On Monday, Canopy Growth (TSX: WEED) (NYSE: CGC) reported its fiscal second quarter 2021 financial results. They reported $135.3 million in revenue, up 77% year over year, a net loss of $96.6 million, and a free cash flow of ($190.4) million.

A number of analysts have since updated their price targets on the company following the results, including the following:

- Piper Sandler raises target price to $27 from $23

- Canaccord Genuity raises target price to C$25 from C$22

- Alliance Global Partners raises target price to C$32 from C$24

- Cormark Securities raises price target to C$28.50 from C$23.50

Canaccord’s Matt Bottomley raised their 12-month price target from C$22 to C$25 and reiterated their hold rating on the company. He justified the adjustment by stating, “we believe Canopy’s EV of >C$10B is still lofty in relation to the current size of the Cdn market and the company’s clouded pathway to profitability.”

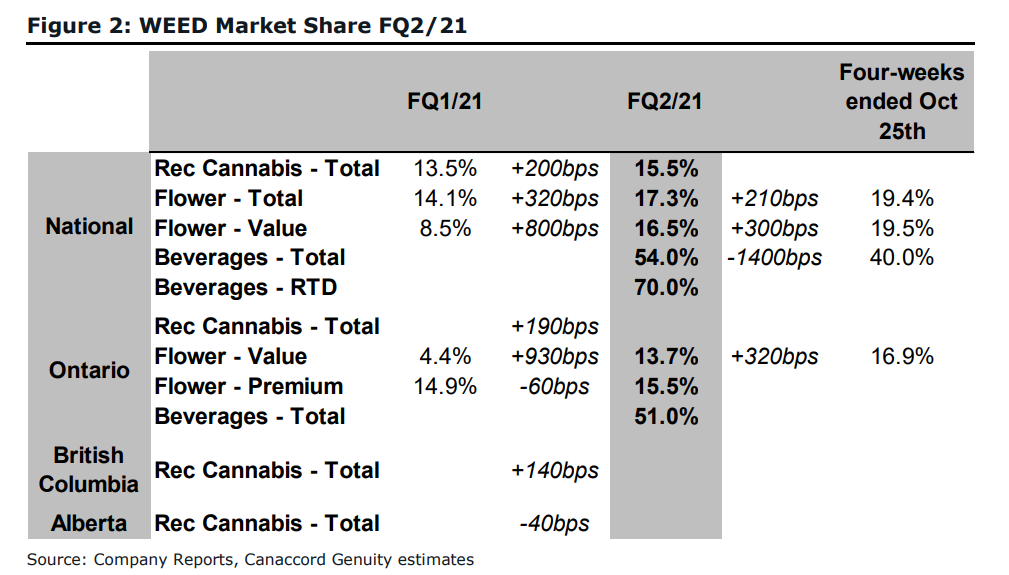

Bottomley headlines the note with, “FQ2/21 review: Increased Cdn market share and growth in ancillary revenues provide top-line beat.” Canopy’s top line of $135.3 million beat Canaccord’s estimate of $119 million. He says that the most notable thing about Canopy’s earnings was that their adult-use revenue increased by ~38% quarter over quarter to $60.9 million vs. Canaccord’s estimate of $50.1 million. He adds, “This was encouraging as we believe the ability to carve out mind-share in the growing Cdn recreational market is the most material value driver for LPs at this time.”

Bottomley then says that Canopy saw a rebound in its direct-to-consumer sales, a 2% increase in national market share to 15.5%, and a large expansion in Canopy’s 2.0 product list.

Canopy reported pretty much flat domestic medical cannabis revenue at $13.9 million, as Bottomley says that registered medical patients in Canada are seeing modest declines. International medical revenue declined by ~13% this quarter to $17.5 million. This decline is attributed to “temporary packing/supply issues and lower flower sales in Germany,” as per Bottomley.

The “Other” category was the home run this quarter, increasing in revenue by 34% quarter over quarter up to $43 million. This category comprises all the non-cannabis selling units of the company, such as Martha Stewart CBD gummies, Storz & Bickell, and BioSteel.

Bottomley adds that Canopy’s $1.72 billion in cash on hand is enough to absorb interim losses. He believes that Canopy reaching profitability is over 12 months away, but their cash position will be enough to cushion the losses.

He then talks about how Canopy is ramping up their activities south of the border. He lists off four things that Canopy has done to drive growth:

- Offering its ShopCanopy.com online CBD e-commerce platform.

- Increasing its available SKU count to include 25 hemp CBD SKUs across its first & free, This Works and BioSteel brands.

- Increasing publicity for its product offerings through its partnerships with Martha Stewart (for a full line of CBD products that began with the sale of gummies, oil, and soft gels in Sept 2020), Patrick Mahomes and DeAndre Hopkins.

- Increasing distribution of Storz & Bickel products in North America and Europe and selling TWEED-branded flower in Illinois, Maine, Massachusetts, and Oregon.

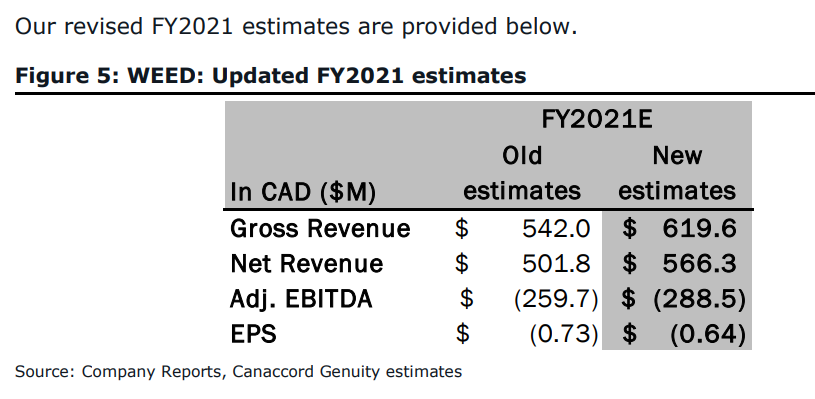

With the price target increase, Bottomley has increased his fiscal 2020 estimates, which can be seen below.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.