Chile is one step closer to nationalizing its copper and lithium mines. But not only does this might spell trouble for Chile-focused mining companies but also maybe for the South American country.

Soon after Chile elected 35-year old activist lawmaker Gabriel Boric as its president in December 2021, the government convened a constituent assembly to rewrite the country’s constitution. On Tuesday, the assembly’s environment committee approved an early proposal that aims to give the country one year to nationalize its lithium and copper mines, removing management away from private firms.

The motion also suggests that mining projects since 1993 would have to undergo an environmental evaluation within three years, while those situated in excluded areas–such as indigenous lands–would be revoked.

In terms of indemnification for private firms, the repayment plan will be based on the book value of equities and will be paid over a maximum of 30 years.

While this is a first for Chile, it came as no surprise as Boric has criticized lithium industry privatization and argued for a national lithium company during his campaign. Nevertheless, the proposal still has to win in-favor votes from two-thirds of the assembly and get ratified by a public referendum.

But this early on, the proposal is facing resistance from various personalities. National Mining Society President Diego Hernández, representing the mining industry, chastised the proposal and called it “barbaric, with clear and obvious legal errors”.

“A nationalization would have serious consequences for our economy in a context of globalization since the affected companies will resort to these treaties to defend their legitimate interests,” he added.

Former Minister of Mines Sergio Bitar also criticized the proposal, describing it as “a delirious return to the past.”

“Please let us be realistic, [be] aware of what is possible and what is not possible,” Bitar said in a MercoPress interview. “We can increase the added value of minerals exported. Move quickly to green copper, green hydrogen, increase solar power, even possibly a state-managed company. We must advance in the desalinization of water, a crucial issue for all the regions of Chile.”

Major copper and lithium players have seen price drops since the proposal passed the assembly committee. Sociedad Quimica y Minera de Chile SA (NYSE: SQM) dropped 7.8% on Monday and further dipped as much as 4.7% as the market opened today.

Global X Lithium & Battery Tech (NYSE Arca: LIT) and Freeport-McMoRan (NYSE: FCX) also fell by 5.1% and 5.9%, respectively.

Albemarle Corp (NYSE: ALB), which initially said it does not expect the new administration will have any impacts on its operations in Chile, also saw its shares drop by 3.9%. The company’s current contract allows the firm to operate in the country until 2043.

