Over the last eighteen months, equity investors have concluded that the stock market is a fairly easy puzzle to solve. All dips represent, in short order, buying opportunities (at least in theory). Presumably, the U.S. Fed or the U.S. Congress will always be there to backstop the market.

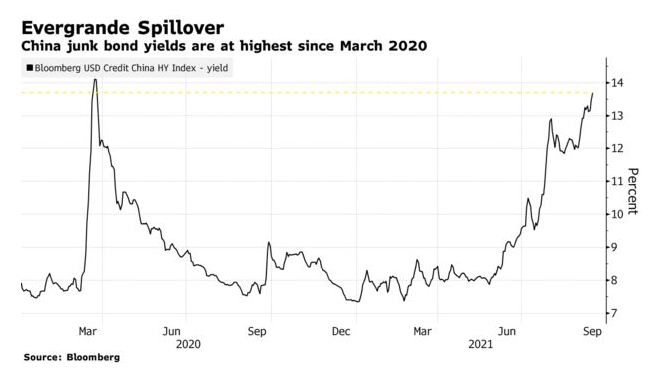

Investors are continuing to follow this blueprint regarding China’s Evergrande crisis. To illustrate this, the S&P 500 is currently just 3.5% off is early September all-time high despite the crisis having rapidly expanded to other property developers and to the overall China junk bond market. Indeed, on October 8, an Intercontinental Exchange/Bank of America index of dollar bonds from Chinese companies showed a yield of 19.8%, higher than at the March 2020 start of the COVID-19 pandemic and its highest level in more than a decade.

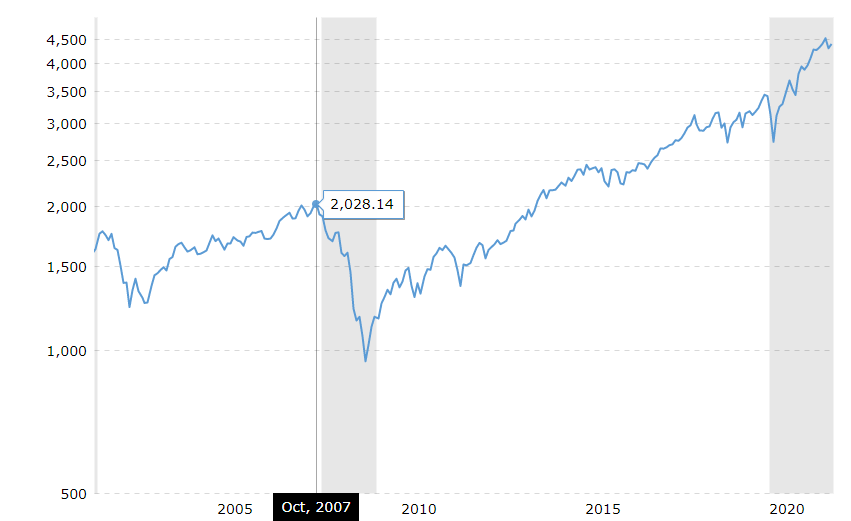

Junk bond yields frequently lead movements in stocks. For example, the U.S. junk bond market sniffed out the 2008 financial crisis well before stock investors. Junk bond yields started rising noticeably in mid-2007, well before the stock market peaked in October 2007.

As noted above, the problems in China are broadening. On October 4, a smaller property developer, Fantasia, defaulted on paying a maturing US$206 million bond two weeks after indicating it would make the payment. According to Reuters, the bonds of both Evergrande and Fantasia are now trading at about 20% of par value.

Similarly, the bonds of residential developer Kasai Group Holdings have collapsed. A 9.375% coupon Kaiser bond traded above 90 a few weeks ago; it now trades at 55.

Another China-based developer, Greenland Holdings, which has built residential towers in New York, Sydney and London, has seen the trading levels of its bonds cut to about 50% of face value. Two other developers, R&F Properties and Xinyuan, suffered credit rating downgrades.

Bonds of companies in other industries are trading lower as well. Yields on bonds issued by West China Cement and an aluminum producer, China Hongqiao, have jumped by a full percentage point since just the end of August, according to Reuters.

Equity markets are in general ignoring these developments in China, reasoning that the problems will be contained there and that their effects will not spread across the Pacific Ocean. That may ultimately prove to be the case, but with the world now so interlinked, it seems odd that most investors have reacted only with complacency to the news — particularly given the junk bond market’s reputation as a better predictor of the future than the equity markets.

Information for this briefing was found via Bloomberg, the Federal Reserve and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.