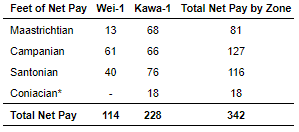

CGX Energy (TSXV: OYL), along with its joint venture partner Frontera Energy (TSX: FEC), is reporting success in its Wei-1 exploration well of its Corentyne Block offshore of Georgetown, Guyana.

The well was drilled to a total depth of 6,233 metres in water approximately 583 metres deep, encountering three aged stacked sands within channel and fan complexes on the north portion of the block. The sands, Maastrichtian, Campanian, and Santonian, collectively saw net pay encountered of 35 metres, with the results said to demonstrate “the potential for a standalone shallow oil resource development across the Corentyne block.”

Total costs associated with the well are said to be between $185 and $190 million. However that expense may just pay off, with a conceptual field plan for the northern portion of the block now completed as well. The plan, which is said to include subsea architecture, development well planning, production and export facilities, is said to suggest that the potential development of the Maastrichtian horizon only may have lower associated development costs and a shorter development timeline than broad development of both shallow and deep zones at the block.

A strategic review of the block meanwhile is said to be underway following two now successful exploration wells.

“With the Joint Venture’s two-well drilling program now complete, and as a result of inbound expressions of interest from various global third parties, the Joint Venture is working with Houlihan Lokey to support a review of strategic options for the Corentyne block, including a potential farm down, as it progresses its efforts to maximize value from its potentially transformational investments in Guyana,” commented Gabriel de Alba, Co-Chairman of CGX and Chairman of Frontera.

CGX Energy last traded at $0.92 on the TSX Venture.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.