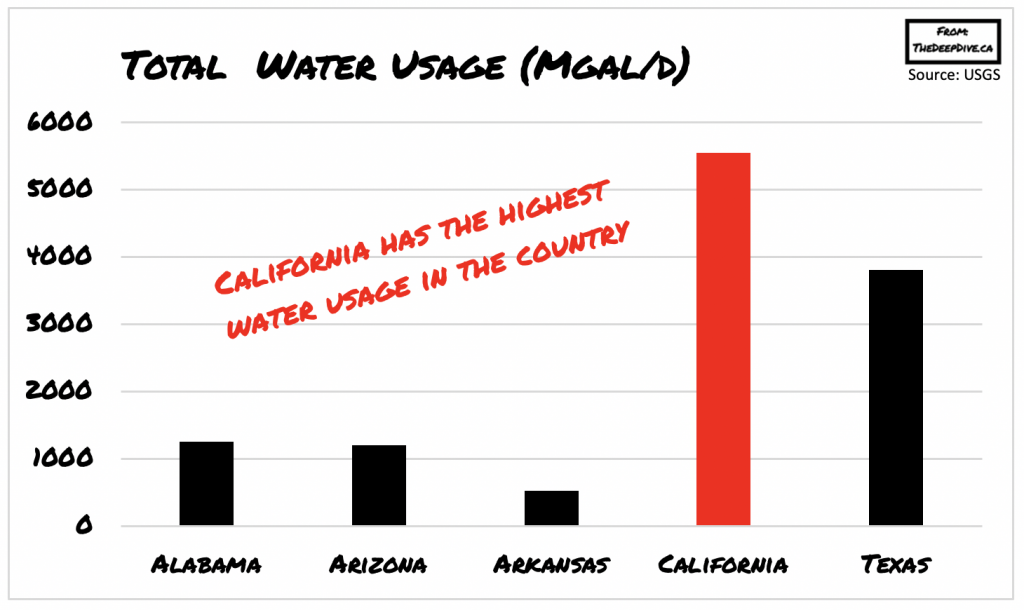

As the global water supply continues to suffer from scarcity, it is projected that almost two-thirds of the global population will experience some form of water shortage by 2025. California is certainly not immune to the alarming trend either, as its $1.1 billion water market faces increasing dangers from environmental factors.

As a result of growing concerns of water supply uncertainty and volatile pricing, CME Group, which is a derivatives marketplace, has teamed up with Nasdaq to create a futures contract based on the Nasdaq Veles California Water Index (NQH2O). The futures will be unique in the sense that it is the first of its kind, and will ultimately serve as a tool for a municipal, agricultural, and commercial water users to gain better price discovery, risk transfer, and increased transparency.

The water futures contract will be based on the Nasdaq Veles California Water Index, and will be representative of a 10 acre-feet of water. Currently, the index sets a benchmark spot price of California water rights each week, which in turn is based on the volume-weighted average price of California’s five major water markets.

However, as environmental uncertainties are increasing plaguing California’s water resources, the new futures contract be able to align a more precise equilibrium between supply and demand. Moreover, a water futures market will allow water users to hedge price risk and adequately plan ahead in the event of changing water costs. The Nasdaq Veles California Water Index futures contract is slated for launch in the fourth quarter of 2020, but is still subject to regulatory review.

As the demand from water grows as a result of the growing global population, its only natural that such a futures contract would be borne out of the demand for the commodity that is increasingly referred to as “blue gold.” This demand has also lead to new issuers arriving on the market, such as Dominion Water Reserves (CSE: DWR), whom is listed on the Canadian Securities Exchange.

The company currently has the contractual rights to over 30% of the total water volume under permit within the Canadian province of Quebec, with a path in place to grow that figure to 70%. That translates to the control of approximately 3 billion litres of water on an annual basis presently. Further water futures contracts hitting the markets for other jurisdictions will serve to properly value the assets of such issuers, while providing further insights to both investors and consumers.

Information for this briefing was found via CME Group and Nasdaq. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

FULL DISCLOSURE: Dominion Water Reserves Corp is a client of Canacom Group, the parent company of The Deep Dive. The company has been compensated to cover Dominion Water Reserves Corp on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.