It has often been said that the bond market sniffs out market inflection points quicker than the equity market. If that is the case, the shares of Coinbase (NASDAQ: COIN) could have even more downside. The stock has already declined around 90% over the last fourteen months.

Coinbase has about US$3.4 billion of bonds outstanding maturing in 2031 which have been trading at about 50 cents on the dollar for the last six weeks. The bonds yield 12.8%.

To put that yield into perspective, distressed junk bonds with CCC debt ratings trade at yields in the 15% vicinity, according to Polen Capital, an investment management firm.

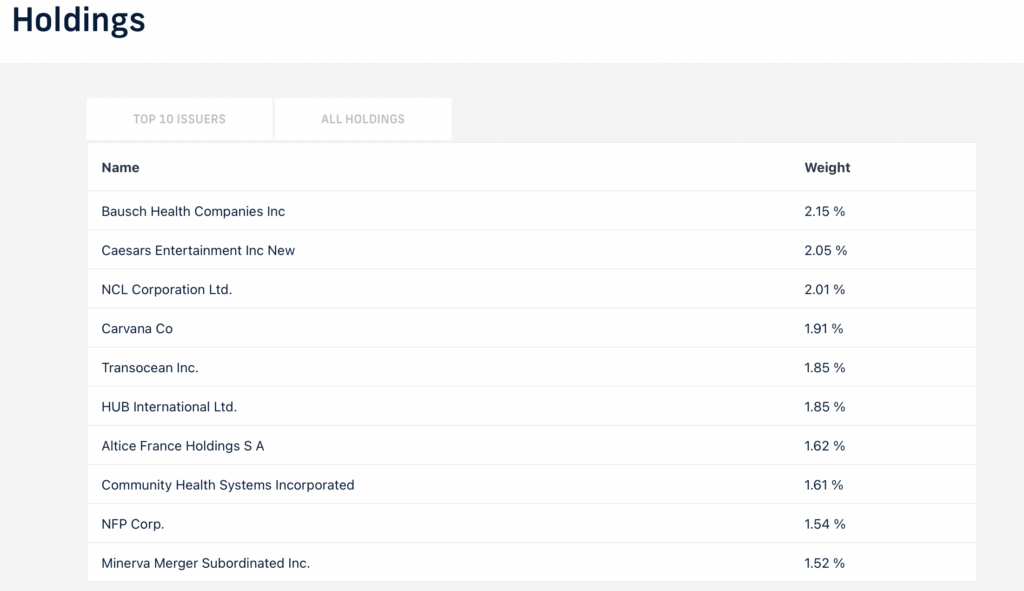

As a next step, consider the composition of the BondBlox CCC Rated USD High Yield Corporate Bond ETF (NYSE: XCCC). It has a current yield to maturity of 14.2%. Two of the larger components of the ETF are the CCC-rated bonds of the troubled car buying and selling platform Carvana Co. (NYSE: CVNA) and the drilling rig owner Transocean Ltd. (NYSE: RIG).

Carvana and Transocean have stock market valuations of about US$850 million and US$3.0 billion, respectively. In comparison, Coinbase, even after its steep descent, still commands a stock market capitalization of US$10.1 billion. Its enterprise value is US$8.6 billion.

For companies whose bonds trade at similar distressed valuations, the gap between the stock market valuations of Carvana and Transocean versus Coinbase seems too large. For companies in financial difficulty, that gap generally narrows by the higher valuation company’s losing altitude as opposed to the more constructive alternative.

Coinbase’s deteriorating financial results over the first nine months of 2022 seem to be consistent with more downside risk. In addition, the fallout from the ongoing crypto nuclear winter, coupled with daily headlines regarding FTX’s implosion, do nothing to bolster investor confidence.

Coinbase’s operating cash flow and adjusted EBITDA for the first three quarters of 2022 total negative US$4.8 billion and negative US$250 million, respectively. As a consequence, the company’s cash balance has plummeted to US$5.0 billion as of September 30, 2022 from US$7.1 billion at year-end 2021.

| COINBASE GLOBAL, INC. | |||||

| (in millions of US dollars, | |||||

| except otherwise noted) | |||||

| Full-Year 2022E | 3Q 2022 | 2Q 2022 | 1Q 2022 | Full Year 2021 | |

| Monthly Transacting Users, or MTUs (millions) | Just under 9.0 | 8.5 | 9.0 | 9.2 | 8.4 |

| Retail Trading Volume | $26,000 | $46,000 | $74,000 | $535,000 | |

| Institutional Trading Volume | $133,000 | $171,000 | $235,000 | $1,136,000 | |

| Trading Volume | $159,000 | $217,000 | $309,000 | $1,671,000 | |

| Retail Assets on Platform | $51,000 | $47,000 | $123,000 | $141,000 | |

| Institutional Assets on Platform | $51,000 | $49,000 | $134,000 | $137,000 | |

| Total Assets on Platform | $102,000 | $96,000 | $256,000 | $278,000 | |

| Total Market Capitalization of All Crypto Assets | $1,050,000 | $970,000 | $1,950,000 | $2,321,000 | |

| % on Coinbase Platform | 9.7% | 9.9% | 13.1% | 11.5% | |

| Transaction Revenue | $366 | $655 | $1,013 | $6,837 | |

| Subscription/Services Revenue | $211 | $147 | $152 | $518 | |

| Net Revenue | $576 | $803 | $1,165 | $7,355 | |

| Retail Transaction Fee Revenue/Retail MTUs | $29 | $64 | |||

| Transaction Expenses as % of Net Revenue | Low 20% range | 18% | 21% | 24% | 17% |

| Sales & Marketing Expenses as % of Net Revenue | $500 to $550 million | 13% | 18% | 17% | 9% |

| Technology and Development Plus G&A Expenses | $4,000 | $896 | $1,079 | $984 | $2,201 |

| Adjusted EBITDA | ($116) | ($151) | $20 | $4,090 | |

| Operating Cash Flow | ($123) | ($3,864) | ($830) | $10,730 | |

| Net Income – Recurring | ($545) | ($647) | ($430) | $3,624 | |

| Cash, Including Digital Assets | $5,007 | $5,682 | $6,116 | $7,123 | |

| Debt – Period End | $3,474 | $3,483 | $3,486 | $3,491 | |

| Shares Outstanding (millions) | 261.9 | 261.9 | 261.9 | 261.9 |

Coinbase Global, Inc. last traded at US$38.69 on the NASDAQ.

Information for this briefing was found via Bloomberg and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.