As many states across the US have begun to ease restrictions and businesses have reopened, the demand for goods and services has increased. Although the Fed’s unprecedented stimulus money printing is surely indicative of a looming spike in inflation, the continuation of soaring infection rates across several states including Texas, Florida, and Arizona have been a factor in the stabilization of prices for the time-being.

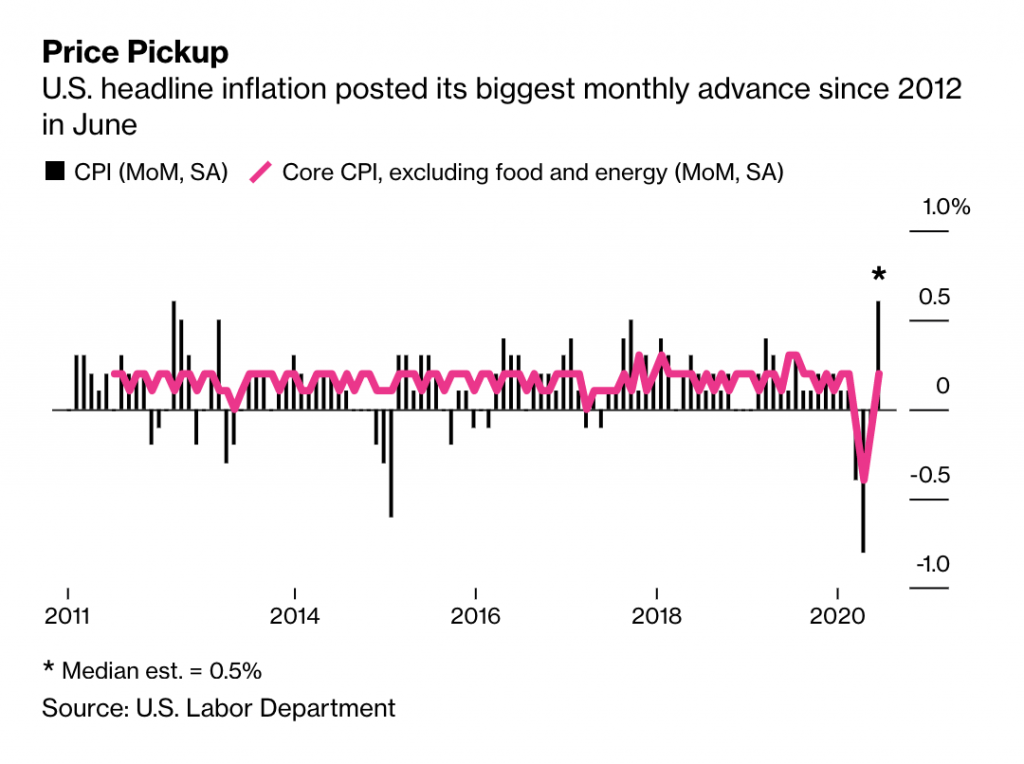

According to latest stats released by the US Department of Labour, consumer prices across the US have risen by the most in June since 2012, with much of the increase attributed to the rebound in gasoline prices. The consumer price index rebounded by 0.6%, after a drop of 0.1% in May. Even though the price of gasoline increased by 12.3%, they are still 23.4% lower when compared to the same time a year prior.

In the meantime, food prices have continued to rise across the US. The cost of groceries increased by 0.7% since May, and increased 5.6% since the previous year. Such a large increase has not been witnessed since 2011. American households ended up paying 1.2% more for goods, and 0.2% more for services. However, the cost of rent for primary residences increased by only 0.1%, as many Americans have been abandoning city dwellings in favour of suburbs and rural communities to hide out from the virus.

Since the US economy entered into a recession in February, pricing power has been diminishing. As a result, producer prices have suddenly begun falling in June, with the cost of meat declining by 27.7%. Consequently, the rate of inflation at the consumer level has been somewhat stagnant relative to the copious amounts of liquidity being injected into the economy by the Federal Reserve.

Information for this briefing was found via US Department of Labour and Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.