Evergrande. That topic you’ve heard about endlessly over the past weeks, yet haven’t taken the time to sit down and actually understand. But your in luck. We’ve collectively read, watched, and listen to over 100 articles on the crisis, so you don’t have to. The events ongoing in China are significant, so its worth the time to understand it.

Let’s start this story off with a Jim Chanos – Charlie Rose interview from almost a decade ago:

“For [China] to get off of or stop construction, you’d see GDP growth go negative very quickly. That’s not going to happen, because in China, as we say, it’s all about making the number. People are rewarded at most every level of government for making their economic growth numbers. The easiest way to do that is to put up another building.”

So that dates back to 2012 – and at that time you could go on YouTube and see dozens of videos of what we’d call ghost malls and buildings, where the shell of a building or tower was created, but there were barely any signs of human life.

When it comes to understanding this crisis let’s put this story into 3 main buckets:

- The Chinese Economy and Real Estate

- Evergrande

- The Global Economy

Bucket 1: The Chinese Economy and Real Estate

So this story begins in the late 1980’s. Now remember, China is a communist state, which made funding housing projects a challenge. Former Premier Zhao Ziyang wrote in his memoirs:

In a great piece by Marc Rubinstein over at Epsilon Theory, we learn that in 1988, the Chinese government changed the constitution to allow rights to use land, not ownership, but to be bought and sold under long term leases. Or as Rubinstein refers to it, a fudge. How this would work was residential deals would come with a seventy year lease and commercial deals would come with a fifty year lease. And just like that, China found itself with a new economic growth driver.

This turned into more than just an economic driver, it turned into a serious self funding machine for the government. From 2009 to 2015, the Chinese government collected nearly US$3 trillion (22T Yuan) simply selling land leases to private enterprises. This allowed the government to fund massive infrastructure investment on a scale that the taxpayer wouldn’t have been able to fund otherwise.

In the decades that followed, China had an economy roaring thanks to rising real estate prices driven by a banking sector willing and able to lend and citizens eager to invest in bricks and mortar.

But the real estate market did more than just roar. It became a national pastime. It became the driver of the economy, and even got to a level that didn’t make sense. For example, the Financial Times tells us there is enough empty property in China to house 90M people. To put that in perspective, China could safely house two Canadas!

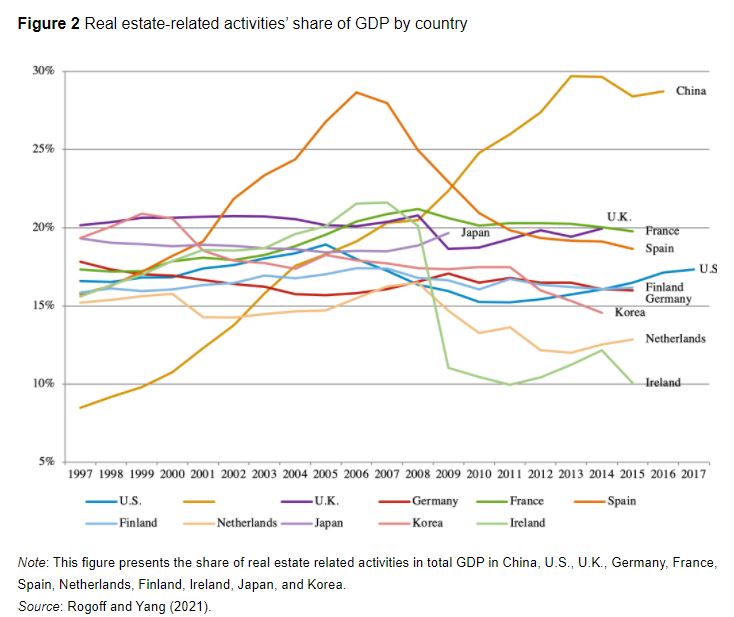

In a paper by Harvard Economics professor Kenneth Rogoff, he tell us “With real estate production and property services accounting for 29% of GDP – rivalling Ireland and Spain at their pre-financial crisis peaks – it is hard to see how a significant slowdown in the Chinese economy can be avoided even if banking problems were contained.”

