On Friday, Chile’s President Gabriel Boric announced plans to nationalize the South American country’s lithium industry. He believes such an action will boost Chile’s economy and protect its environment. When Chile’s leftist leader was elected in December 2021, championing green investment was one of his key positions.

Important to note: President Boric’s plans cannot be implemented unilaterally; the policy must be approved by Chile’s Congress.

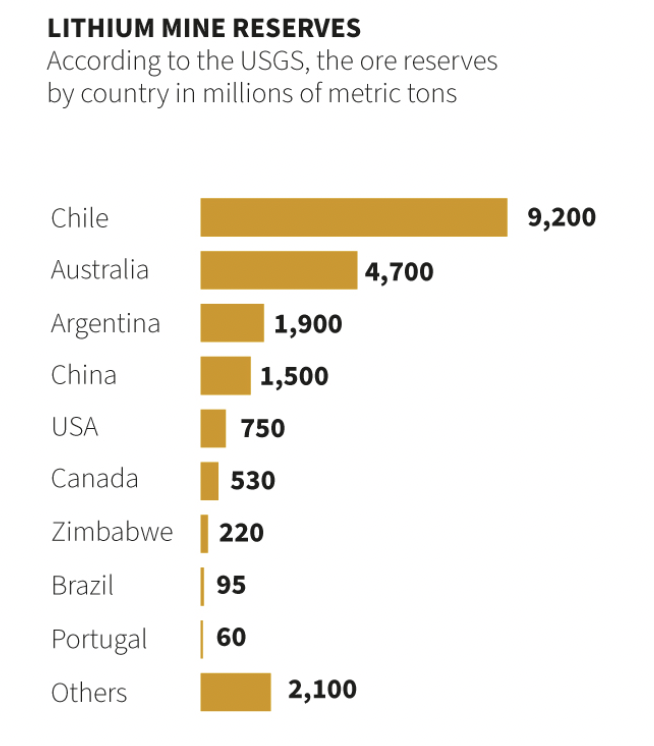

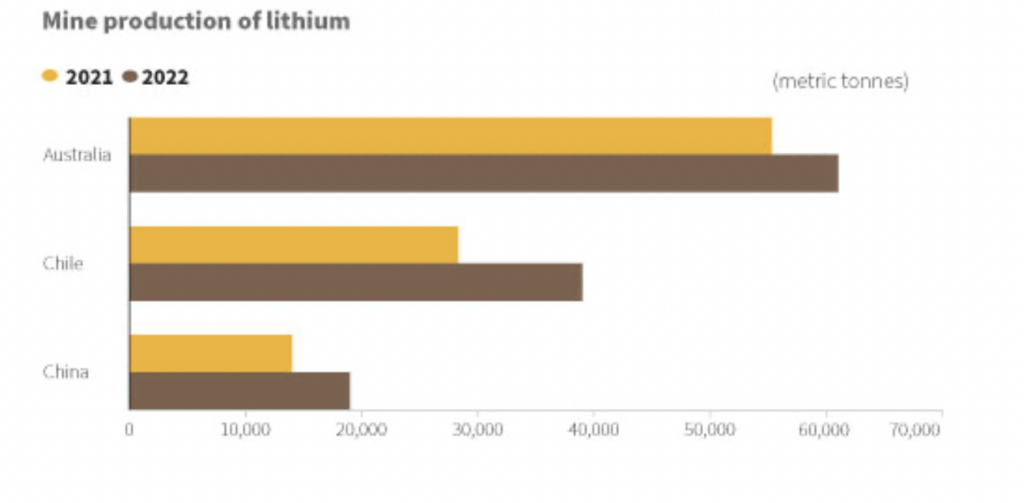

Chile’s stark policy change is especially consequential for the fast-growing lithium industry because Chile has about 40% of the world’s lithium reserves. The nation is also the world’s second largest producer of the silvery white metal, which is used in almost all electric vehicle (EV) batteries.

