Major Chinese names rallied today after the Chinese government vowed to “actively release policies favourable to markets.” This follows after heightened government regulatory crackdown on tech firms and fears of delisting from US exchanges drove down the stocks of the Chinese companies.

In a meeting of Beijing’s Financial Stability and Development Committee, Vice Premier Liu He said that the country’s call is to take economic stability as its priority.

“In the face of new downward pressure, the task of ensuring stable growth needs to occupy an even more prominent position,” Liu said in a speech to the committee.

The promise of market-friendly measures came as Liu announces the country’s target for a modest 5.5% GDP growth in 2022 due to global economic pressures. Beijing is also looking at 11 million new urban jobs, less than 5.5% urban unemployment rate, and a 3% CPI increase.

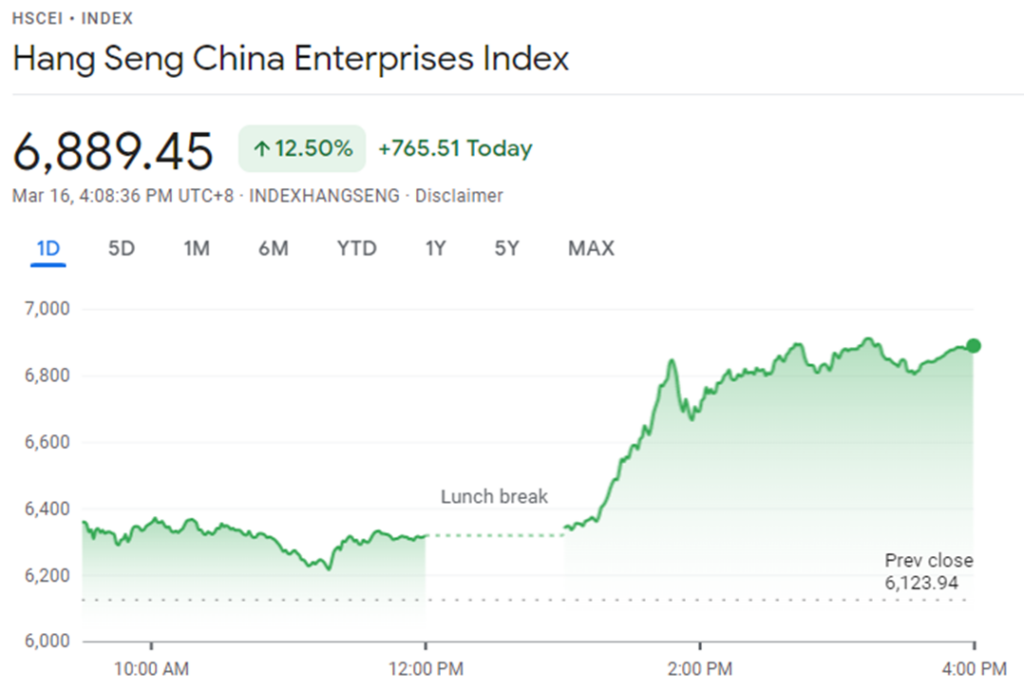

Following the announcement, stock prices rally–with Hang Seng China Enterprises Index jumping by 12.5% on Wednesday. JD.com (NYSE: JD) and Alibaba (NYSE: BABA) rose up by 31% and 23% as of this writing, respectively.

Same effect happened with Baidu Inc. (Nasdaq: BIDU) and Nio Inc. (NYSE: NIO), which jumped by 25% and 20%, respectively.

DiDi Global (NYSE: DIDI), which has recently been the brunt of the Cyberspace Administration of China’s crackdown on cybersecurity measures that led to the firm’s delayed Hong Kong Stock Exchange listing, saw a 46% jump on its shares as of this writing.

A report by Xinhua News Agency citing the committee meeting also noted that Beijing “continues to support various types of companies to list overseas.”

“Regarding China Concept Stock, the regulatory agencies of China and the United States have maintained good communication, and have made positive progress, and are working on forming a specific cooperation plan,” the article said in Chinese.

Last week, fears of dual-listed Chinese tech firms being delisted from US exchanges surfaced after the Securities and Exchange Commission announced five US-listed American depositary receipts failing to adhere to the Holding Foreign Companies Accountable Act. The law allows the US regulatory agency to ban and delist companies that wouldn’t submit their audits for review by the SEC for three consecutive years.

However, this might take a toll on all US-listed Chinese firms since China has a law that prohibits the auditor to provide their review to US regulatory authorities

Information for this briefing was found via South China Morning Post, Seeking Alpha, and Yahoo Finance. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.