Canopy Growth Corp (TSX: WEED) (NASDAQ: CGC) has seen a plethora of insider transactions filed over the course of the last week, following blackout periods that were lifted following the reporting of the firms second quarter results. While the transactions were set off by the exercise of several rights restricted stock units, our focus lies in the selling largely conducted by two executives at the company.

The first transaction that is noteworthy is one filed by Rade Kovacevic, President and Chief Product Officer for Canopy. His sale of 150,000 common shares of the issuer on November 12, filed on November 16, netted him a cool $4,747,500 in gross proceeds. From here, things get a bit confusing in terms of Rade’s filings.

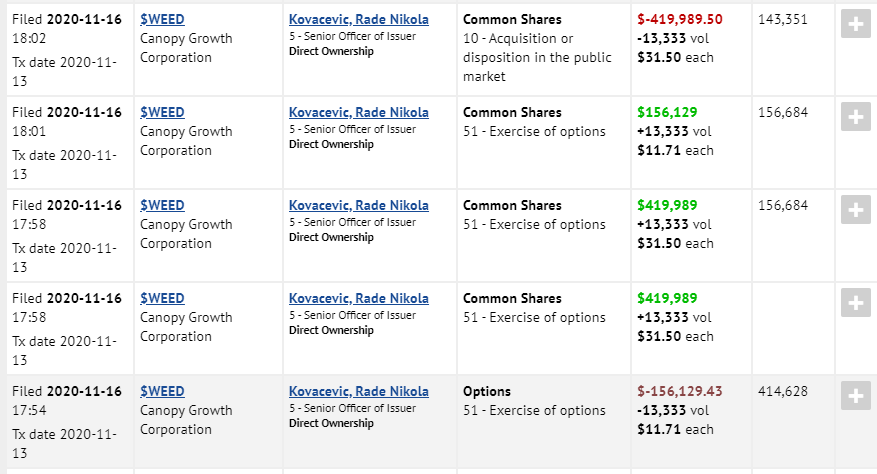

After the first initial filing, Rade recorded an exercise of options had occurred, with him purchasing 13,333 common shares of the issuer at a price of $11.71 per share. He then recorded a total of three filings indicating he had added to his common share holdings via the exercise of 13,333 options, followed by one filing of a sales transaction of 13,333 common shares for proceeds of $419,989.50. Given the timestamps of several of the transactions, it appears like at least one error, if not more, in these filings were possibly made, which were then followed by a possible correction.

Kovacevic then filed that he exercised 73,333 options at a price of $8.18 each, which were then subsequently sold once being converted to shares, raising gross proceeds of $2,299,722.88 from the sale. The short of it, is that its clear Rade took at least $7.0 million off the table in gross proceeds, if not more.

Following the transactions filed by Kovacevic, Chief Legal Officer Philip Shaer was next to file a number of transactions, the first being the exercise of 36,667 options at a price of $2.68 each. After being promptly sold, Shaer received $1,137,777.01 in net proceeds, a very swift 10x multiple on his brief investment. A further 33,333 options were then exercised at $8.18 a piece, which were sold $31.02 a piece, generating gross proceeds of $1,033,989.66 on the sale while Shaer unfortunately had to settle for just under a 4x return on his brief investment.

A final sale of 36,667 shares at $31.03 per share was then recorded by Shaer, for proceeds of $1,137,777.01. However, it should be noted that his share ownership total at the time of transaction was already labeled as being zero, so its not entirely certain where these shares came from. Subsequent backdated filings filed last night did little to clear things up, with it being indicated that a further 66,666 options at $8.18 were exercised, leaving Shaer with a current share position of 33,333 common shares. All told, as per filings Shaer pocketed $3.3 million from the transactions.

Finally, honourable mention goes to director David Lazzarato, whom cashed in on 1,010 common shares at a price of $31.30 each, generating proceeds of $31,613.

Canopy Growth Corp last traded at $32.09 on the TSX.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.