This morning, Canaccord Genuity released their second-quarter earnings preview for Canopy Growth Corp (TSX: WEED) (NYSE: CGC). Canopy Growth will be reporting their results for the period ending September 30th on Monday, November 9th, before market open and their investor call will be at 10:00 am.

Matt Bottomley, Canaccord’s cannabis analyst, has a C$22.00 price target and a hold rating on the stock. He headlines, “FQ2/21 preview: Expecting incremental improvements.” While also setting the tone of the current macro cannabis environment he comments, “during the quarter, we continued to see strong provincial retail sales growth on the back of accelerated store openings and increased product breadth introduced throughout the sector,” and makes note that during the summer months COVID case counts were lower.

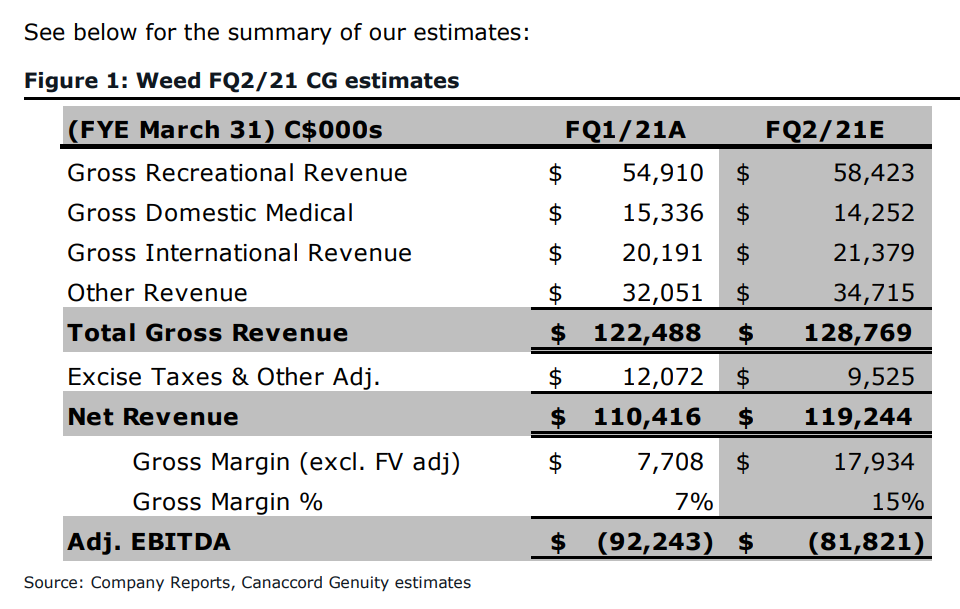

Bottomley expects that gross recreational revenue will come in at $58.4 million, which is a quarter over quarter increase of 13.6%, while stating that last quarter Canopy was forced to close 22 Tweed and Tokyo Smoke locations because of the pandemic. 20% of Canopy’s recreational revenue comes from their own stores, which Bottomley says, “we expect this portion of its revenues to see sizable improvement QoQ to just under pre-COVID levels.”

With these stores now being open again, alongside the country’s overall retail footprint growing and Canopy’s 2.0 product offerings growing, it is the main justification for the forecasted increase in revenue. Alongside the 13.6% increase in revenue, they also forecast sales to the provinces to grow +10% quarter over quarter due to more beverage and value product offerings.

Onto Canadian and international medical sales, Bottomley has the revenue from these segments estimated at C$35.6 million. The mix is 40% Canadian medical and 60% international medical. This estimate is pretty much flat, and Bottomley explains it as, “a result of the continuing trend of declining domestic medical sales in Canada.” He says that international medical revenue will only come in modestly higher and attributes that to COVID headwinds.

In terms of total net revenue, Bottomley is expecting total net revenue to be C$119.2 million, or 8% growth quarter over quarter. He attributes this to recreational revenue coming in higher and the “other” category, including Storz & Bickel, BioSteel, and This Works. He expects this “other” category revenue to be C$34.7 million or an 8% increase quarter over quarter. He attributes this growth to “a newly launched ecommerce platform that may have helped sales counter brick-and-mortar store closures; and the introduction of the Martha Stewart CBD product line.”

Bottomley expects that Canopy will have an adjusted gross margin of C$18 million or roughly 15%, which is higher than the ~7% they reported last quarter. Adjusted EBITDA loss is estimated to be (C$81.8) million, down from (C$92.2) million last quarter as the company has reduced its workforce by 18% to date.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.