This morning, CloudMD Software & Services (TSXV: DOC) announced that they purchased Rx Infinity, an e-commerce specialty pharmacy, and wholesaler, for $2.5 million in cash, $4 million in shares, and a performance-based earnout of $3 million for a total consideration of $9.5 million.

RX Infinity is a Mississauga, ON-based specialty pharmacy and wholesaler serving patients mainly in Ontario, but can distribute nationwide to a network of over 500 independent pharmacies.

CloudMD currently has four analysts covering the company with a weighted 12-month price target of C$3.58. This is slightly up from the average last month, which was C$3.45. One analyst has a strong buy rating, while the other three have buy ratings on the company.

Canaccord Genuity reiterated their Speculative Buy rating alongside their C$3.25 12-month price target on CloudMD this morning following the announcement. Doug Taylor, Canaccord’s analyst, headlines, “Brisk pace of M&A continues with online specialty pharma acquisition.” Taylor believes that this deal will bring top-line synergies to support CloudMD’s growing primary care network, existing pharmacy footprint and will grow its relationship with pharmaceutical manufacturers.

Taylor writes, “With Rxi and assuming the close of its remaining outstanding deals, CloudMD now has a $60M revenue run rate and ~$42M in net cash for additional accretive M&A to extend its physical and digital health footprint”.

Taylor says RX Infinity, “adds a complimentary online footprint and expands the company’s presence into Ontario and other provincial markets,” while the company says it expects synergies from connecting its primary care network and EMR platform with RX Infinity.

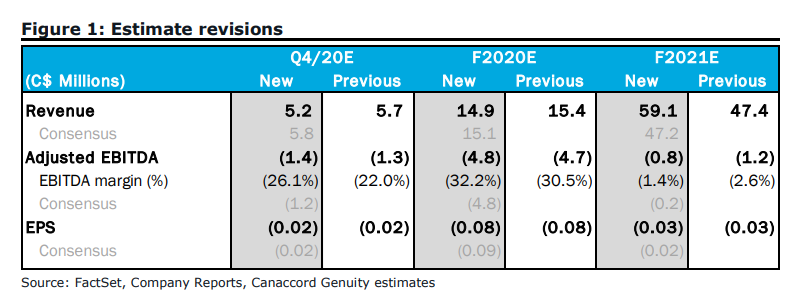

Below you can see the new 2020/2021 estimates, which have been raised on the back of this acquisition. Taylor adds, “we have adjusted our Q4/20 expectations to reflect the updated timing of contributions from the company’s HumanaCare, Medical Confidence, and Canadian Medical Directory acquisitions, which all closed in January”.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.