Despite high interest rates and dampened economic conditions, the demand for housing across Canada isn’t showing signs of wavering.

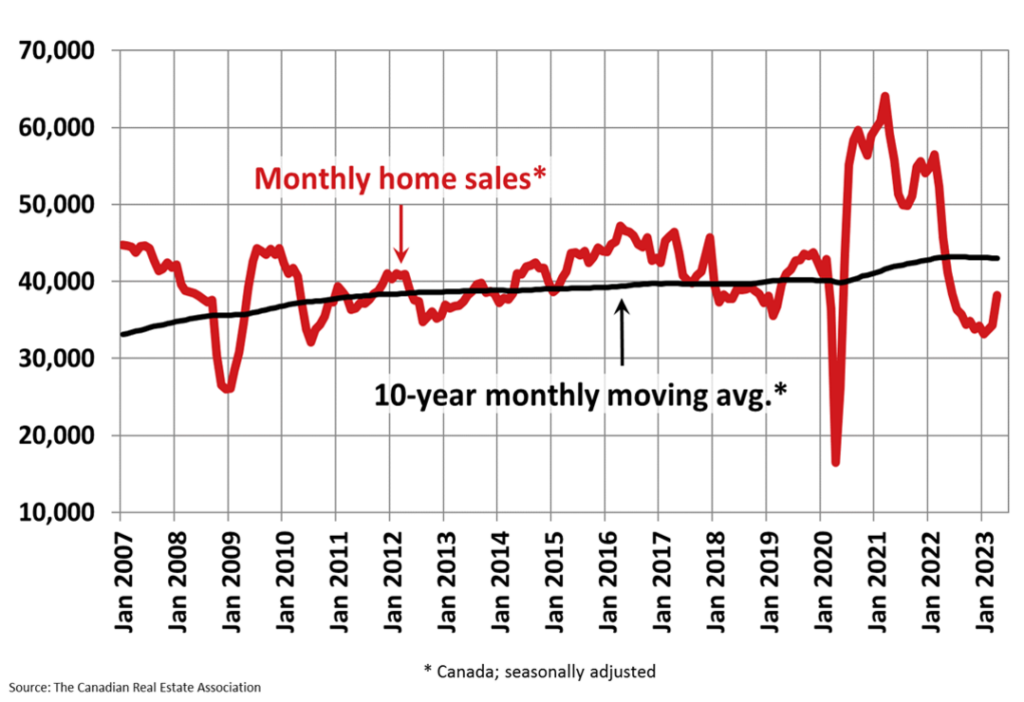

Latest figures from the Canadian Real Estate Association (CREA) show that home sales across the country jumped 11.3% between March and April, but are still down 19.5% from last year’s levels. The increase was primarily dominated by real estate markets in the BC Lower Mainland region as well as the Greater Toronto Area.

“Over the last few months, there have been signs that housing markets were going to heat back up this year, so it wasn’t a surprise to see things take off after the Easter weekend, which often serves as the opener to the spring market,” said CREA chair Larry Cerqua. “The issue going forward is not new: demand is once again returning at a scale that is outpacing supply.”

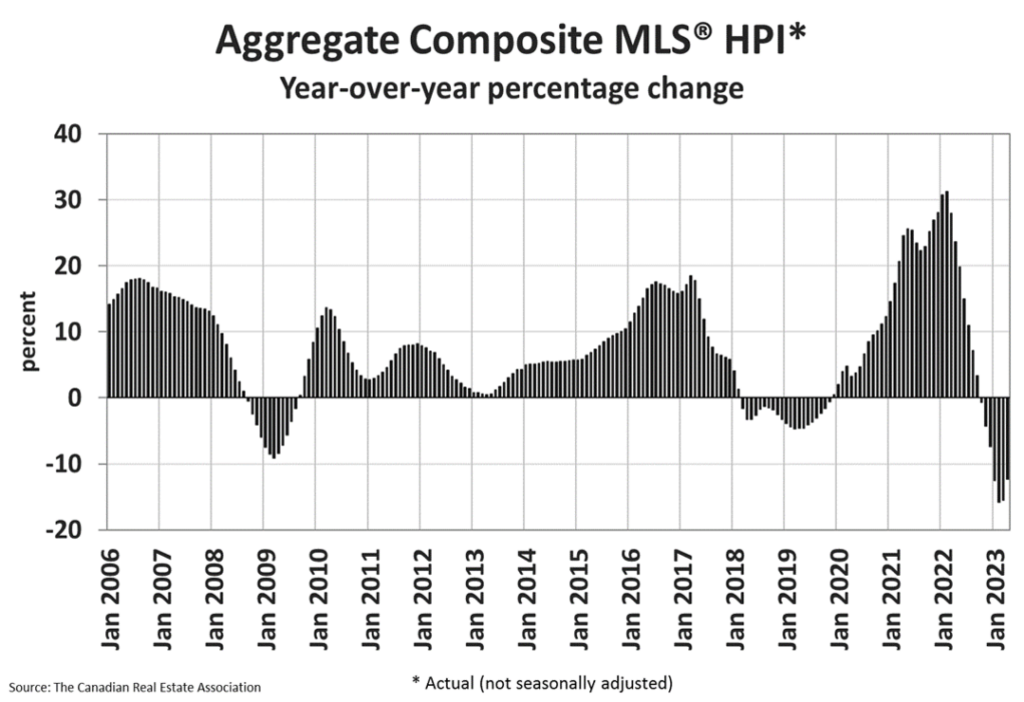

Even though the number of freshly listed homes was up 1.6% month-over-month, supply still sits at a 20-year low. CREA reported that there was about 3.3 months worth of inventory last month, substantially below the long-run average of five months. The Home Price Index, meanwhile, rose 1.6% from March, but is still 12.3% below April 2022 levels. The average price of a home stood at $716,000.

“With interest rates at a top, and home prices at a bottom, it wasn’t all that surprising to see buyers jumping off the sidelines and back into the market in April,” said CREA senior economist Shaun Cathcart. “Supply, on the other hand, has been sluggish, hence the price gains from March to April seen all over the country.”

Information for this briefing was found via CREA. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.