Coinbase Global (NASDAQ: COIN) has been initiated by another large analyst firm. This time it’s Canaccord Genuity, whose analyst believes their is a 23% upside to the company, placing the long-term price target at $285 and gives the company a buy rating.

Joseph Vafi, the firms analyst, says that they view Coinbase as a “super on-ramp” to basically everything crypto, as their exchange has both retail and institutional platforms. However, Vafi is quick to say that “We would not be bullish on COIN if we did not also like the longer-term setup for Bitcoin.”

Coinbase currently has 17 analysts covering the company with a weighted 12-month price target of $388.27, or a 67% upside. Out of the 17 analysts, five have strong buy ratings, and seven have buy ratings. Four have hold ratings and a single analyst has a sell rating. The street high comes from D.A Davidson with a $650 price target while the lowest price target sits at $225.

Vafi believes that Coinbase is the definitive leader in digital assets and that the IPO helped build out their c-suite with a bunch of new hires that happened right before the IPO. One of the big reasons Vafi did not give Coinbase a larger upside is due to Coinbase’s revenue being “highly correlated to crypto spot prices,” and that “if we are in a Bitcoin holding pattern here for a while, COIN could likely see sequentially weaker financial performance.” They do believe that this could cause some short-term headwinds and could affect their share price, but that only makes the “investment case more intriguing.”

Vafi gives a long primer into Coinbase before getting to their analysis of the company due to the variability of many moving pieces that this company is made from, such as the points above, but goes into more detail. He says that the short-term thesis is not really clear, and that it’s a “delicate balance between stellar earnings power potential and shorter-term earnings headwinds driven by the volatility of crypto spot prices.” Vafi comments however that the long-term thesis shows that Coinbase is attractive.

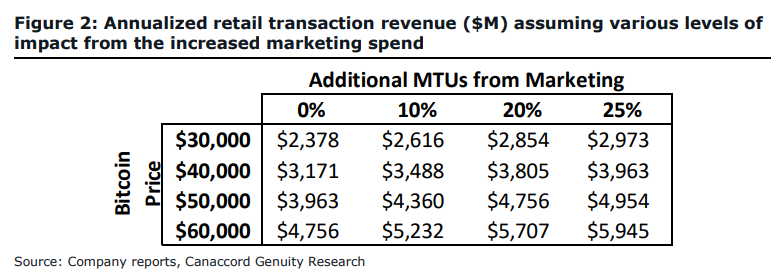

With the company growing its monthly transacting users, or MTU, which grew over 100% from 4Q20 to 1Q21, Canaccord tries to build out a matrix for monthly revenue depending on the price of Bitcoin. They believe that with bitcoin trading at $39,000, the company could be making anywhere between $2.7 – $3.9 million per month – a figure which goes up to $4.1 – $5.9 million if bitcoin can sustain a price of $60,000.

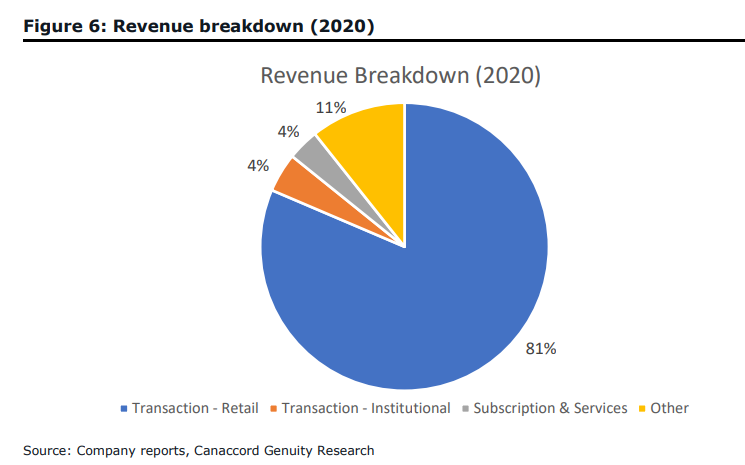

This is because 81% of Coinbase’s revenue is derived from retail trading revenue, and is highly reliant on Bitcoin’s trading price as they find that the higher the Bitcoin price, the more MTU there are. Even with the revenue being so concentrated, their hope is that institutional revenue will start to pick up, rising from its current 4% of revenue to upwards of 15% as the fast adoption by institutions to own crypto will flow right into Coinbase as they have a superior product and ecosystem.

Speaking to the ecosystem, Vafi calls Coinbase a “crypto juggernaut” who is creating a “powerful flywheel in the cryptoeconomy.” Coinbase has some strong stats to back up that claim, including $223 billion in assets on the platform, over 56 million users, 8,000 institutional clients, and 134,000 partners. This shows that Coinbase is most likely the leader in the space for people to trade or store their crypto says Vafi.

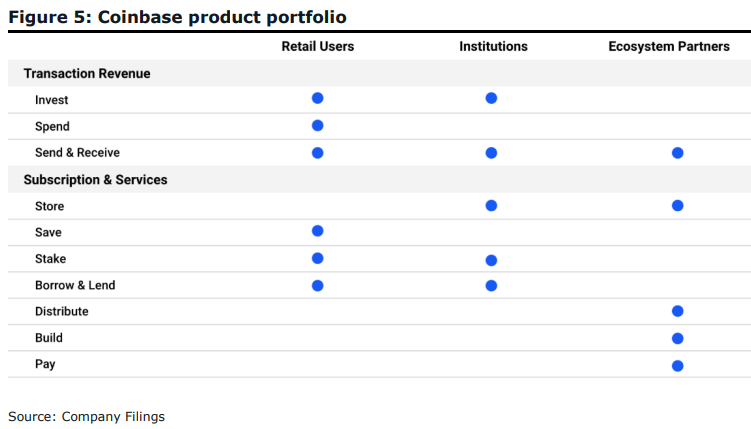

Below you can see Coinbase’s portfolio of products.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.