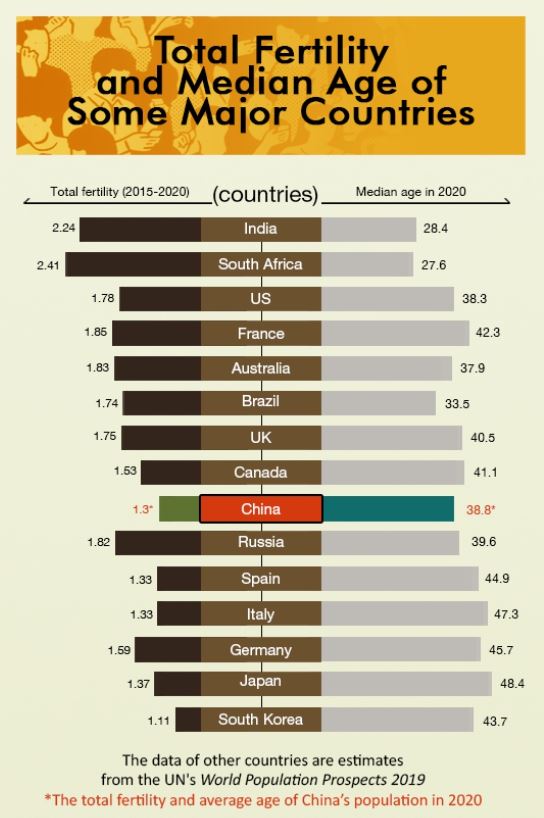

There is also another big problem with an economy built on real estate. When prices and investment simply spiral out of control, it can have an impact on the prosperity of the people. For example, China has a declining birth rate with an average of 1.3 births per female; however, in order to sustain a population, the birth rate needs to be at a steady 2.1. It wouldn’t be unfair to suggest the reason for the dwindling population has been decreasing housing affordability, which has prevented Chinese men from moving out of their parents’ dwelling and buying a home of their own.

Aside from that, a major problem with an economy largely dependent on real estate and real estate related services, is the misallocation of capital. As newly famous Twitter macro guy, and food lover, @INArteCarloDoss tells us:

“As a result of years of seeking easy growth through construction and leverage, the misallocation of capital was : 1- capital starving more innovative and high tech sectors (see chart) and 2- creating a headwind for a rebalancing towards a more consumption driven growth.“

So this brings us to Xi Jinping’s move towards a focus on “Common Prosperity.” Considering how 600M Chinese have a monthly income of $160 or less and asset prices not matching real wages, Xi decided it’s time to reign in the real estate sector. For this he introduces the 3 red lines. Under this guideline, developers would need to have:

- Liabilities to Assets no higher than 70%

- Net Debt to Equity no higher than 100%

- And Cash to Short Term Debt higher than 100%

And in the event the developers failed to meet any of the ‘three red lines,’ regulators would then place limits on their access to new debt.

And just like that, a company named China Evergrande Group found themselves in a precarious position.

Bucket 2: Evergrande

Evergrande was started in 1996 by Hui Ka Yan. Initially called Hengda Group, their core business was simple. Lease land, develop housing and buildings, and sell it to owners and investors.

The company went public on the Hong Kong Stock exchange in 2009. At the time, they had 55M square metres of total land reserve and a great pipeline of projects. In the year prior they only developed around 5.6M square metres of the 55M pipeline. And as we all know when it comes to raising money, storytelling is everything – “just look at that pipeline.” Bankers were calling it the McDonalds of Chinese Real Estate. The company raised $722M in their IPO, which was massively oversubscribed, and the stock popped 33% on it’s first day of trading.

The company used it’s funds to clean up the balance sheet and grab more land. They planned to build mini-cities that could accommodate up to 65,000 people on a single site. And by the end of their first year, they found themselves with a land bank that had grown by 75% and significantly more cash from raising debt and selling pre-builds.

