One of the biggest red flags for an investor is a stock’s refusal to participate in a broad-based, largely indiscriminate stock market rally when there is no company-specific news or analyst ratings changes that might explain such price action. On January 6, shares of Coinbase Global, Inc. (NASDAQ: COIN) behaved in such a manner.

The S&P 500 Index popped 2.3% that day, its biggest jump since November 30, in reaction to what was perceived as a Goldilocks jobs report. The number of advancing stocks on the NYSE outnumbered declining stocks by nearly a seven-to-one ratio. However, Coinbase shares fell US$0.27, or 0.8%, to $33.26.

(Of course, the inverse argument would apply to a stock which performs well in the face of a broad market decline. Investors are disinclined to sell a stock with improving fundamentals even on a weak market day.)

One may have expected Coinbase to rally with the market in a big up day. On January 4, the company settled a case brought by the New York Department of Financial Services over failures in Coinbase’s compliance program. The agreement, which will cost the company US$100 million over a two-year period, was generally applauded by Coinbase bulls as having a smaller price tag than feared and for removing some regulatory uncertainty.

In addition to concerns about Coinbase’s deteriorating cash flows due to the implosion in cryptocurrencies, investors may be worried about the implications of a civil suit brought by the SEC in July 2022 against three men, one a former Coinbase manager.

The suit contends that nine cryptocurrencies, including seven that can be bought and sold on Coinbase’s platform, are actually securities that should have been registered with the SEC under the Securities Act of 1933 (1933 Act). The SEC contends they are securities because “each of the crypto asset securities were offered and sold by an issuer to raise money that would be used for the issuer’s business.” The suit remains outstanding, and no significant developments have been announced since the summer.

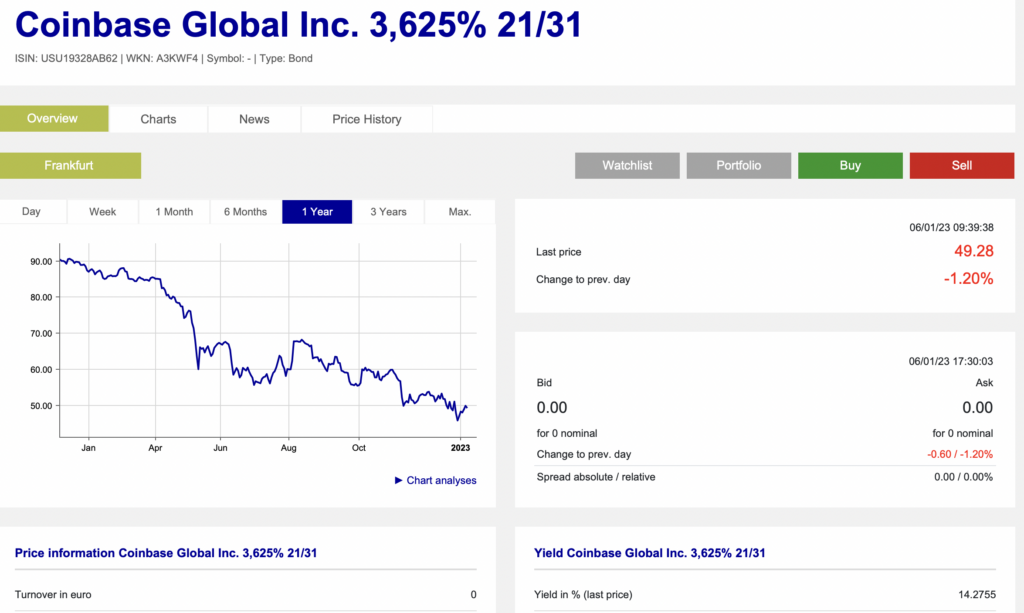

Furthermore, the price action in and associated yield on Coinbase bonds paint an increasingly worrisome picture. The company has about US$3.4 billion of bonds outstanding maturing in 2031. The bond price pierced 50 cents on the dollar for the first time in mid-December and continues to trade below that level (currently about 49 cents). The bonds yield 14.3%, up from 12.8% in mid-December. To put Coinbase’s bond yield into perspective, distressed junk bonds with CCC debt ratings trade at yields in the 15% vicinity, according to Polen Capital, an investment management firm.

Speculative-minded investors should maintain a cautious stance on Coinbase. The combination of a curious reaction to a strong and broad market rally, weak bond pricing for a company with US$5.0 billion of cash on its balance sheet, and significant legal uncertainties seems to represent a bright red warning flag.

Coinbase Global, Inc. last traded at US$33.26 on the NASDAQ.

Information for this briefing was found via Edgar and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.