI) became the latest issue to hit the Canadian Securities Exchange, experiencing its first day of trading today. The firm is primarily focused on the Bathurst Mining Camp, located in New Brunswick, Canada.

While the company currently have five projects under option in the Bathurst Camp, its flagship property is referred to as the Chester Project, which is said to have known copper resources. While the property was never commercially mined, a 470 metre decline was placed on the property in 1975, which confirmed high grade copper at over 2% copper, and saw a 35,000 ton bulk sample conducted.

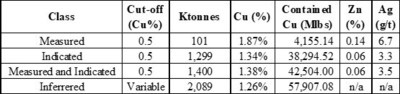

While historical in nature, a resource estimate exists for the property that outlines 42,504 million pounds of measured and indicated copper at 1.38%, with a further 57,907.08 million pounds of inferred copper resources at 1.26% copper.

In terms of drilling, 2021 saw two separate drill programs conducted on the property. The first consisted of a phase one, 33 hole program conducted with 3,924 metres drilled in aggregate. The second program saw a further 26 holes across 2,139 metres completed under a phase two program.

Canadian Copper is said to have five main objectives for the project currently, including:

- Validate the historical resource estimate

- Identify gaps in the historical resource

- Explore for gold and silver mineralization within gossanous areas

- Explore below known resource limits for feeder zones

- Conduct regional exploration on geochemical and geophysical anomalies

With that being said, prospecting is said to begin on the Chester property, as well as the firms Murray Brook West and Turgeon properties and is set to be conducted throughout the remainder of the year. Structural mapping, geochemical samples and trench are set to occur under this plan, with the company looking to identify drill targets for both 2022 and 2023.

Finally, a mineral resource estimate is currently slated to be released in the second half of the year for the Chester property.

Canadian Copper last traded at $0.15 on the CSE.

FULL DISCLOSURE: Canacom Group, the parent company of The Deep Dive, is currently long Canadian Copper. Not a recommendation to buy or sell. We may buy or sell securities in the company at any time. Always do additional research and consult a professional before purchasing a security.