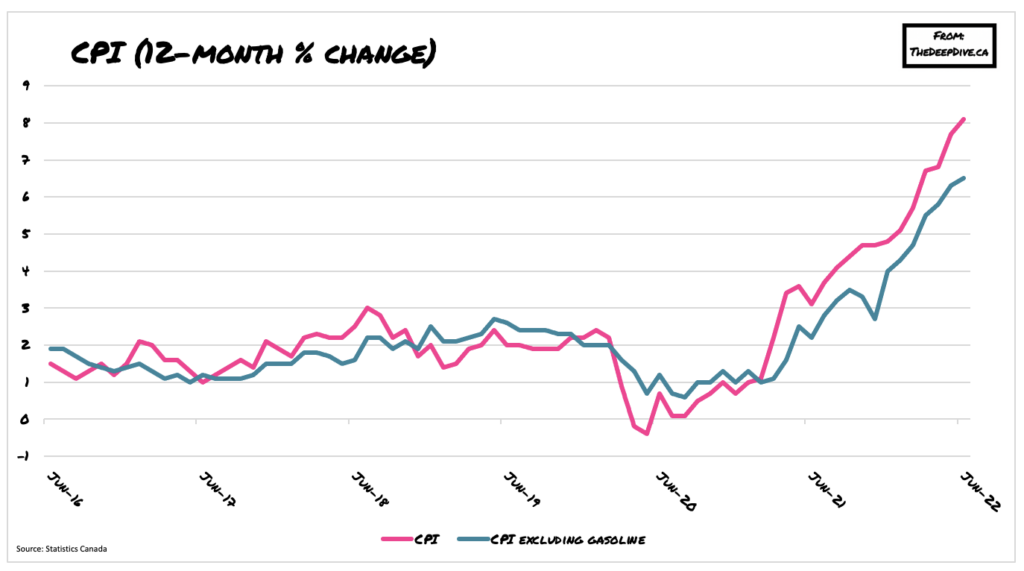

Canadians continue to pay more for goods and services with each passing month, even as the Bank of Canada embarks on one of the most hawkish tightening cycles since the 1990s.

Latest data from Statistics Canada shows that prices rose 8.1% year-over-year in June, following an increase of 7.7% in the prior month. The jump was the biggest annual gain since January 1983, with seven of the eight major components noting increases of over 3%. Meanwhile, core CPI, which excludes gasoline, rose 6.5% from June 2021 after rising 6.3% in May.

Last month’s acceleration in consumer prices was largely the result of elevated gasoline prices, which were up 54.6% compared to the same period one year ago. Hitting traveling Canadians’ wallets even harder was the cost of passenger vehicles, which increased 8.2% year-over-year after rising 6.8% in May. Likewise, the lifting of Covid-19 related public health restrictions coupled with the summer tourist season caused accommodation costs to rise 49.7% compared to last year, while the cost of air transportation jumped 6.4% between May and June.

On the contrary, though, the Bank of Canada’s hawkish monetary policy caused shelter costs to decelerate, rising only 12.2% year-over-year compared to an annual increase of 14.8% in May. The homeowner’s replacement cost index also increased last month, albeit at a reduced pace, as real estate commissions decreased in reflection of declining home prices. The mortgage interest cost index also declined at a slower pace in June, falling 0.6% since 2021 compared to a drop of 2.7% in May, putting upward pressure on inflation as borrowing costs rise.

Information for this briefing was found via Statistics Canada. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.