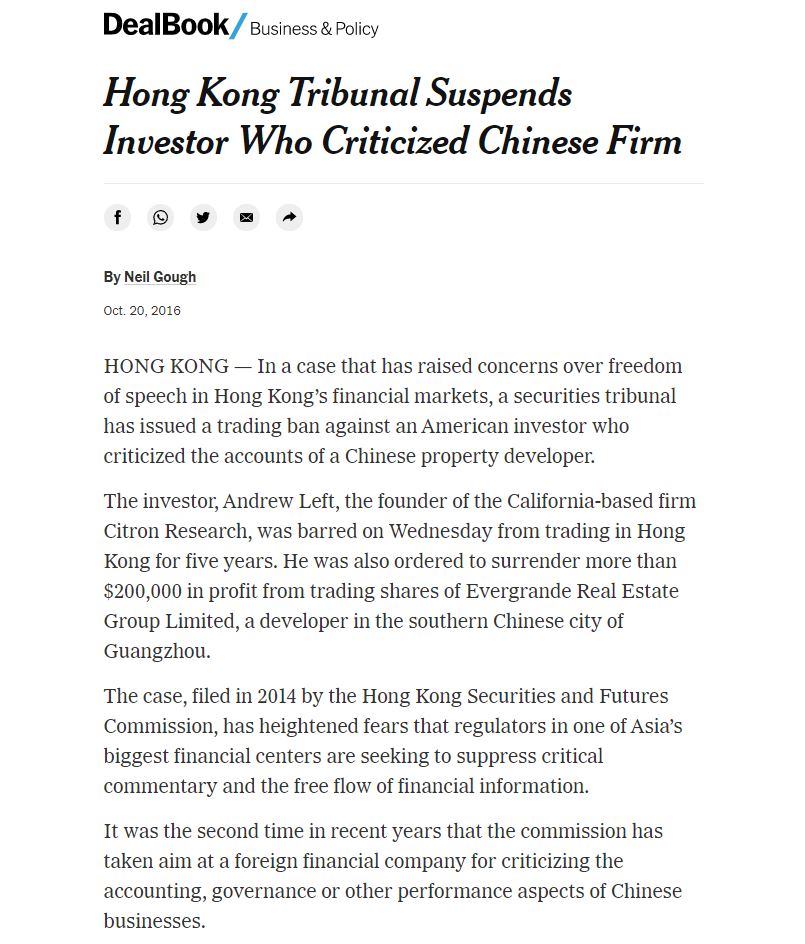

Then in 2012, the company saw this pesky bastard known as Andrew Left from Citron Research put out a short report on the company. Their 57 page report claimed that Evergrande was insolvent. Specifically, it claimed they applied at least 6 accounting shenanigans, were bribing government officials, and created a complex web of Ponzi-like financing schemes.

Our favourite part of the report is where they call out Hui for his honorary doctorate from the University of West Alabama, which was given to him in 2008 as part of winning the World Outstanding Chinese Award. After looking up the University of West Alabama, which turns out is a real school, and almost all of their notable alumni are football players. The point is that the company marketed Hui as a doctor and professor at the Wuhan University of Science and Technology, which Citron’s sources said was untrue.

As you can imagine, the higher powers of both China didn’t take to kindly to this report. And Mr Left received a 5 year suspension from trading in Hong Kong, which appears to be up next month.

Today the company employs around 200,000 people with reports suggesting they hire as many as 4 million workers with subcontractors a year. They own more than 1,300 projects in more than 280 cities. They have over $300B in debt. Lastly, Research firm Capital Economics estimates Evergrande has sold around 1.4 million apartments, worth $200 billion, that it hasn’t yet completed.

So let’s move forward to today. If we look at Evergrande’s annual filings, as of December 31, 2020, Liabilities to assets sit at 82%, well above that red line of 70%. Net gearing defined as borrowing to total equity sits at 204%, above that red line of 100%. And if we look at short term cash to short term borrowings, Evergrande sits at 47%, well below the 100% threshold. And just like that Evergrande has crossed all three red lines.

The company does various things outside of real estate development. They have an electric vehicle division, they own amusement parks, a professional soccer team, a mineral water company, a media company and even dabble in healthcare. So the company is sort of a Ponzi-like scheme in that they bring in cash from various parties to pay off other parties, all as part of a business model that fails to consistently generate free cash flow to sustain itself.

Looking at the roster of businesses they surround, it isn’t unreasonable to suspect a great deal of these ventures were about raising capital and less about the operating business. Which is what you have to do, when you are an over leveraged real estate company, with lengthy cash conversion cycles and an inability to take on more debt.

So in 2019, the company started offering wealth management products. Which we suppose theoretically is a great idea to try to match your long term borrowing with your cash inflows. But of course, as you would suspect with Evergrande, they over promised with up to 12% yields coupled with gifts such as Dyson air purifiers and Gucci bags, and hey, it even worked. They managed to find 80,000 investors for these products, many of which were employees or family members of employees that today fear they won’t get paid back.

The nutty part of this story is that we have a company that clearly crossed the red lines of leverage. Yet, as recently as this year Evergrande was raising money while attempting to pay directors dividends. Forbes reports that Hui has been paid out $8B in dividends since the company first went public in 2009. And even more shockingly, Evergrande attempted to issue a special dividend for 2021, claiming it would increase interest in their share price, which they ended up canceling on July 27th.

