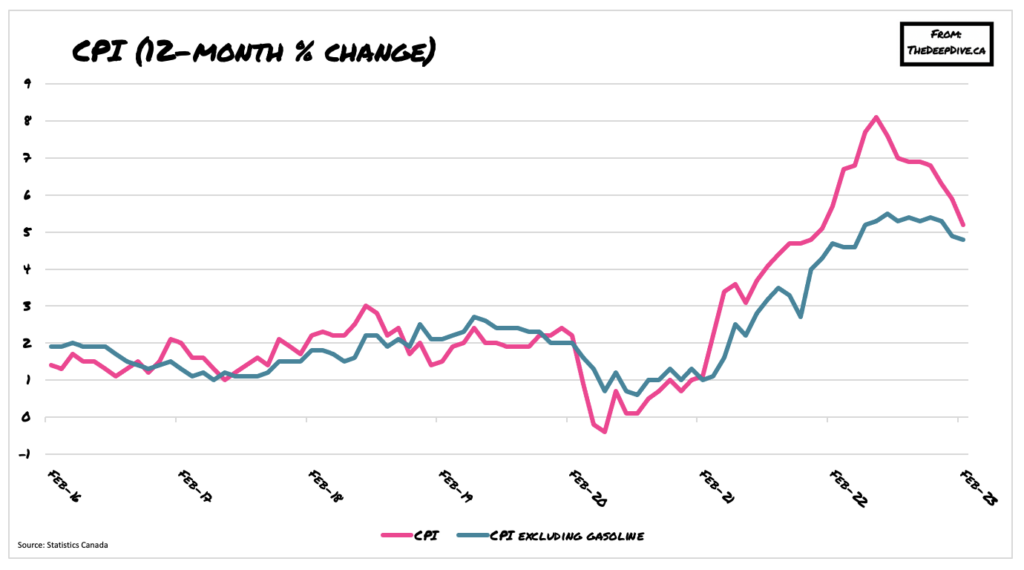

Canadian consumer prices continued increasing in February, albeit at a much slower pace thanks to base-year effects. Prices for food and shelter, however, aren’t showing signs of easing— in fact rather the opposite, to the horror of Canadians’ wallets.

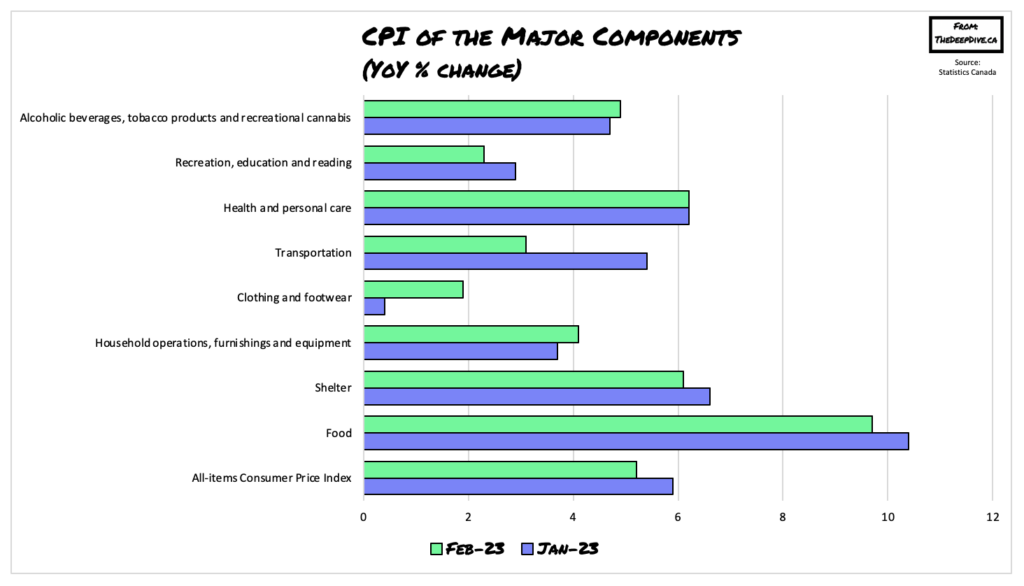

Latest data from Statistics Canada showed CPI rose 0.4% to 5.2% last month against January’s figure of 5.9% and economists’ forecasts calling for a reading of 5.4%. Core CPI, which strips out volatile components including food and energy, rose in line with expectations to 4.8%, compared to the prior month’s print of 5%.

The statistics Agency pointed out the deceleration was primarily due to the base-year effect, whereby prices last year were already so elevated, 2023 inflation gains appear minuscule in comparison. However, when last month’s inflation is compared to 18 months ago, Canadians paid a staggering 8.3% more for goods and services.

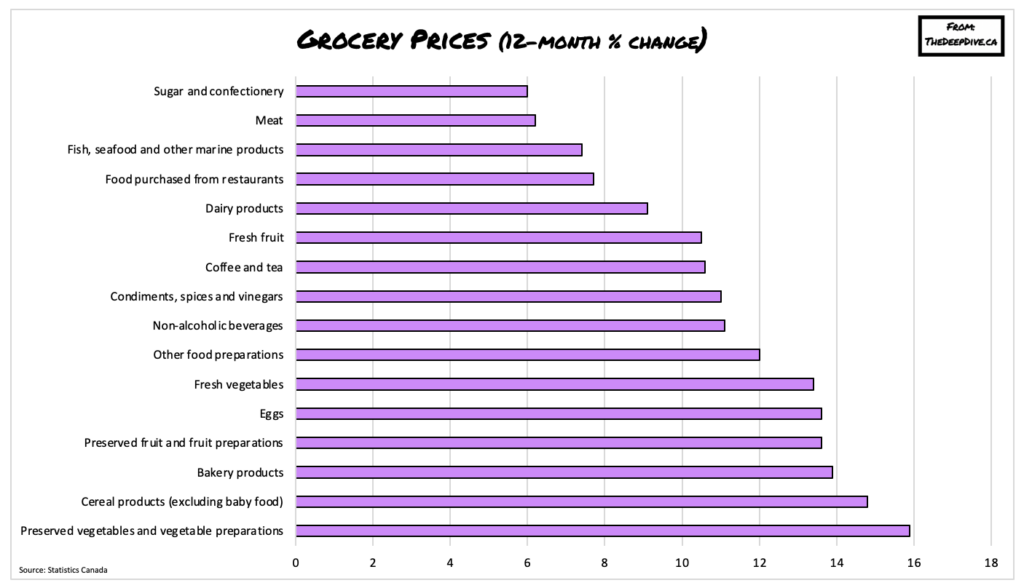

Prices of food purchased from stores was up another 10.6% from one year ago, marking the seventh straight month of double-digit price gains. Energy prices, however, were down 0.6% year-over-year after rising 5.4% in January— largely thanks to the base-year effect, too. Shelter costs, though, continued their upward momentum and increased 6.1% in February as the mortgage interest cost index surged 23.9% from one year ago— the fastest pace since July 1982.

Information for this briefing was found via Statistics Canada. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.