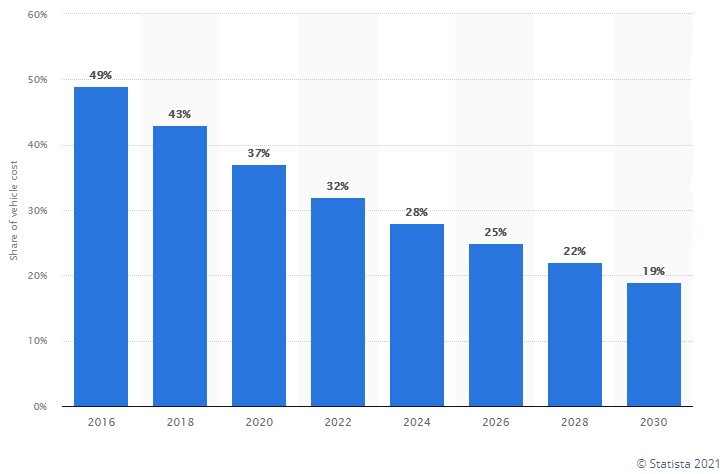

Inflation is everywhere. On October 27, the giant China-based electric vehicle (EV) and battery maker BYD announced that it will raise battery prices at least 20% effective November 1. This increase has significant implications for EV manufacturers, as batteries typically comprise about a third of the price of an electric vehicle.

BYD supplies batteries to Toyota, Ford Motor Company and Beijing Automotive Group.

Other smaller battery makers, including Guangzhou Great Power, have also raised prices. Guangzhou’s clients are General Motors, SACI Motor, Liuzhou Wuling Motors, and Changan Automobile.

It is unclear when EV makers like General Motors, Lucid Group and Fisker will be forced to raise prices to offset higher battery costs. The manufacturers will likely be inclined to delay any price adjustment to maintain consumers’ interest in buying EVs, but given the significance of the cost of a battery as a portion of the overall manufacturing cost of a vehicle, increases in sticker prices seem inevitable.

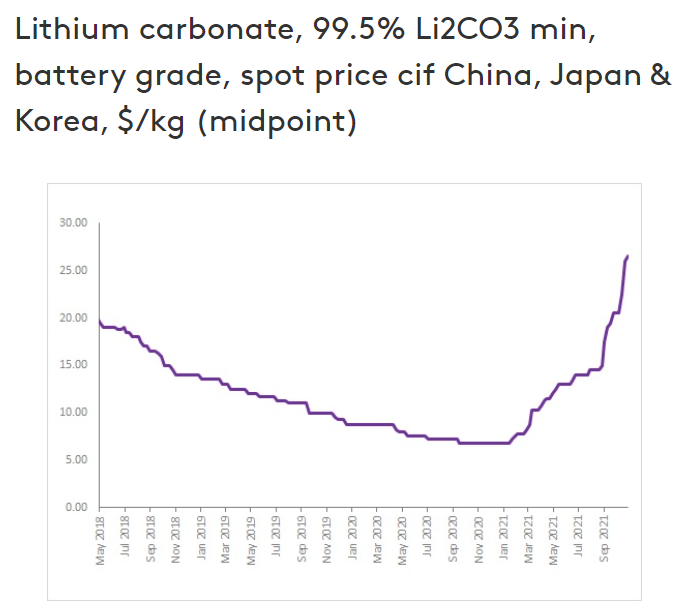

The culprit in all this is lithium, a key component in most EV batteries. Battery grade lithium carbonate has quadrupled since January 2021. Moreover, most commodity analysts see no interruption in this price over the foreseeable future.

Battery makers have quite sensibly stepped up their efforts to secure lithium supplies. In September, Contemporary Amperex Technology (CATL), another giant Chinese battery maker, acquired Millennial Lithium for nearly US$300 million. Millennial Lithium has lithium mining sites in Argentina. CATL has also purchased a 24% stake in a lithium project in the Democratic Republic of the Congo for US$240 million.

It is possible that junior lithium miners like Lithium Americas Corp. (TSX: LAC) and Sigma Lithium Corporation (TSXV: SGML) could be considered takeover targets by large battery manufacturers. Lithium Americas is developing lithium projects in Argentina and the U.S. state of Nevada, and Sigma is developing the Grota do Cirilo lithium project in Brazil.

If demand for EVs were to wane, possibly due to consumers’ sticker shock over vehicle price increases, the demand for lithium would likewise fall markedly. Lithium miner stocks would be similarly affected.

The demand for lithium has caused the price of the commodity to soar, which in turn has caused EV battery prices to jump. EV manufacturers will likely soon adjust sticker prices accordingly. Given all this, the stocks of junior lithium miners could be interesting speculations.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.