Trafigura, one of the world’s largest commodities traders, has a grim warning: copper stocks are running dangerously low. If inventories used to be counted in weeks of global consumption, they’re now being counted in days — with the forecast seeing it drop to just 2.7 days by the end of the year.

The #copper market’s available inventory is normally marked in weeks. Currently, only 4.9 days of material is available, falling to 2.7 days by the end of the year according to Trafigura who know a thing or two about these things. pic.twitter.com/0XLkUDrNTd

— Gianni Kovacevic (@GianniKov) October 22, 2022

Limited supplies signal the possibility of a sudden spike in prices for the commodity, which is used across industries, primarily in electronics, construction, industrial machinery and equipment, and transportation, with the transition to electric vehicles and green energy heating up demand.

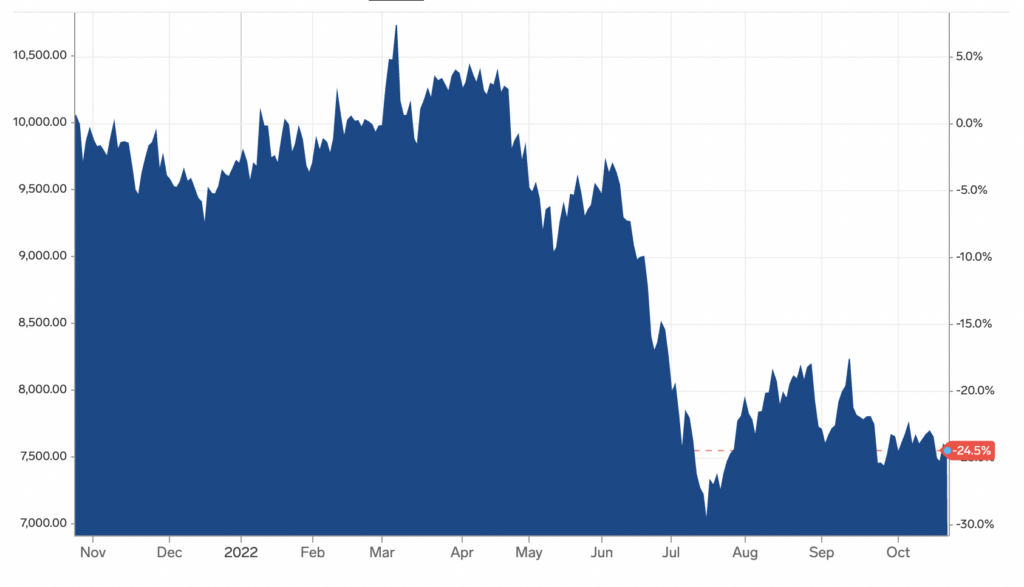

Copper prices most recently closed at $7,585.50 per metric ton, down from a peak of around $10,700 early in March.

Kostas Bintas, co-head of metals and minerals trading at Trafigura, said at the FT Mining Summit on Thursday that today’s copper market only has inventories that cover 4.9 days of global consumption.

“While there is so much attention being paid to the weakness in the real estate sector in China, quietly, the demand for infrastructure, electric vehicle-related copper demand, more than makes up for it,” Bintas explained. “It actually not only cancels completely the real estate weakness, but also adds to their consumption growth increase.”

Bintas, also pointed out the acceleration of Europe’s transition to renewable energy as it tries to wean itself off Russian gas.

“It is not accidental that the EU has decided to bring forward the target of doubling its solar capacity from 2030 to 2025. All that requires a lot of copper,” he said. “Look at electric vehicles everywhere, [the numbers on the road] are surprising to the upside. That’s a lot of copper too. As a result, we’ve been drawing down stocks throughout this very difficult year.”

Bintas, who last year projected that copper prices would soar to $15,000 per metric ton, says the metal is being sold on recession fears. The Trafigura executive expects a “structural repricing” to happen “very quickly” once recession fears ease.

“I think it’s fair to assume a higher price of what we have today,” he said. “Is it going to be more than $15,000? I think time will tell.”

Information for this briefing was found via the Financial Times, and the sources and companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.