It appears that the Canadian federal government has finally caved, and will be providing financial support to large, publicly traded companies struggling through the coronavirus pandemic.

The Large Employers Emergency Financing Facility will be available to Canadian companies that generate in excess of $300 million in annual revenue, and those companies will have to take on loans that are a minimum of $60 million. Then, 20% of that loan will need to be secured senior debt, and come affixed with an interest rate of 5% applicable for the first year, followed by 8% in the second year. However, the company also has the option to pay the loan in full before the year is up without any penalties.

But unlike Donald Trump who has no shame in generously propping up train-wreck companies like Boeing with taxpayer’s money, the Canadian government is going about things a bit different. There will be stringent conditions attached to the loans, including a hefty government stake in the company.

Under the terms of the Large Employers Emergency Financing Facility, the federal government will need to be presented with the option to collect the company’s stock equivalent to 15% of the loan. There is also a warrant requirement, with which the government will have the right to buy the company’s stock at a certain price. These measures will allow taxpayers to earn a profit on their money, while also holding the companies receiving the aid accountable.

In addition, the companies seeking the government’s financial aid will be barred from conducting share buybacks, dividends, as well as increasing executive salaries, or issuing bonuses. And of course lets not forget to mention the federal government’s obsession with meeting climate targets: the struggling companies will also have to issue environmental reports to let the taxpayer know how they are adhering to climate change regulations.

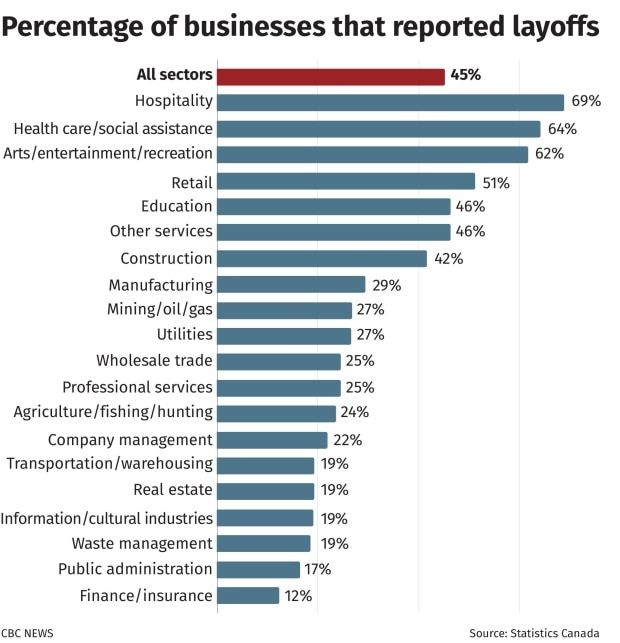

The main aim of this program is to allow particular sectors of Canada’s economy which have been significantly struggling through the pandemic crisis to grab onto a lifeline. It is anticipated that oil and gas companies will apply for the financing facility, as well as airlines and retailers. The federal government did not specify whether this would be the only loan companies will be able to apply for, or if more financing facilities will be made available at a later date.

Information for this briefing was found via CBC and Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.