Wednesday morning, it was announced that CloudMD Software & Services (TSXV: DOC) is acquiring VisionPros, a vertically integrated eyecare platform. The deal will cost CloudMD C$60 million along with a potential one-time C$40 million earnout. The C$60 million comes in one C$30 million cash payment and one C$30 million payment in common shares of the company. Following this, they also announced a C$45 million bought deal, which was upsized yesterday morning to C$55 million.

CloudMD currently has five analysts covering the company with a weighted 12-month price target of C$3.91. This is slightly up from the average in January, which was C$3.33. One analyst has a strong buy rating, while the other four analysts have buy ratings.

Canaccord’s Doug Taylor raised CloudMD’s 12-month price target to C$3.75 from C$3.25 while reiterating their speculative buy rating on the name. He writes, “Today’s announcement represents the single largest acquisition DOC has undertaken and brings the company’s annualized revenue run rate to over $85M.” He also believes that this deal could bring potential cross-selling opportunities for patients.

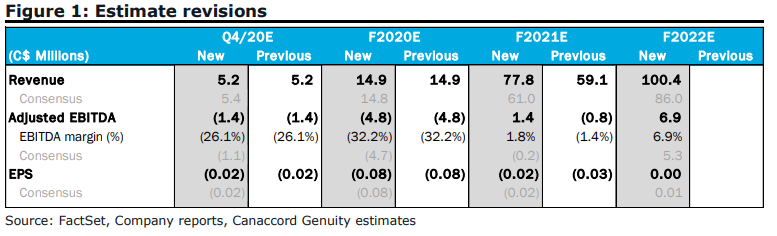

In the news release, CloudMD noted that VisionPro had generated over C$22m in revenue with a >10% EBITDA margin during 2020. Taylor writes, “The deal is financially accretive, with upfront consideration representing 2.7x trailing revenue (4.5x including earnouts) vs. DOC 8.7x 2021E EV/Sales.” Taylor believes that gross margin is in-line with CloudMD’s of 30% and says that if the earnout were trigged by VisionPro growing 50% annually across 2021 and 2022, it would make Canaccord upgrade their forecast.

Alongside the potential cross-selling, Taylor believes the potential exists for synergies with CloudMD’s Rx Infinity digital pharmacy acquisition. Below you can see the key estimates that Canaccord has made for 2021 and 2022 for the firm.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

It should going up.