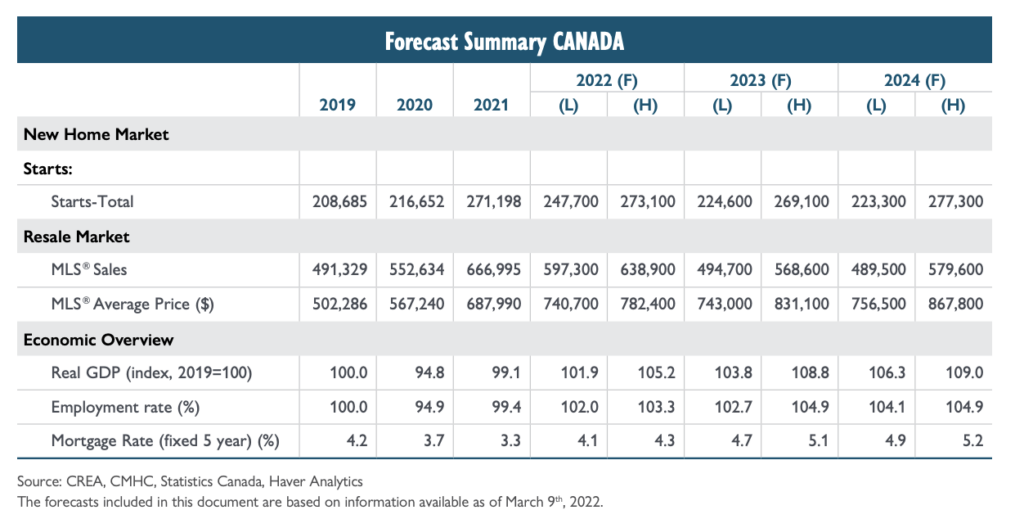

Canada’s housing market is expected to recede from the historic highs witnessed throughout 2021, as higher mortgage rates and home prices erode away at homeownership affordability.

The CMHC’s latest Housing Market Outlook paints an economic picture of reduced affordability, as low supply in high demand markets such as Vancouver and Toronto push home prices even higher, and historically high inflation levels invite tighter monetary policy and subsequent increases in mortgage rates. Although real estate activity is forecast to remain elevated throughout 2022, price growth, sales levels, and housing starts will moderate from record-breaking levels, but will receive support from a relatively robust economy.

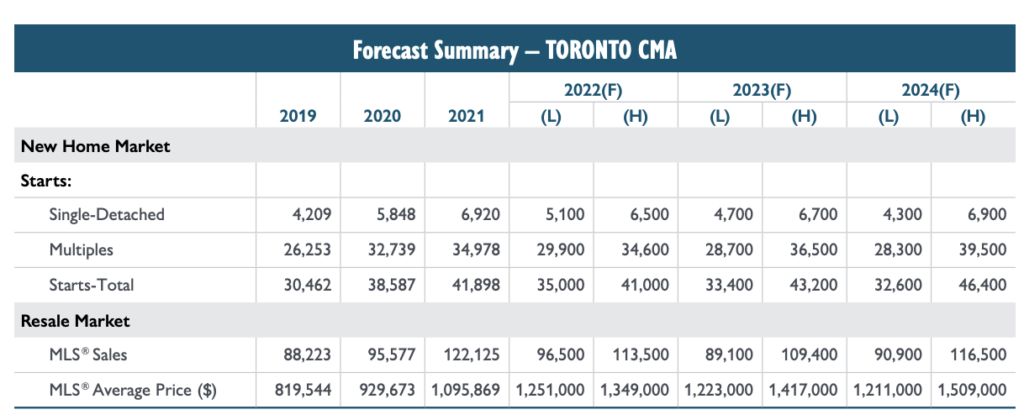

Come 2023, however, an increased number of Canadians will face headwinds will home affordability, as housing prices surpass income growth. Likewise, rental affordability will also decline, amid increased demand and low supply of rental units. Price growth for homes in the hot real estate markets of Vancouver and Toronto will likely continue to suffer from low listings and slower growth in housing supply, which will push price growth even higher.

