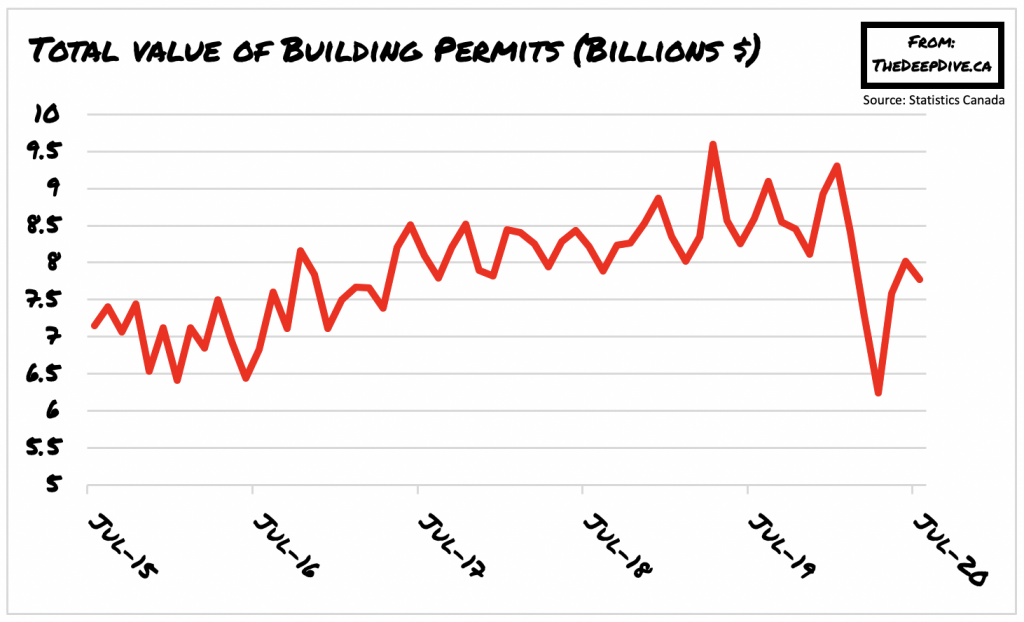

It appears that the momentum in Canada’s construction sector is beginning to show signs of a slowdown. According to latest data released by Statistics Canada, the month of July saw the value of building permits decline by 3% to a total of $7.8 billion.

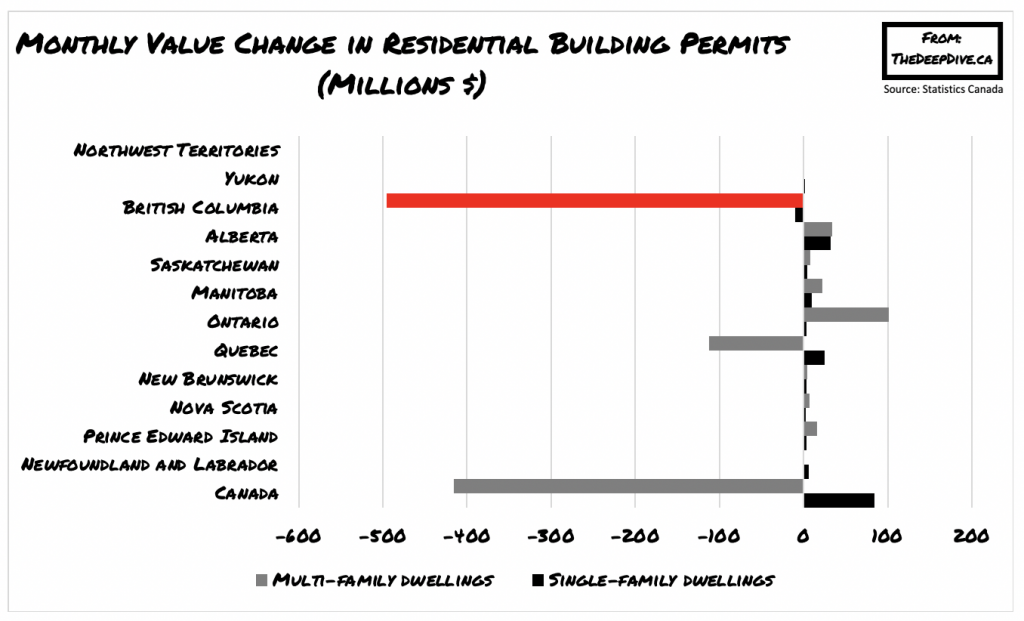

The sudden decline in building permits can be attributed to a select few provinces, which were the subject of plummeting volumes. Quebec, British Columbia, and Newfoundland and Labrador each saw drastic declines of 15.1%, 34.2%, and 19% respectively in July, suggesting that the record gains following the economic slowdown of March and April are only seemingly short-lived. Oddly enough however, the declining values were only limited to those three provinces, as the rest of the country saw the value of permits evidently increase.

With respect to residential permits, the value declined by 6.2% in July, to a total of $5.1 billion. Most notably, permits for multi-family dwellings in British Columbia fell by a staggering 47.8%, after posting a record rebound of 31.1% in June. The province of Quebec also followed suit with a drop of 16.2% to a total of $581 million, after permit volumes increased by 13.6% in the prior month.

Although residential and multi-family permit volumes fell in July, they were offset by gains in commercial permits. Statistics Canada reported an overall increase of 3.3% in non-residential permits, amounting to a total of $2.7 billion in July. Specifically, commercial permits rose by 29.9%, after the city of Ottawa issued a $474 million permit for a 2.7 million square foot project that will house an Amazon distribution centre.

Despite the positive gains for commercial permit volumes, industrial permits continue to post consecutive declines. For the second month in a row, industrial permits fell by 15.7% to $462 million, with Quebec attributing to the largest drop of over 37%. Institutional permits also decreased by 24.2% in July, with British Columbia suffering the largest volume decline on 50.2%.

Information for this briefing was found via Statistics Canada. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.