On November 29th, CloudMD Software & Services Inc. (TSXV: DOC) announced its third quarter financial results. This is the first full quarter with a number of acquisitions, bringing the company’s quarterly revenue to $39.16 million, up 150% quarter over quarter. Additionally, the company saw gross profits grow 158% to $12.21 million or a 31.2% gross margin. Adjusted EBITDA grew to $0.81 million, up from a negative $1.32 million last year. Lastly, the company reported a net loss of $4.33 million, or earnings per share of negative $0.02.

CLoudMD currently has only 6 analysts covering their stock with an average 12-month price target of C$3.83, or a 189% upside to the current stock price. Out of the 6 analysts, 2 have strong buy ratings and the other 4 have buy ratings. The street high sits at C$5.00 from Stephens Inc while the lowest price target is C$3.00 from two analysts.

In Canaccord’s third quarter review, they reiterated their C$3.00 12-month price target and speculative buy rating on CloudMD, saying that the results came in line with the companies preannounced results. For the results, Canaccord had estimates of C$36.9 million in revenue and adjusted EBITDA of C$1.0 million.

While the company beat Canaccord’s revenue estimate, they say that the company saw 11% year over year organic growth versus the 9% last quarter. Specifically, Digital Health Solutions saw 26% organic growth to $10 million, while the company’s numerous amounts of M&A contributed to the rest of the revenue growth.

During the call, the company noted that they saw the $1.5 million in annual cost saving from MindBeacon, but now the company believes there is another $2 million in potential synergies to be unlocked post-close.

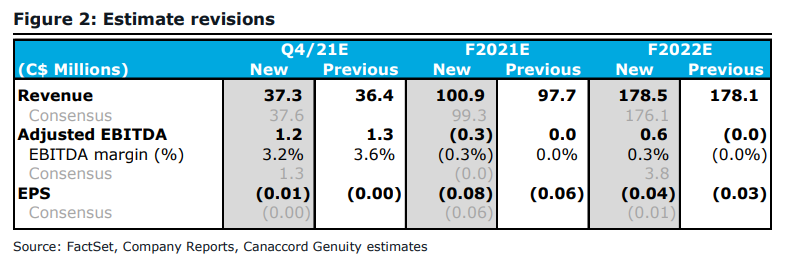

Below you can see Canaccord’s updated fourth quarter, full year 2021, and 2022 estimates. They say that the updates stem from management’s updated commentary on MindBeacon.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.