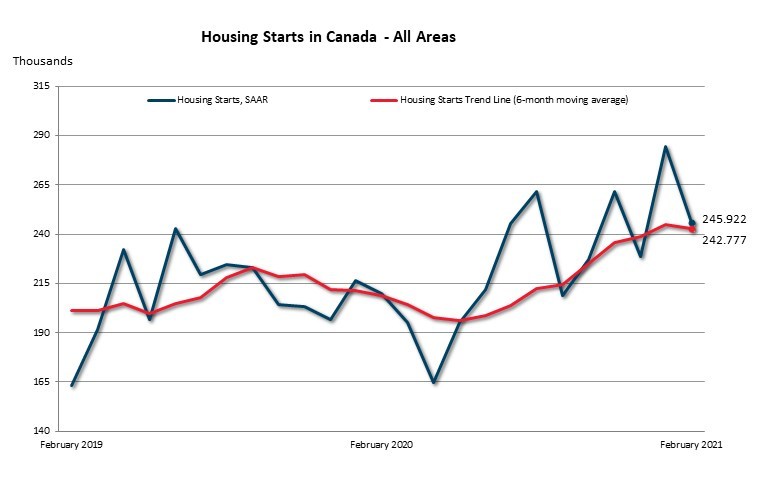

Following a strong start in the first month of the year, housing starts fell by 13.5% in February, despite real estate activity continuing to remain elevated. According to Canada Mortgage and Housing Corporation (CMHC), the seasonally adjusted annual rate of housing starts fell from 284,372 units to only 245,922 units in February. This puts the 6-month moving average at 242,777 units, down from 244,963 units in January.

A large part of the decline was attributed to the decrease in urban starts, which fell by 14% last month, followed by a 15.8% drop in multiple urban starts. Single-detached urban starts also suffered a decline, falling by 9.3% to 67,285 units. The CMHC estimated that rural starts were at a seasonally adjusted annual rate of 14,880 units last month.

However, despite the slowdown in housing starts, the demand for housing in Canada continues to remain elevated. According to the latest data from the Canadian Real Estate Association (CREA), national home sales soared to yet another all-time record in February, rising by 6.6% month-over-month to an annualized pace of 783,636 units. Likewise, the national average home price in February rose by 25% from the year prior, to a record $978,091 in February.

As a result of the historic level of real estate activity over the past year, CREA forecasts that another 702,000 units will trade hands through the Canadian MLS systems in 2021, compared to 551,262 units last year. The updated outlook also projects that national home prices will rise by 16.5% to an annualized average of $665,000 next year. By 2022, however, the association expects that real estate activity will begin to cool down, with home sales falling to around 614,000 units with prices rising to approximately $679,341.

Information for this briefing was found via the CMHC and CREA. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.