Long gone are the days when one could buy items for one dollar, let alone four dollars! Popular discount store Dollarama (TSX: DOL) on Wednesday announced during its quarterly results that it too, is no longer immune to the rampant non-transitory inflationary pressures gripping the economy, and will be unveiling additional price points up to $5 dollars in 2022. “It will be a gradual ramp up starting mid-year and becoming more noticeable through the second half of the year. In the near-term, this brings additional flexibility to manage cost pressures in a heightened inflationary environment,” explained Dollarama president and CEO Neil Rossy.

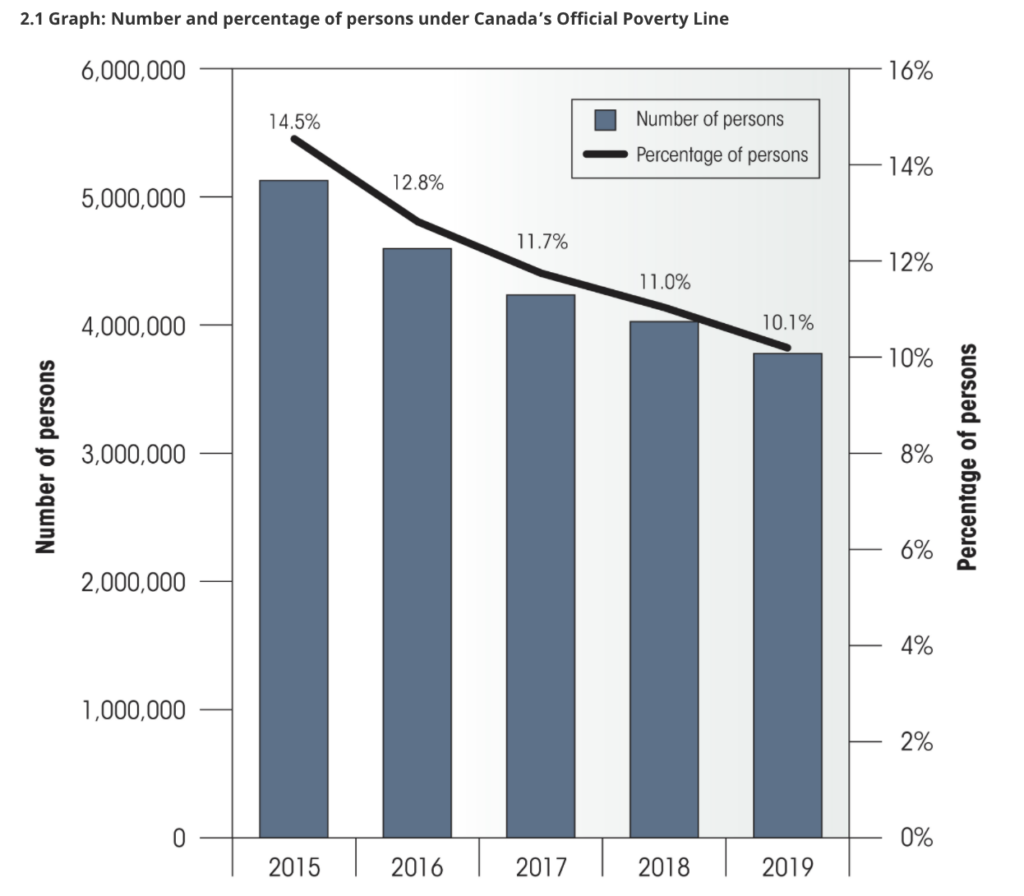

As of right now, some of Dollarama’s most costly items sit at $4, with most products priced below that. However, for households experiencing financial hardships, even a $1 increase in the price of a good could have overwhelming consequences. “To a person living in poverty, it can spell the difference between a meal that night, the difference between making your rent that month, the difference between being able to even transport your child to school,” said Calgary’s anti-poverty group Vibrant Communities executive director Meaghon Reid as cited by CBC.

The discount store has more than 1,400 locations across Canada, and although the chain did at one time sell items for less than $1, it introduced additional price points of $1.25, $1.50, and $2.00 in 2009. But, in the face of receding gross margins for fiscal 2023, Dollarama said it had no choice but to raise prices in order to protect margins from further erosion.

Despite setbacks from lockdowns related to Covid-19, the discount chain saw its sales increase from $1.1 billion last year to $1.22 billion in the first quarter of 2022, while profits were up from $173 million to $220 million.

Then change the damn name from dollarama to nothing for a dollar https://t.co/JrUtE7tq6d

— Sharan (@Sharasbearss) March 30, 2022

The positive financial position gave Dollarama the assurance to raise shareholder dividends by 10%, up from 5.03 cents per share to 5.53 cents per share. But, the firm now only expects gross margins to sit between 42.9% and 43.9%, after reporting gross margins of 43.9% during the fiscal year ending in January.

Nonetheless, Dollarama now anticipates that a positive sales environment is en route, as pandemic-related setbacks continue to phase out. Still, the discount store warned that supply chain disruptions and inflationary pressures are going to be more pronounced this year. “Historically, new price points has one rule, which was to bring new and exciting to the table. In the current environment, it will be that combined with the fact that we are living in an inflationary environment,” said Rossy.

Information for this briefing was found via Dollarama and CBC. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.