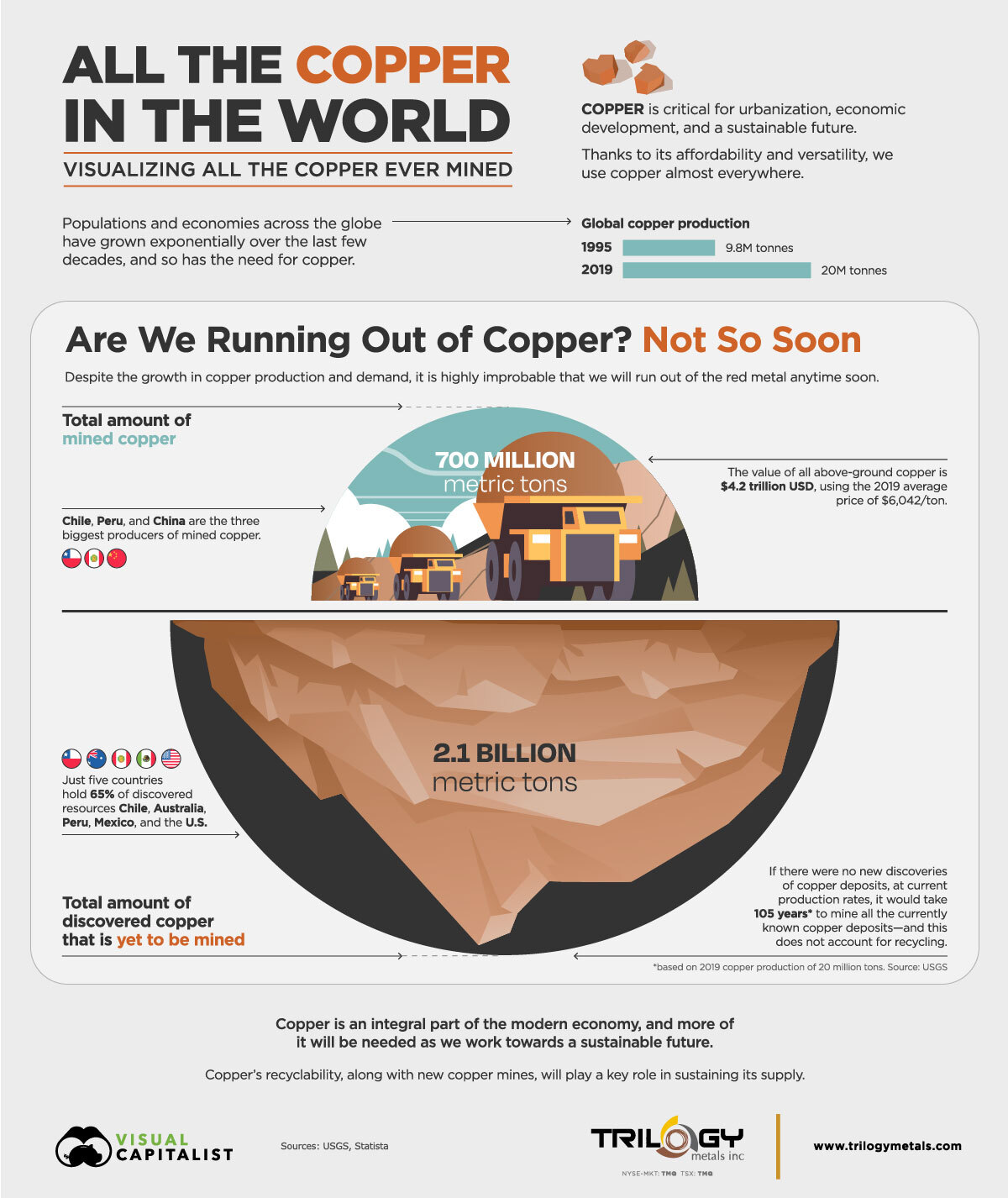

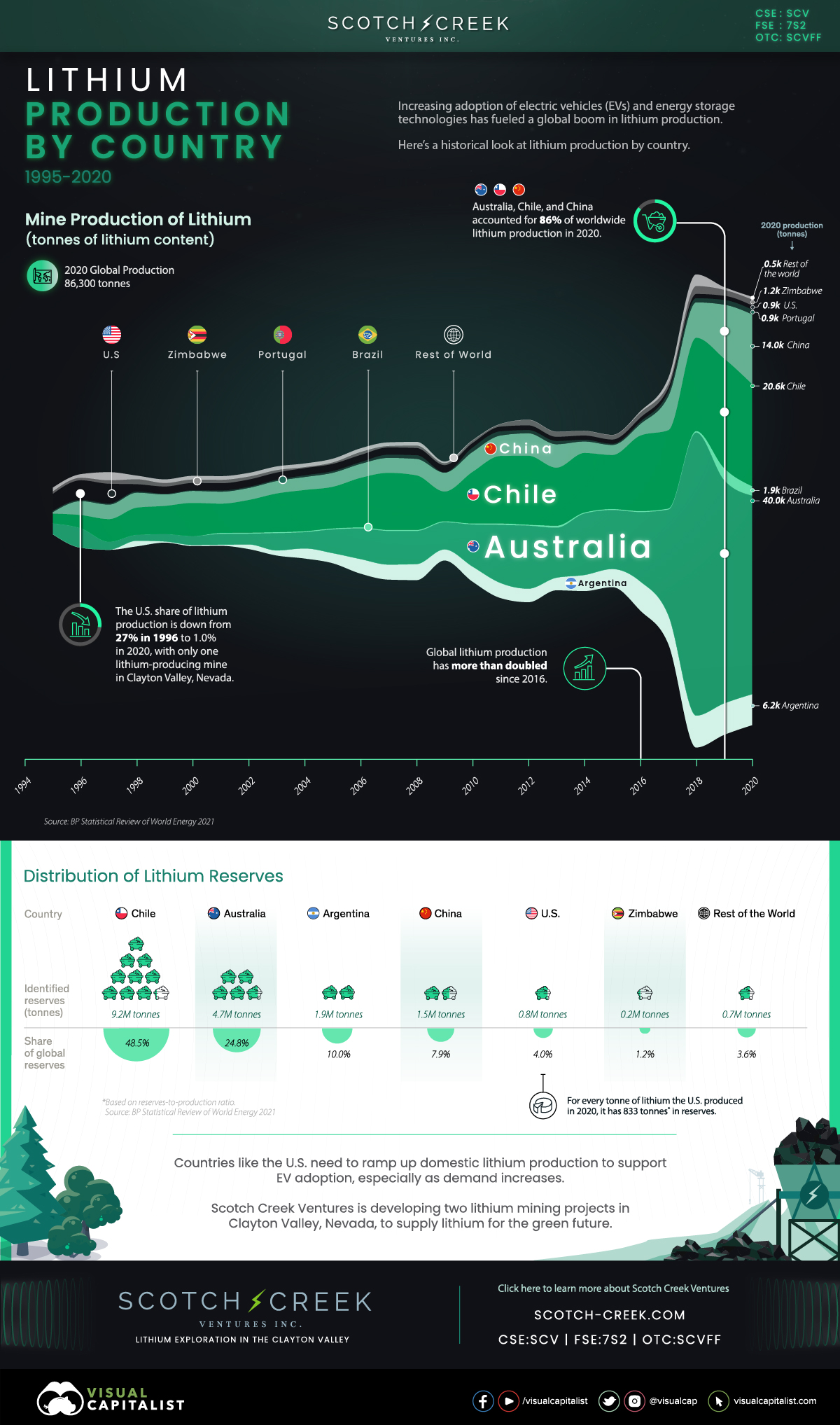

Nationalizing the country’s copper and lithium mines will create a huge impact on global resources. Chile is the world’s top copper producer and second-largest lithium producer. The South American country also holds the world’s largest known reserves of copper and lithium.

It is estimated that there are around US$70 billion in potential mining projects for the decade. Between buying out the private companies and spending for social services–which triggered the constitution change in the first place–the nation’s outlook on its largest sector is shaky at best as Boric takes oath on Friday.

Information for this briefing was found via Mining.com, MercoPress, Bloomberg, Forbes. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.