Friday evening following the close of markets, a note was sent out by PI Financials to those of whom receive analyst notes on the cannabis sector. Within, it identified that the analyst firm would be discontinuing coverage on two cannabis operations, with no reasoning behind the move disclosed. Coincidentally, both firms are focused on the extraction market.

The first of the firms identified as seeing its coverage discontinued, surprisingly, is that of Medipharm Labs (TSX: LABS). Seen by many as one of the leaders within the niche extraction space, the discontinuation was rather unexpected. However, the company has been struggling over the course of 2020 in terms of revenue growth, with the company seeing declining year over year revenues the last several quarters.

In its last note issued on Medipharm, which was released on August 13, analyst Devin Shilling identified that they believed market challenges, such as oversupply of bulk oil along with pricing pressure, will persist over the medium term. As a result, Medipharm is expected to see a negative impact on its business, with international sales expected to not provide a sufficient offset to the challenges within Canada.

The note then went on to identify that spot sales of concentrates accounted for 65% of the firms total sales in the latest quarter, while the firm was also faced with increasing general and administrative expenses that had climbed 24% on a quarter over quarter basis. This culminatived in PI leaving a neutral rating on Medipharm unchanged, while decreasing the price target to $1.25.

Prior to discontinuing coverage, PI had anticipated the cannabis extractor to post revenues of $60.2 million for all of fiscal 2020, along with an EBITDA loss of $11.4 million.

The second firm to see coverage discontinued by PI on Friday is that of Heritage Cannabis (CSE: CANN), the second of only four firms currently listed in the extraction peer group. The company had not issued a note on the firm since June 30, following the second quarter results being posted by Heritage Cannabis.

Within the note, analyst Devin Schilling had headlined the update as “Q2A: Revenue Down 78%,” which essentially set the tone for the rest of the report. The impact was stated to be negative, given that results were below expectations significantly. Heritage had only posted revenue of $0.9 million, while the analyst had forecasted far higher at $2.9 million for the quarter.

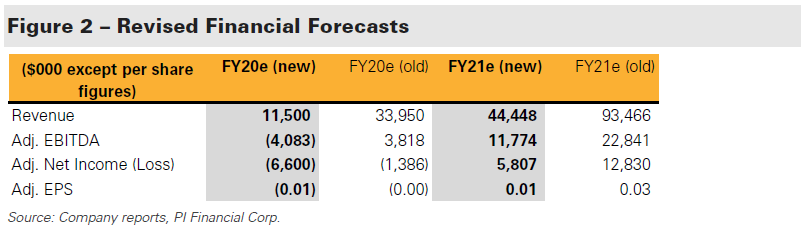

Aside from identifying that the company poses significant risk in terms of high customer concentration, with 3 clients accounting for 95% of revenue, little else was provided within the report that is worth identifying. PI had left the rating on Heritage unchanged at buy, while slashing the twelve month price target in half, from $0.60 to $0.30. Prior to discontinuing coverage, PI had anticipated that Heritage would post $11.5 million in revenues throughout fiscal year 2020, and $44.4 million in fiscal year 2021.

As a result of the discontinuation of coverage, PI Financial has indicated that they are withdrawing all ratings, targets and estimates for both Medipharm Labs and Heritage Cannabis.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.