According to economists at Capital Economics, the recent increase in vacancy rates for short-term rentals could have a significant impact on housing prices in the near term.

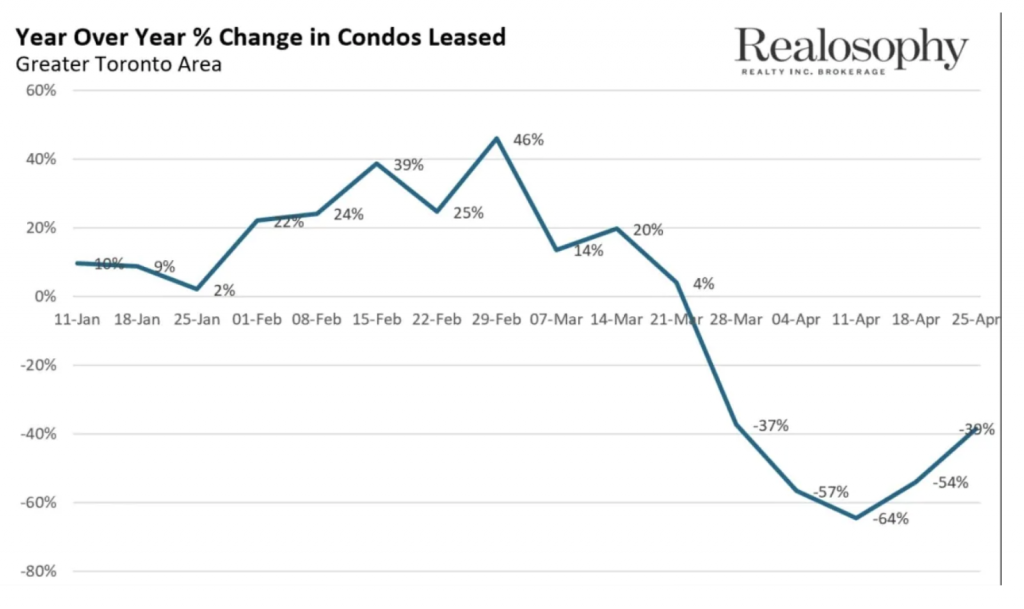

The lockdown measures and travel restrictions have caused immigration to drop to near zero, as well as increase the the unemployment rate among the bottom quartile incomes. As a result, the demand for short-term rentals in many heavily-populated areas such as Vancouver and Montreal has fallen significantly, causing the rental price to follow suit.

Even in the event that economic lockdowns and travel restrictions are lifted within the next short while, causing vacancy rates to taper off, the rental price decline could still very well be anywhere between 5% to 10%. Such a dramatic drop in rental prices could be disastrous for housing prices. In Toronto alone, if the vacancy rate increases from 1.5% to 4.5%, then that easily translates to a 15% drop in rent prices.

Many landlords have already been struggling with covering their costs from lack of incoming rent payments, which could mean they may look at selling their property as a means of alleviating the financial strain. In the event that a house-selling cascade is triggered, housing prices could fall by more than the anticipated 5%.

Information for this briefing was found via Bloomberg and CBC. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.