So if you’re taking notes, the company’s near term cash needs for servicing both it’s onshore and offshore debt is over 700M USD. Of course, we assume the onshore debt holders will get priority, as has been the case so far, but this is where we get into the next bucket.

Bucket 3: The Global Economy

Will there be contagion?

We have to think about this first domestically and then globally.

So domestically, the government has come out and said “no more further excessive real estate borrowing,” with that whole 3 red line policy.

And this is interesting because according to Goldman Sachs the total value of Chinese homes and developers’ inventory hit $52 trillion in 2019, which is twice the size of the U.S. residential market.

Now, whenever there is a housing bubble one of the concerns we all turn to is the shadow banking system. The shadow banking system is private lending where borrowers use overvalued and bad real estate collateral to take on more debt in a largely unregulated high yield fashion. Some have suggested that the Chinese shadow banking system is largely comprised of billionaires and stolen funds from bureaucrats, which then gets levered via fractional reserve banking.

We’ve also learned that retail investors in China were participating in this system as well. For example, Evergrande Wealth, which sold the company’s Wealth Management Products, is considered a part of this shadow banking system. And overall this system has the potential to be a canary in the coal mine given a sideways or declining real estate market if it is as out of control as many believe. But we will leave that for another time.

This reminds some of us of Japan. In a great piece over at the Financial Times, Gillian Tett compares Evergrande’s failure to that of regional bank Hokkaido Takushoku, when more than 1/10th of the loans went bad in the $75B portfolio. In her belief, there are two things that hold up asset prices 1) government support and 2) scrutiny by investors.

So when the Japanese bubble burst in the early 1990s, despite suspicions of bad loans, there wasn’t much initial panic. This was because the pillar of government support still existed. But then in 1997, the Bank of Japan declared it impossible for the company to meet its funding requirements. And just like that, confidence disappeared faster than a tray of delicious sushi presented to SmallCapSteve.

So here we have Evergrande, which given the recent events doesn’t hold up to investor scrutiny and no longer has government support. Thus, the pillars are broken. The question becomes, where do the pillars of government support for both the other real estate developers and the general real estate economy go from here? Time will tell, but it may be too late.

Jim Chanos tells us that this may actually be worse than the Lehman Brothers catastrophe:

“In many ways you don’t have to worry that it’s a Lehman-type situation but in many others, it’s far worse because it’s symptomatic of the whole economic model and the debt that’s behind the economic model,”

And as another famous short seller, Kyle Bass, tells us, that this isn’t about Xi propping up the stock market. It’s about those 600M people living below the poverty line revolting against the government.

If we look at China’s main imports we see integrated circuits, crude petroleum, iron ore and gold at the top.

Already we have seen some cracks start to appear if we look at iron ore, which is one of the key materials used in real estate construction.

What about the owners of Evergrande’s offshore debt? Well we must shed a tear for all those fund managers and high net worth individuals who are likely to be bagged by those raspy devils over at Credit Suisse.

It’s well known that HSBC and Blackrock both may take hits from the offshore bonds, with some rumours swirling that HSBC may even have issued billions of dollars in mortgages to Chinese buyers of Evergrande property. Jason Burack even suggests in a YouTube video that he was told in private conversations with Kyle Bass that there is a chance HSBC stock could go to zero over this.

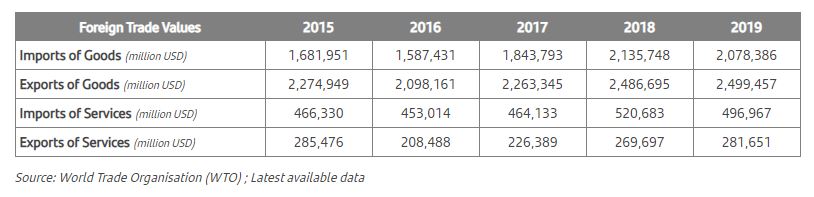

China is the second largest economy in the world. They do over $2T in trades both in terms of exports and imports. It would be foolish to suggest there won’t be contagion. Many of these trades occur in US dollars, which could affect both money markets, banks, and suppliers around the globe as velocity slows down.

Heck, there is even an outside chance that all the real estate various Chinese citizens have acquired internationally could be sold off and repatriated to bring US dollars back to China. Don’t put anything past President Xi Jinping.

Information for this briefing was found via Bloomberg, The Financial Times, CNBC, Reuters, Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.