The rate of increase in Canadian consumer prices has slowed down further, with the Consumer Price Index (CPI) 4.3% year over year in March, the slowest hike since August 2021. The headline print followed a 5.2% increase in February and is higher than forecasts calling for a reading of 4.1%.

Core CPI, which strips out volatile components including food and energy, rose to 4.5%, compared to the prior month’s print of 4.8%. CPI excluding mortgage interest cost rose 3.6%, after increasing 4.7% in February.

The transportation inflation rate fell (0.3% vs 3.1% in February), owing primarily to decreasing gasoline prices (-13.8%), as the base year included the initial economic impact of Russia’s invasion of Ukraine. Food (8.9% vs 9.7%) and shelter (5.4% vs 6.1%) also saw a decrease in the CPI.

Costs for food purchased in stores further climbed in March (+9.7%), albeit slower than in February (+10.6%), with the slowdown owing to reduced costs for fresh fruits and vegetables.

In particular, homeowners’ replacement costs increased 1.7% year over year in March, compared to a 3.3% increase in February, showing a general softening of the housing market. Mortgage interest rates, on the other hand, increased at a quicker rate in March (+26.4%) than in February (+23.9%). As Canadians continued to renew and commence mortgages with rising interest rates, this was the highest yearly increase on record.

Last week, Bank of Canada Governor Tiff Macklem opted to keep the overnight rate unchanged at 4.5%, gripped with confidence that inflation levels will keep receding quickly over the next several months.

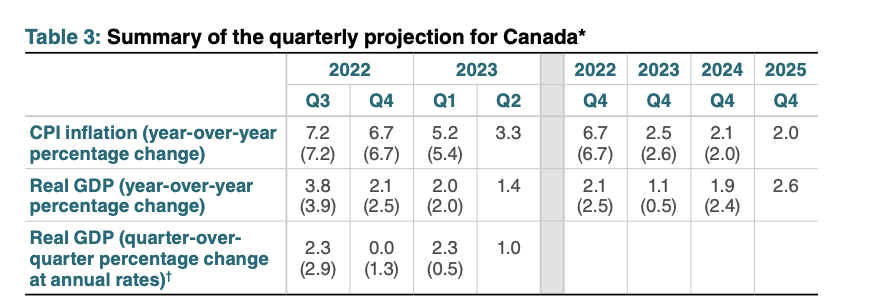

Macklem expects inflation will “fall quickly” to around 3% by the second half of the year, before declining more “gradually to the 2% target by the end of 2024.” Policy makers said they’re confident high interest rates are filtering through the economy, and will keep economic growth capped at 1.4% in 2023 and 1.3% the following year.

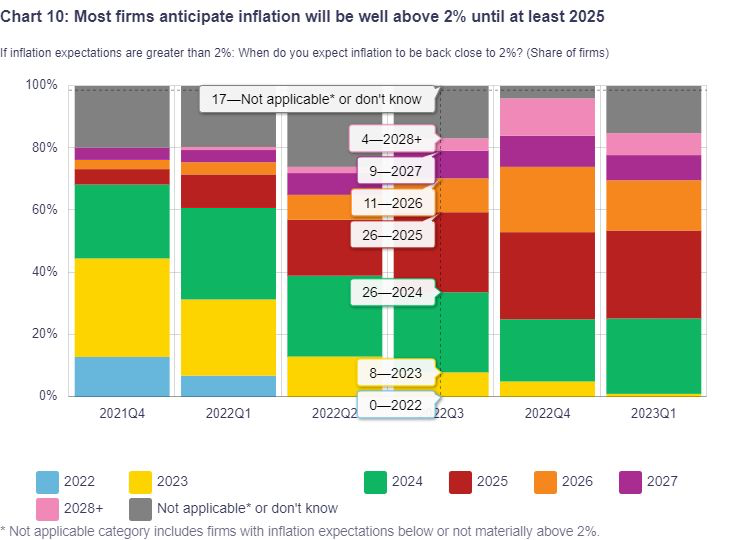

However, Canadian businesses are projecting rising wage pressures and inflation to remain above the Bank of Canada’s target range of 2% until at least 2025.

Information for this briefing was found via the Statistics Canada and Bank of Canada. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.