Although the coronavirus pandemic is showing no signs of dissipating anytime soon, many pandemic-related emergency measures that were enacted in the spring are beginning to phase out causing a great amount of worry among real estate lenders and renters.

When state governments enacted pandemic restrictions and social distancing protocol, many commercial businesses found themselves in a position of suddenly reduced liquidity, and thus the inability to make their mortgage payments. In response, lenders quickly offered debt forbearance programs to the struggling businesses, under the assumption that the pandemic slump would only be temporary. However, nearly eight months into the pandemic later, the financial situation for many businesses across the US has not improved.

As forbearance programs are expiring across the country, many lenders have begun the exhausting process of chasing after borrowers, demanding further capital in exchange for additional forbearance extensions in leu of foreclosures. However, given that a lot of businesses have not even begun to recover from the extensive amounts of debt piled on by the pandemic’s record-breaking reduced consumerism, foreclosure proceedings have now become the norm. In fact, there have been a slew of recent high-profile foreclosure proceedings, including Chicago’s Palmer House Hilton and CBL & Associates Properties Inc, which owns the $63 million Burnsville Center mall in Minnesota.

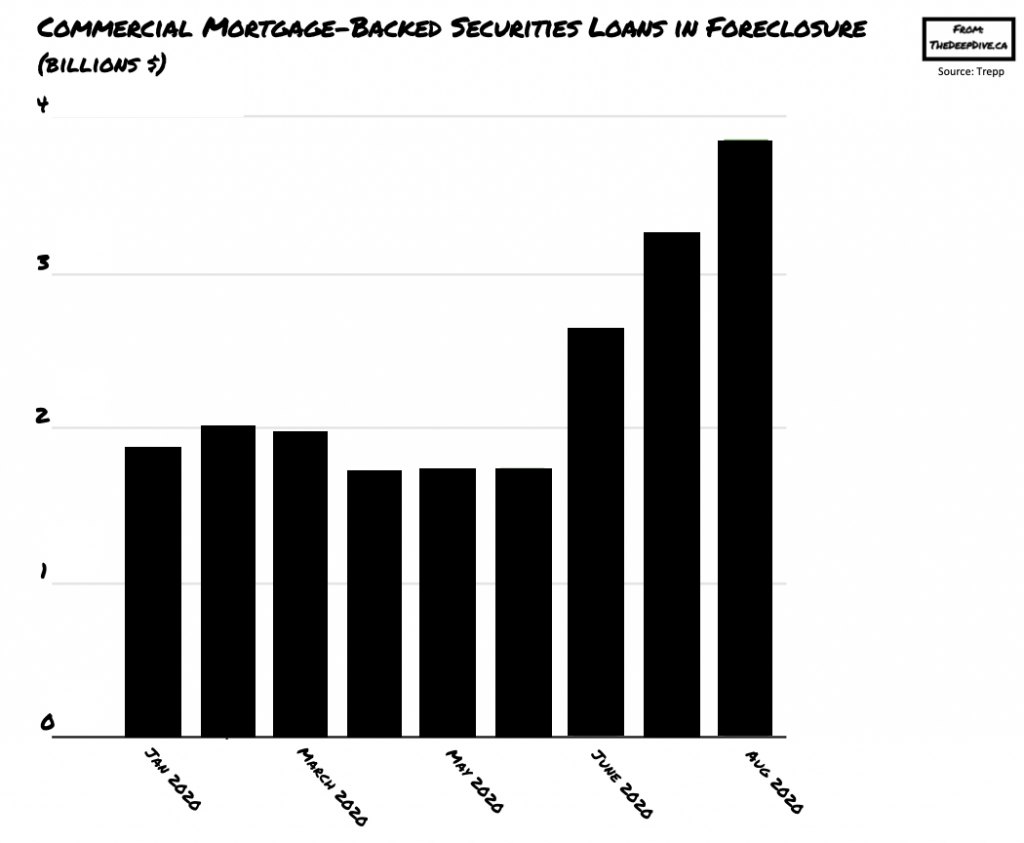

However, the emerging cascade of foreclosures does not stop there. According to Trepp, across the US there have been over 278 securitized mortgage-backed properties foreclosed as of last week, with at least 80 of those properties experiencing financial troubles as a direct result of COVID-19. Many executives and real-estate attorneys anticipate that the number will continue to rise, as the pandemic’s economic effects are far from being under control.

NAI Global chief executive Jay Olshonsky predicts that commercial real estate foreclosures stemming from the pandemic will be significantly worse in terms of numbers compared to the 2008-2009 recession. The immediate vulnerability will stem from businesses concentrated in the restaurant and travel industries, as well as retail sales. The eagerness to foreclose properties will likely stem from nonbank lenders such as commercial mortgage-backed securities and private-equity fund lenders as opposed to banks, which have more leeway from regulators.

In the meantime, CBL was in talks regarding an extension on its Burnsville Center mortgage back in July, but eventually declined to offer more capital in exchange for holding onto the property even after the forbearance period came to an end. However, the situation is more challenging beneath the surface. The JC Penny and Macy’s stores in the mall had already closed, which in turn significantly reduced mall traffic.

Meanwhile three quarters of the mall’s remaining tenants have a clause which would allow them to vacate the property in the event that other anchor stores shut their doors. As a result, CBL has essentially given up, and will not resist foreclosure. In the end, the borrowers will lose, allowing lenders to take back their properties. Now what the lenders will do with the slew of vacant and foreclosed properties all across the US is a question for another day.

Information for this briefing was found via the WSJ and Trepp LLC. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.