FULL DISCLOSURE: Canadian Copper is a sponsor of theDeepDive.ca.

Canadian Copper Corp (CSE: CCI) has announced plans to raise $10.0 million via a non-brokered private placement in support of their intention to secure the Caribou Processing Complex in Newfoundland.

The funding round is expected to largely be covered by Ocean Partners, who has committed to a lead order of up to $8.0 million as part of the financing. The large investment is expected to increase the ownership position of Ocean Partners from 4.7% to 29%, subject to minority shareholder approval. Canadian Copper CEO Simon Quick is also expected to participate in the financing.

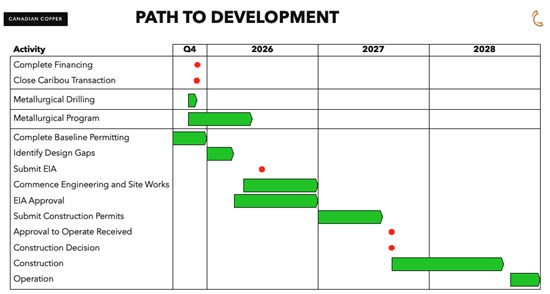

Funds from the financing will see $6.0 million go towards the Caribou transaction, with customary closing conditions on the purchase expected to occur in the fourth quarter. In an effort to advance the development of the project,

Canadian Copper has also identified key personnel with extensive Caribou operating experience still living in the Bathurst area that they intend to employ beginning in the fourth quarter, while a COO is in the process of being identified to execute on the engineering, permitting, and construction efforts to get the Complex back into production.

The remaining funds are earmarked for the completion of environmental baseline studies this year, as part of an effort to submit an environmental impact assessment in the first half of 2026, while funds will also be used for a 1,000 metre metallurgical drill program and identifying engineering design requirements for the Murray Brook deposit.

READ: Canadian Copper Outlines $171 Million NPV, 36% IRR In PEA For Murray Brook And Caribou Complex

The offering is set to see the company raise gross proceeds via the sale of units at $0.20 per unit. Each unit is to contain one common share and one half warrant, with each whole warrant containing an exercise price of $0.25 per share and a 12 month expiry.

“Junior mining companies need strong local, governmental, technical, and financial partners to convert development projects into producing mines. We are incredibly fortunate to have Ocean Partners involved this early in Canadian Copper and for their significant participation in this financing. Our focus is now on developing a new Canadian critical metal operation by purchasing the only permitted mill and tailings site, with access to a deep-water port in the province,” commented Simon Quick.

Canadian Copper last traded at $0.185 on the CSE.

FULL DISCLOSURE: Canadian Copper is a client of Canacom Group, the parent company of The Deep Dive. Canacom Group is currently long the equity of Canadian Copper. The author has been compensated to cover Canadian Copper on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.