Canopy Growth (TSX: WEED) (NYSE: CGC) will report their first fiscal quarter of 2021 on August 10th before market open with the call following at 10:00 am. With a C$2.2 billion annualized run-rate that is the Canadian market, Canaccord analyst Matt Bottomley says that COVID-19 is likely to weigh on the quarter, as sales from licensed producers to distributors have most likely been impacted more heavily than what retail data suggests.

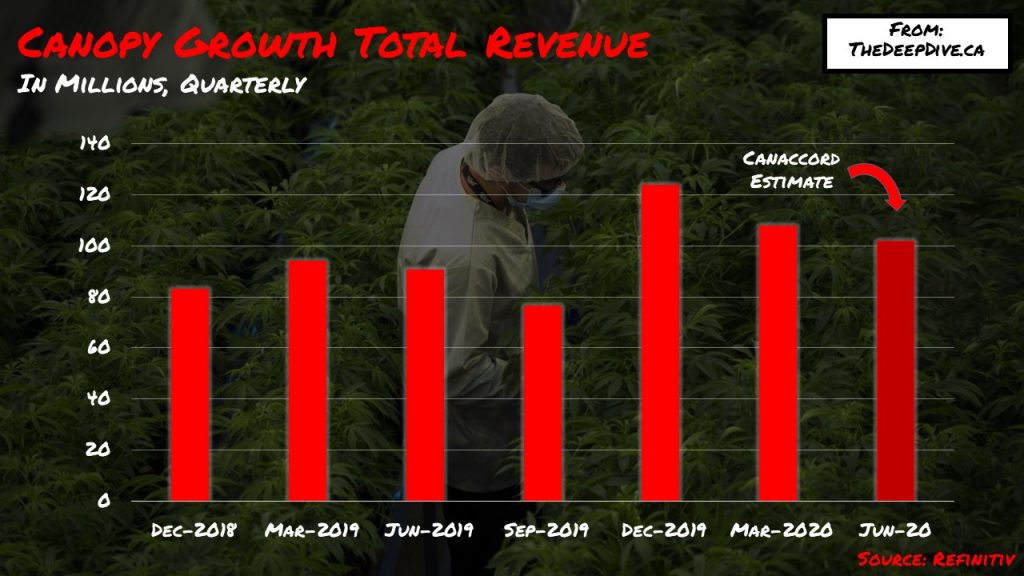

Canaccord’s Matt Bottomley estimates are forecasting that Canopy’s recreational cannabis revenue come in at C$40.8 million, which is around C$9 million lower than the fourth fiscal quarter of C$49.7 million or an 18% decrease quarter over quarter. Meanwhile Gross Domestic Medical and Gross International Revenue are currently estimated to bet C$14.6 million and C$20.9 million, respectively, which will be flat quarter over quarter. Finally, Total Revenue totaling C$101.1 million is estimated for the quarter, C$14 million lower than last quarter’s figure or a 12% decrease quarter over quarter.

Bottomley states that even though Cannabis 2.0 sales are expected to be over 10% of total says during this quarter, due to “less favourable provincial purchasing patterns” and the closing of many of Canopy’s owned retail stores is the reasoning behind why they are forecasting C$40.8 million in revenue or a decrease of 18% quarter over quarter. Alongside forecasting flat international and Canadian medical sales quarter over quarter, Bottomley is also forecasting a 16.5% decline in Canopy’s “other” revenue streams. Management has cited that the segment has rebounded modestly from the 30% declines it saw at the start of the quarter. For these reasons, Canaccord forecasts net revenue to come in at C$94.7 million, or down 12% from last quarter.

The last thing to note is that Canaccord is forecasting Canopy’s cash position to come in around C$2 billion, as the exercise of C$245 million in warrants by Constellation Brands offsets the estimated C$225 million in operating and capital expenses for the quarter.

Currently, Canaccord has a hold rating and a C$21 price target on Canopy Growth.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.