Canadian home sales slumped in August as the Bank of Canada’s recent rate hike heightened affordability concerns.

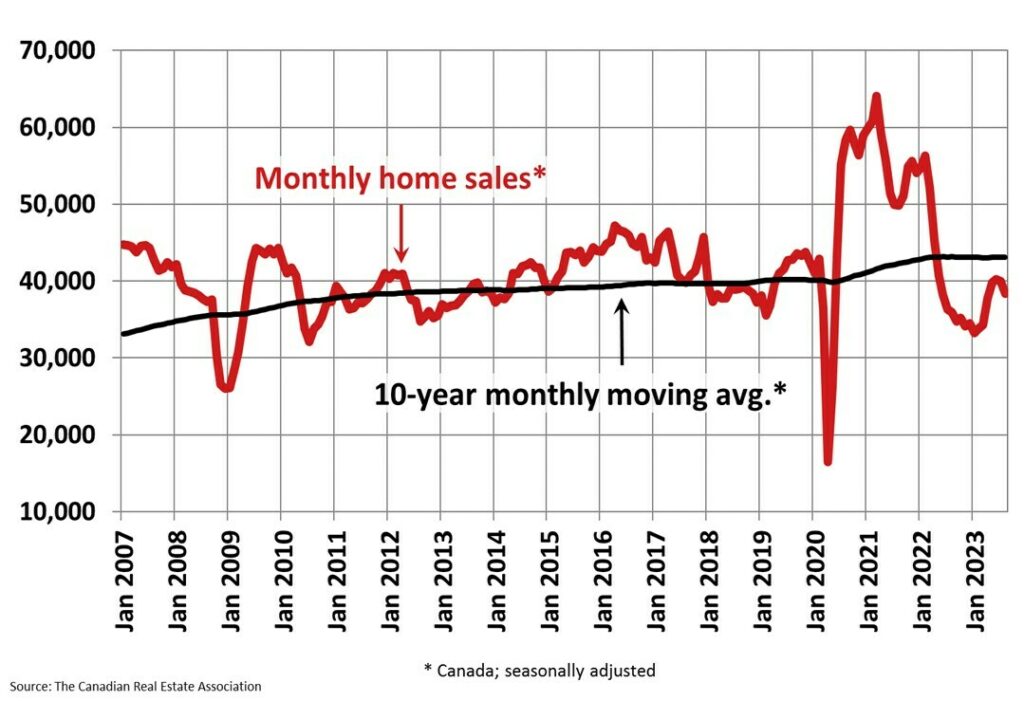

According to data from the Canadian Real Estate Association (CREA), national sales dipped by 4.1% from July, but were up by 5.3% compared to the same period one year ago. Interestingly, newly listed properties showed a minor increase of 0.8% over the previous month.

This decline in sales was prominently influenced by declines in regions such as Greater Vancouver, Montreal, and Ottawa. By August’s end, the average sale price of homes was marked at $650,140— a 2.1% rise from the previous year.

“August was the first full month of housing data following the Bank of Canada’s July rate hike, so a dip in activity was expected,” said CREA senior economist Shaun Cathcart. “The demand is obviously still there, and it will be back, but as the housing affordability crisis re-emerges as a top policy issue, for now, the slowdown on the buyer side should help keep a lid on prices.”

Despite starting the year at a 20-year low, new listings for 2023 are now nearing average figures, having gained over 24% from March to July. Meanwhile, CREA reported there about 3.4 months of inventory across Canada in August, up from 3.2 months in July.

Information for this story was found via CREA. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.