Chile’s decision seems likely to cause battery makers to carefully consider whether they will renew or enter into new contracts with lithium producers in Chile, as buyers will now have to factor in the risks of state involvement. Not surprisingly, shares of Chilean lithium industry giants Albemarle Corporation (NYSE: ALB) and Sociedad Quimica y Minera de Chile S.A. (NYSE: SQM) sold off sharply on the news, declining 10% and 19%, respectively, on April 21. President Boric said the state would negotiate deals with Albemarle and SQM to take stakes in their operations before their contracts to extract lithium in Chile’s Atacama salt flat expire in 2043 and 2030, respectively.

A 40% royalty isn’t enough? Let the Chilean government build their own mines because this is a joke. Expect the same thing to happen with copper when the price skyrockets. https://t.co/tUKhrXJ6Gv

— The Mining Bartender (@jtourzan) April 21, 2023

EV and battery manufacturers seem likely to channel more lithium investment dollars to projects and mines based outside of Chile and particularly in the U.S., given the tax credits available to U.S. car buyers if the lithium in the vehicle’s battery is sourced from domestic mines. Lithium Americas Corp. (NYSE: LAC) is an obvious beneficiary, as its flagship Cauchari-Olaroz lithium mine in Argentina is set to begin production this quarter, and the U.S. District Court for the District of Nevada recently approved construction to start on the company’s giant Thacker Pass lithium project in that U.S. state.

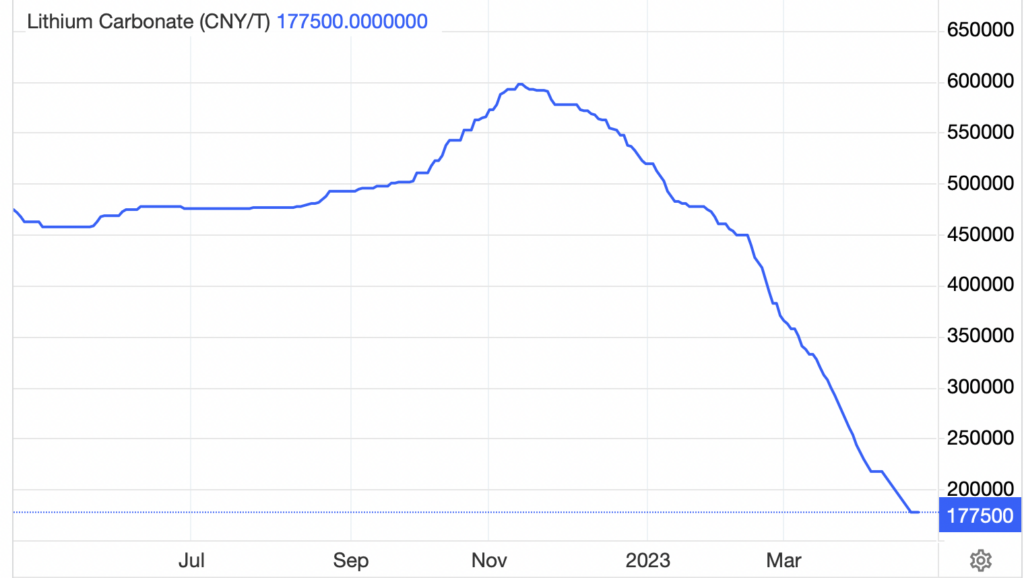

Lithium prices have plummeted over the last six months; the price of lithium carbonate, currently around US$26,000 per tonne, is down about 70% since peaking in November 2022. Asian lithium companies overproduced in late 2022, and it has taken time to work the excess capacity off.

However, the Chile nationalization news may have changed pricing trends. According to Reuters, the most heavily traded lithium carbonate futures contract on the Wuxi (China) Stainless Steel Exchange fell 11% early on April 21, but then jumped a similar amount later that same day. Presumably, the Chile announcement prompted that rally.

Information for this briefing was found via Edgar and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.