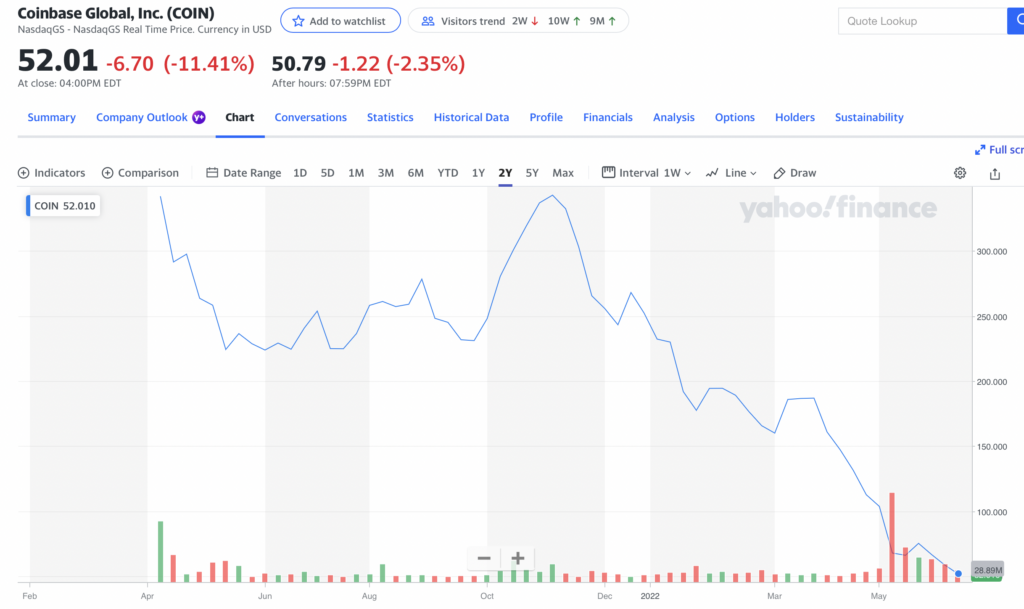

Coinbase Global, Inc. (NASDAQ: COIN) has perhaps the worst possible profile for a stock in this market. Not only is it a high-valuation, formerly high-flying stock, its business is dependent on the viability of (ideally appreciating) digital currencies. To state the obvious, the opposite of that condition currently prevails in the cryptocurrency world.

Perhaps not surprisingly, the stock has been quite weak — down about 25% since June 8. Despite this plunge, it seems possible that the stock could have additional downside risk.

Consider the following three points.

First, Coinbase’s operating cash flow flipped dramatically to negative US$830 million in 1Q 2022 from positive $3.0 billion in 4Q 2021, as its adjusted EBITDA was merely US$20 million in the quarter, down from US$4.1 billion in the full year 2021. (Coinbase’s lowest quarterly adjusted EBITDA in 2021 came in 3Q 2021 when it recorded positive US$618 million.) In turn, the company’s cash balance fell to US$6.1 billion at March 31, 2022 from US$7.1 billion as of December 31, 2021.

| (in millions of US dollars, except otherwise noted) | 2022E | 1Q 2022 | Full Year 2021 | 4Q 2021 | 3Q 2021 |

| Monthly Transacting Users, or MTUs (millions) | 5 to 15 | 9.2 | 8.4 | 11.4 | 7.4 |

| Retail Trading Volume | $74,000 | $535,000 | $177,000 | $93,000 | |

| Institutional Trading Volume | $235,000 | $1,136,000 | $371,000 | $234,000 | |

| Trading Volume | $309,000 | $1,671,000 | $547,000 | $327,000 | |

| Retail Assets on Platform | $123,000 | $141,000 | $141,000 | $116,000 | |

| Institutional Assets on Platform | $134,000 | $137,000 | $137,000 | $139,000 | |

| Total Assets on Platform | $256,000 | $278,000 | $278,000 | $255,000 | |

| Total Market Capitalization of All Crypto Assets | $2,321,000 | $2,321,000 | $2,090,000 | ||

| % on Coinbase Platform | 11.5% | 11.5% | 12.2% | ||

| Transaction Revenue | $1,013 | $6,837 | $2,277 | $1,090 | |

| Subscription/Services Revenue | $152 | $518 | $213 | $145 | |

| Net Revenue | $1,165 | $7,355 | $2,490 | $1,235 | |

| Retail Transaction Fee Revenue/Retail MTUs | ~$45 | $64 | |||

| Transaction Expenses as % of Net Revenue | Low 20% range | 24% | 17% | 20% | 16% |

| Sales & Marketing Expenses as % of Net Revenue | 12% to 15% | 17% | 9% | 10% | 9% |

| Technology and Development Plus G&A Expenses | $4,750 | $984 | $2,201 | $757 | $599 |

| Adjusted EBITDA | $20 | $4,090 | $1,205 | $618 | |

| Operating Cash Flow | ($830) | $10,730 | $2,993 | $342 | |

| Net Income | ($430) | $3,624 | $840 | $406 | |

| Cash, Including Digital Assets | $6,116 | $7,123 | $7,123 | $6,353 | |

| Debt – Period End | $3,486 | $3,491 | $3,491 | $3,496 | |

| Shares Outstanding (millions) | 261.9 | 261.9 | 261.9 | 261.9 |

The concern with these results is that Coinbase burned through about US$1 billion of cash in a quarter when the average Bitcoin price was around US$40,000. So far in 2Q 2022, Bitcoin has traded at an average of around US$33,000, so the cash burn in the current quarter promises to be markedly worse.

A significant cash erosion could force Coinbase to issue equity in the public markets fairly soon. Investors would likely not greet such news warmly.

Second, worker morale at Coinbase appears to be at a very low ebb. Unnamed employees recently began circulating a “no confidence” petition regarding three senior executives on a website. In addition, the company also has been rescinding job offers it made to prospective employees.

Finally, for technically-oriented traders, there is no obvious support point on its stock chart. Virtually every purchase since late March 2022 has proved to be the wrong call. As a result, algorithmic traders seem unlikely to step in as buyers.

A potential trading positive that Coinbase does have is a high short interest. As of May 31, about 12% of its shares outstanding and 18% of its float were shorted.

Despite falling 85% since November 2021, Coinbase still appears to have more downside risk than upside potential. The stock does not look cheap based on fundamentals and its cash burn seems likely to accelerate in 2Q 2022, a situation which could force the company to sell new equity.

Coinbase Global, Inc. last traded at US$51.22 on the NASDAQ.

Information for this briefing was found via Edgar and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.