The world’s largest asset manager meets the world’s largest cryptocurrency exchange platform as BlackRock (NYSE: BLK) and Coinbase Global (Nasdaq: COIN) team up to widen the bridge between institutional investors and digital asset trading.

The partnership essentially provides BlackRock clients an avenue to manage their portfolio–traditional securities and digital assets alike–all within the firm’s investment management system Aladdin. The companies said the engagement “will initially be on bitcoin.”

“Our institutional clients are increasingly interested in gaining exposure to digital-asset markets and are focused on how to efficiently manage the operational life cycle of these assets,” said BlackRock COO Joseph Chalom.

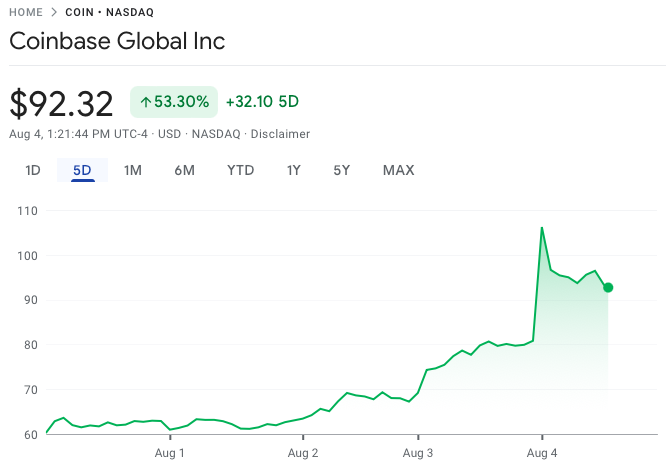

Following the announcement, Coinbase shares rallied by as much as 31.4% when the opening bell rang today.

The move comes amid the increasingly litigious crypto space as the Securities and Exchange Commission has been ramping up its regulatory efforts on the firms within the industry–one of which is Coinbase. The crypto exchange is also currently facing a legal battle related to an insider trading scheme perpetrated by its former product manager.

The BlackRock-Coinbase team up is expected to entice more institutional investors’ foray into the crypto industry, seemingly an antithesis of SEC’s contention with the crypto exchange on whether its traded assets should be considered securities or digital properties outside the regulatory agency’s purview. Coinbase CEO Brian Armstrong has been calling out the commission to draft a set of regulations for cryptocurrency and the trading of its assets.

We need clear, consistent rules to regulate the cryptocurrency industry in the US. It’s great to see policymakers on both sides of the aisle work towards bringing that clarity. https://t.co/N2YvbYagkI

— Brian Armstrong – barmstrong.eth (@brian_armstrong) August 4, 2022

According to Coinbase’s Q1 2022 financial reports, institutional investors account for about three-quarters of the total US$309 billion. On the other hand, BlackRock has reportedly been currently managing US$10 trillion in assets under management.

“The Coinbase partnership between BlackRock and Aladdin is an exciting milestone for our firm,” said Coinbase Institutional Head Brett Tejpaul. “We are committed to pushing the industry forward and creating new access points as institutional crypto adoption continues to rapidly accelerate.”

The partnership also comes at a time when bitcoin prices are currently trading at its lowest levels, falling 52.6% year-to-date.

Coinbase Global last traded at US$94.62 on the Nasdaq.

Information for this briefing was found via Bloomberg. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.