Last Tuesday, Columbia Care (CSE: CCHW) announced that they had signed a definitive agreement to acquire a California based company called Project Cannabis for $69 million, which is comprised of $12 to $17 million in cash and $52 to $57 million in stock, with the final make-up of the transaction dependent on certain real estate transactions.

Project Cannabis is one of the leading fully integrated cannabis companies in Los Angeles. The firm operates a 32,000 ft cultivation facility and three adult-use retail dispensaries in North Hollywood, Downtown Los Angeles, and Studio City. They are also in San Francisco, where it operates a single adult-use retail dispensary.

Canaccord Genuity Matt Bottomley’s headlines, “Columbia Care set to acquire California-based free cash flow positive Project Cannabis.” Bottomley reiterates his C$13 12-month price target and their Speculative Buy rating on the stock. Bottomley then says that using the company’s estimate, the deal represents a multiple of 1.3x to 1.4x 2020 revenues and 6.1x to 6.7x 2020 adjusted EBITDA. Using the midpoints of the ranges given, he estimates that Project Cannabis is to generate U$42.2m in revenue and U$8.9 million in adjusted EBITDA in 2020.

The new asset is also free cash flow positive, which, “should be immediately accretive upon closing,” says Bottomley. He also states that this deal provides a reliable platform for Columbia Care so that they can continue to add to its CA exposure and that the “decision to acquire a more modest, but immediately cash-flowing asset is an attractive and risk-mitigated way to build up exposure to the US’ largest cannabis market that is still in a rather disaggregated state.”

Bottomley also comments, “PC should be immediately accretive on Adj. EBITDA/Cash Flow.” As above, Canaccord estimates that based on management commentary, Project Cannabis is to achieve U$9 million in adjusted EBITDA in 2020, which will grow to U$11 million in 2021 EBITDA and add roughly 15% more shares to Columbia Care’s share count. Bottomley also mentions that Columbia Care’s 2021 EV/EBITDA multiple is currently expected to come in at 7.6x.

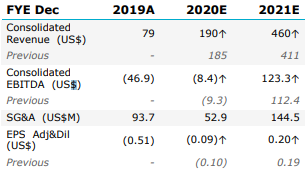

“We believe CCHW is already undervalued on a stand-alone basis vs. its MSO peers and have elected to continue rounding our PT down to the nearest dollar to be conservative,” comments Bottomley. With the acquisition, he has revised Columbia Care’s 2020 and 2021 revenue and adjusted EBITDA estimates. Canaccord now estimates that in 2020 revenue and adjusted EBITDA will come in at $189.5 million and -$8.4 million, respectively, and 2021 will see $459.8 million and $123.3 million, respectively.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.