It appears that despite record stimulus spending by the Federal Reserve and copious government bailouts, it did not pull the US economy out of its deeply troubled recession.

According to Commerce Department data released on Wednesday, the US economy contracted by a 31.4% annualized rate in the second quarter of 2020 – the steepest drop on records that date back to 1947. Although estimates last month called for a 31.7% drop. To put the dire state of the US economy into context, the last time a quarterly drop of such a magnitude occurred was in 1958, when the economy contracted by 10% on an annualized basis.

With respect to the third quarter which just ended in September, the GDP results will not be made public until October 29, which is only a mere five days before the US presidential election. Although US President Donald Trump is anticipating an economic rebound to factor into a potential second term, a number of economists are becoming increasingly pessimistic about a surge in economic growth. Moreover, the US economy could very easily plunge into an even deeper recession if Congress fails to arrive at another stimulus bill, or the pandemic resurfaces into a third wave.

Indeed, the lack of a stimulus bill is certainly having a toll on US consumers, which have grown reliant on the $600 per-week benefit top-up that expired at the end of July. Although weekly initial jobless claims have fallen below 1 million for several consecutive weeks in a row now, there are still millions of Americans that are dependent on the government’s two other stimulus pillars, the Pandemic Unemployment Assistance (PUA) and the Pandemic Emergency Unemployment Compensation (PEUC), which are both set to expire at the end of December.

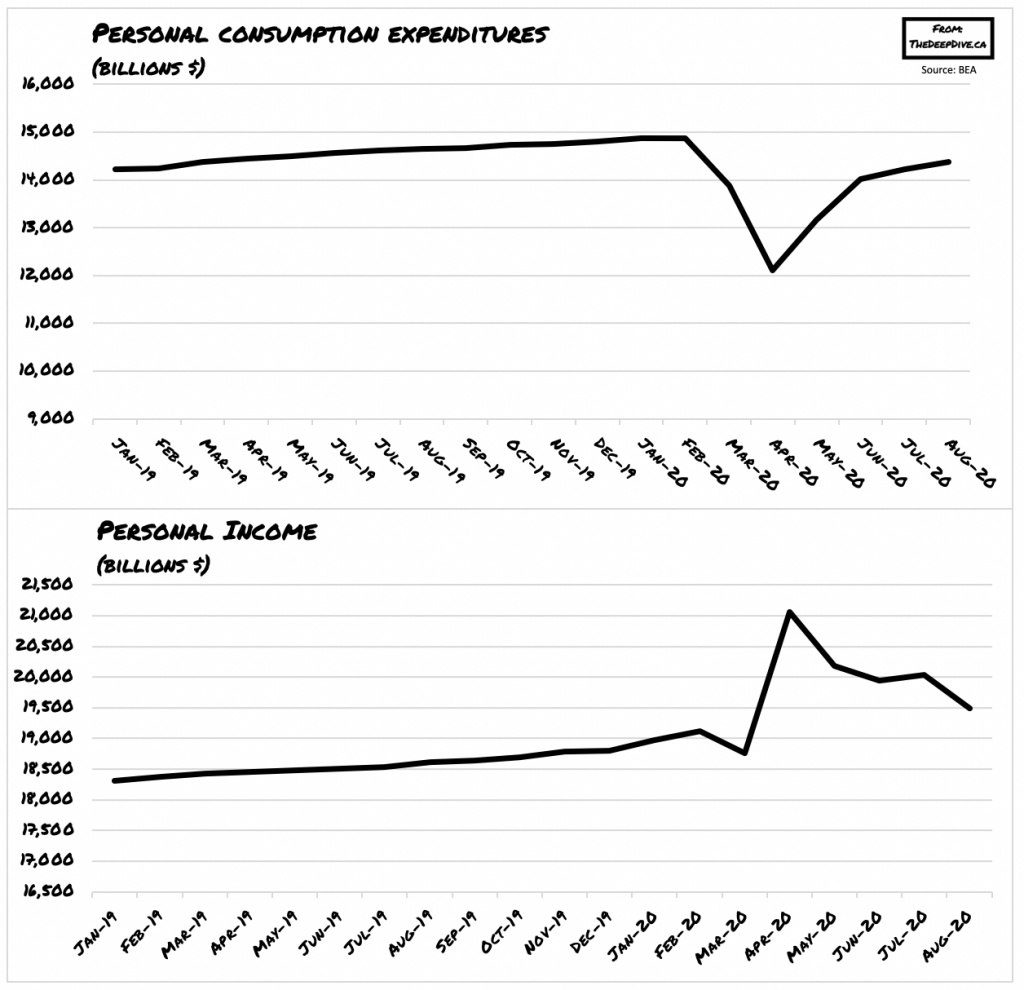

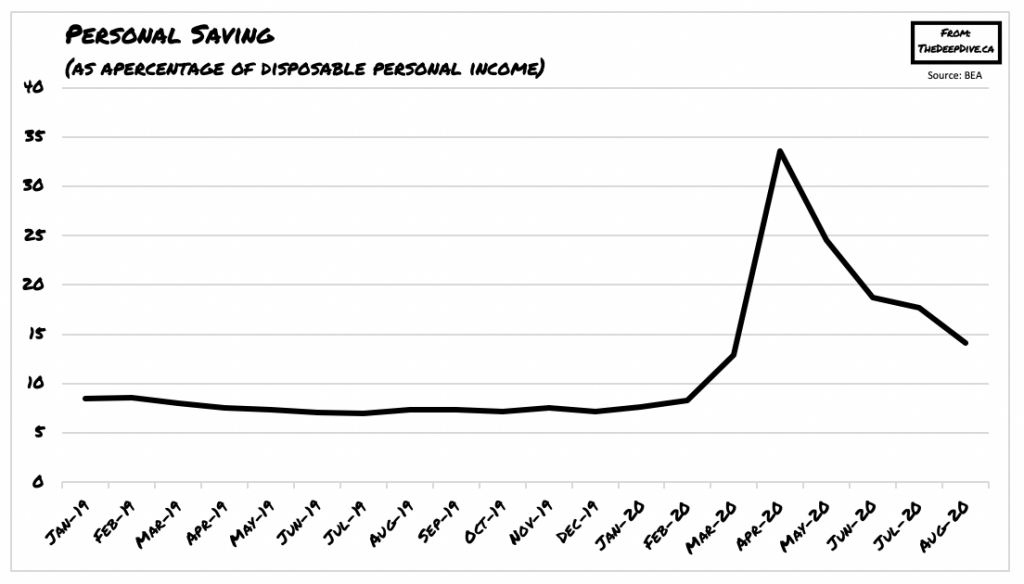

In the meantime, August data shows that personal income growth dropped by only 2.7%, while personal income declined by 2.7%. The decline in income was attributed to the elimination of the $600 weekly top-up, but was then partially offset by a slight improvement in the labour market, which caused salaries and wages to rise by 1.3% in August. On the other hand, personal spending also rose above expectations, increasing by 1%. Alas, a rise in spending may seem like an optimistic variable in a potential economic recovery, but there is just one problem: a decline in personal income paired with increased consumption means that many Americans have been burning through their savings.

Indeed, according to BEA data the month of August saw annualized savings fall by $723 billion to $2.435 trillion, which is the lowest it has been since the beginning of the pandemic in March. Simultaneously, the personal savings rate crumbled by 17.7%, which suggests that the 60% in savings that was accumulated following the CARES Act stimulus has all been burned through. This means that unless Congress introduces yet another stimulus bill, and soon, US consumption will likely once again collapse, and further push the US economy into the dark abyss.

Information for this briefing was found via the Commerce Department and the BEA. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.