Underlying the CMHC’s housing forecast are GDP and employment levels, which too, are predicted to slow down from 2022. Net international migration is expected to increase throughout the current year, giving rise to economic conditions in support of more housing starts and home sales. But, at the same time, the robust demand for housing, coupled with low listing levels, will prevent real estate prices from abating too quickly. Eventually though, the cooling impact of higher mortgage rates will cause home sales and price growth to fall in line with historical averages sometime in late 2023 or early 2024.

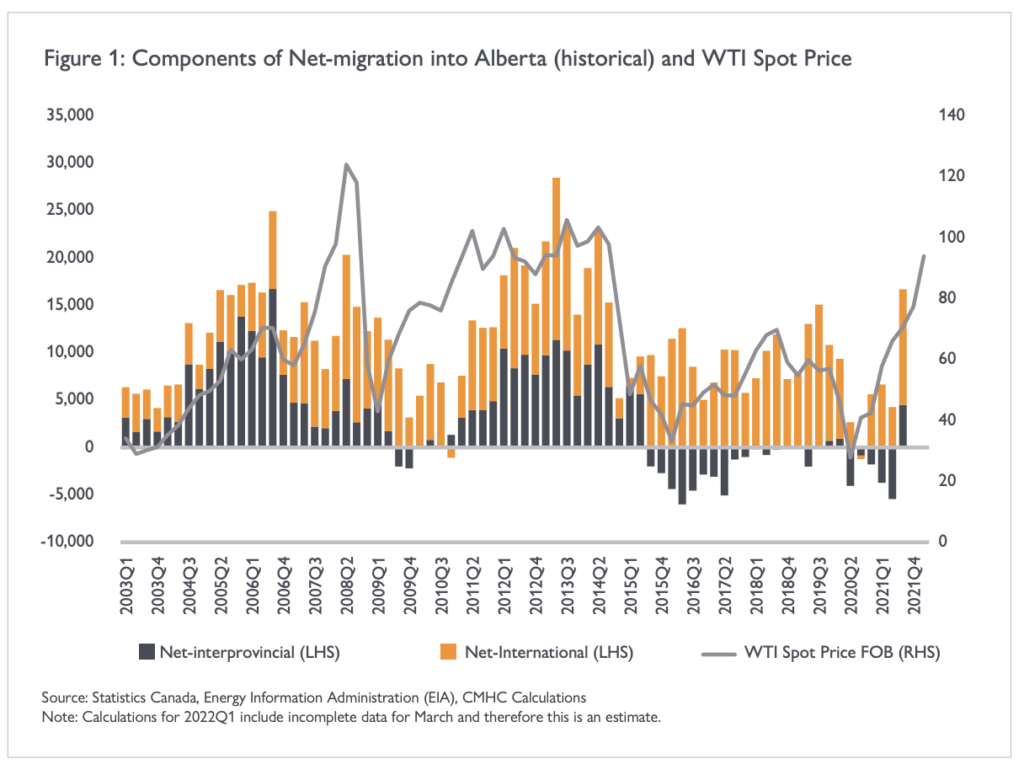

Regionally, the prairie provinces, particularly Alberta, will see robust sales and housing starts levels supported by investments in the energy sector and higher commodity and energy prices, which will create more jobs and attract migration. However, price growth is expected to remain below the national average, indicating a more balanced housing supply relative to other regions. Provinces in the Atlantic region will also see continued upward pressure on real estate markets and price growth due to higher interprovincial migration. Home price levels are forecast to stay lower compared to the overall national average, too.

Ontario, Quebec, and British Columbia, on the other hand, will experience rapid price gains throughout 2022, mostly reflective of tighter supply relative to the rest of the country. By the end of 2024, though, that price growth is expected to slow down significantly.

Information for this briefing was found via the CMHC. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.