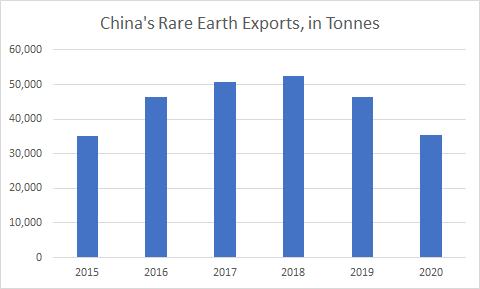

Last week, China announced that it exported only 35,448 tonnes of rare earth materials, down 23% from 46,330 tonnes in 2019 and its lowest annual export total since 2015. Part of this decline may be attributed to the effects of the COVID-19 pandemic, but much of it is due to China’s oft-articulated national strategy of becoming a global manufacturer and exporter of technology-laden finished goods.

Also last week, China published draft regulations that would require Chinese companies in any stage of rare earth production, such as mine development, smelting, or separation, to follow strict export control laws and regulations regarding the import and export of rare earth materials. This action seems to be a fairly direct response to continued trade tensions with the U.S.

Taken together, these two news stories highlight the importance of establishing an integrated rare earth elements (REE) production chain in North America. There exist several rare earth deposits in the United States and Canada, and one mine operated by MP Materials, but no refining operation that can produce extremely valuable rare earth oxides. China controls about 85% of worldwide rare earth refining capacity, and exports of those materials to Western companies seem likely to trend down over time.

There are 17 total rare earth elements. Neodymium (Nd) oxide, praseodymium oxide, terbium, and dysprosium oxide are widely used as magnets in the engines in electric vehicles (EV) and in the magnets of windshield wiper, sensor and mirror motors in all cars.

Energy Fuels (TSX: EFR) is beginning a process that could allow it to fill part of the void described above. In December 2020, it reached a deal with The Chemours Company (NYSE: CC) to buy at least 2,500 tons per year of natural monazite sand ore. Monazite, a phosphate mineral that contains the rare earth elements cerium, lanthanum, neodymium, and yttrium, is perhaps the most commonly mined mineral source of REEs worldwide. Upon refining, the monazite purchased by Energy Fuels could contain nearly 10% of the annual U.S. demand for REEs.

In October 2020, Energy Fuels produced a small amount of REE concentrate from monazite sand at its White Mesa Mill in Utah. In 1Q 2021, the company plans to process the monazite on a commercial scale. Energy Fuels would recover a marketable mixed REE carbonate, as well as contained uranium, from the process.

Energy Fuels’ Balance Sheet is Well Capitalized

The company had US$28.1 million of cash and marketable securities and only US$7.9 million of debt, as of September 30, 2020. The company retired that debt in October 2020. Energy Fuels has managed its cash expenses reasonably effectively, as its operating cash flow deficit was US$25.3 million over the first three quarters of 2020, down from US$34.7 million over the corresponding 2019 period.

Creating an efficient rare earth elements refinery has technical, environmental and financial challenges. In particular, many of the additives in the refining process are toxic chemicals. Consequently, the time frame for building a functioning refinery may be extended. Similarly, the costs entailed could be substantial.

Energy Fuels’ shares have more than doubled over the last three months, as investors have begun to focus on companies that could become important players in the REE industry, particularly as supply from China seems likely to dwindle. If Energy Fuels can build a significant REE refinery in the U.S., the company could become a high-margin supplier of a product which has substantial demand from western EV battery manufacturers and aerospace and defense firms, among other enterprises.

Energy Fuels is trading at $4.96 on the TSX Exchange.