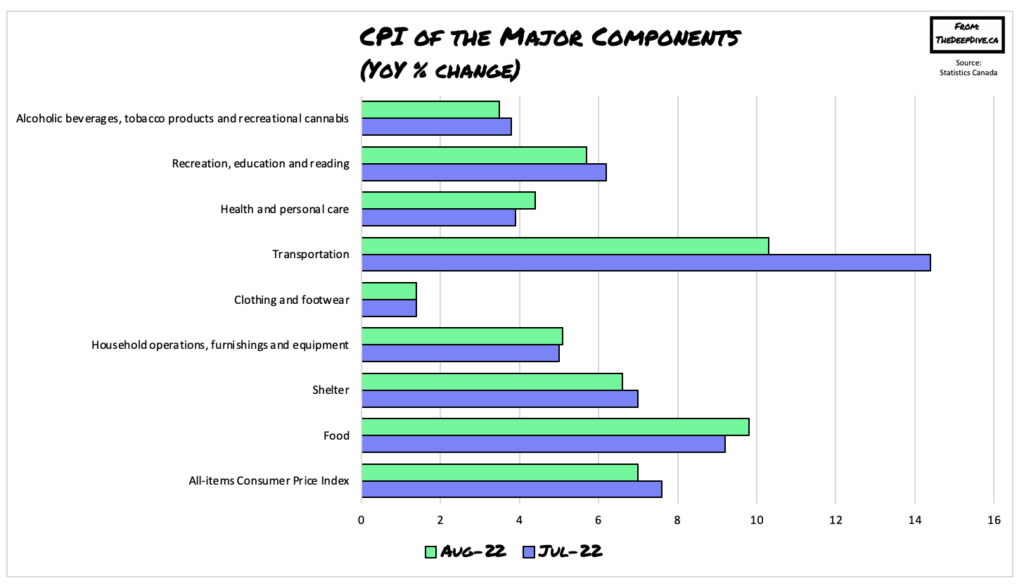

Both headline and core consumer prices may have slowed in August, but prices for things Canadians are purchasing the most— such as food, continue to soar to record-breaking levels.

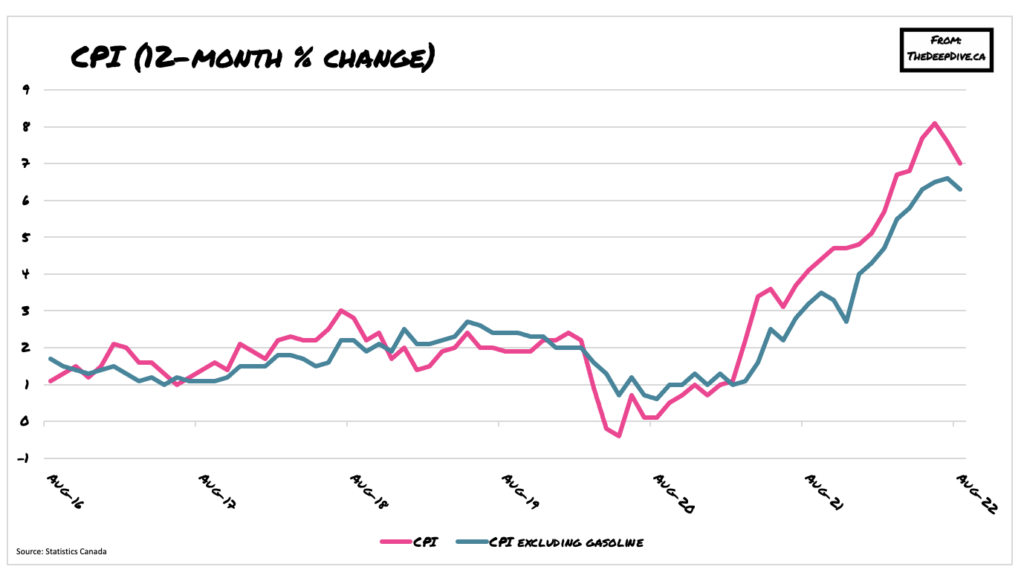

Latest data from Statistics Canada showed CPI slow from an annualized 7.6% in July to 7% in August, against expectations of a 7.3% print, marking the second month of a slowdown thanks to lower prices at the pump. Core inflation, which does not account for gasoline, was up 6.3% from August 2021, following a 6.6% increase in July. That was the first time the core measure declined year-over-year since June 2021. When compared on a monthly basis, consumer prices were down 0.3%, making August the biggest month-over-month drop since the beginning of the pandemic.

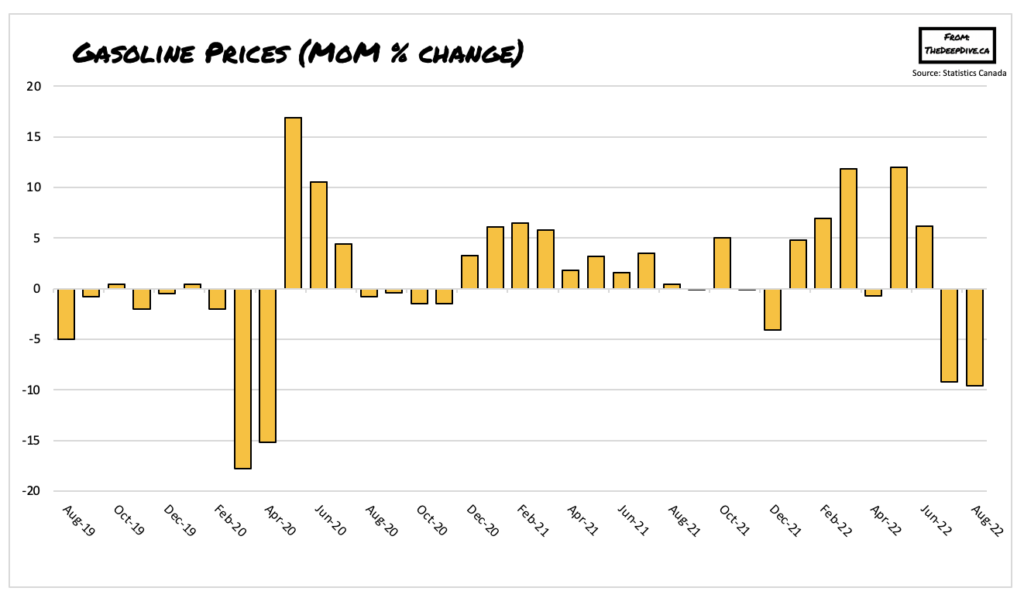

Much of last month’s decline was thanks to a deceleration in transportation and shelter prices. Although gasoline prices rose 22.1% year-over-year compared to July’s annualized 35.6% gain, on a monthly basis, though, Canadians paid 9.6% less at the pump, marking the sharpest monthly drop since April 2020. Much of last month’s decline was due to higher global crude production, as well as a weakening in refining margins.

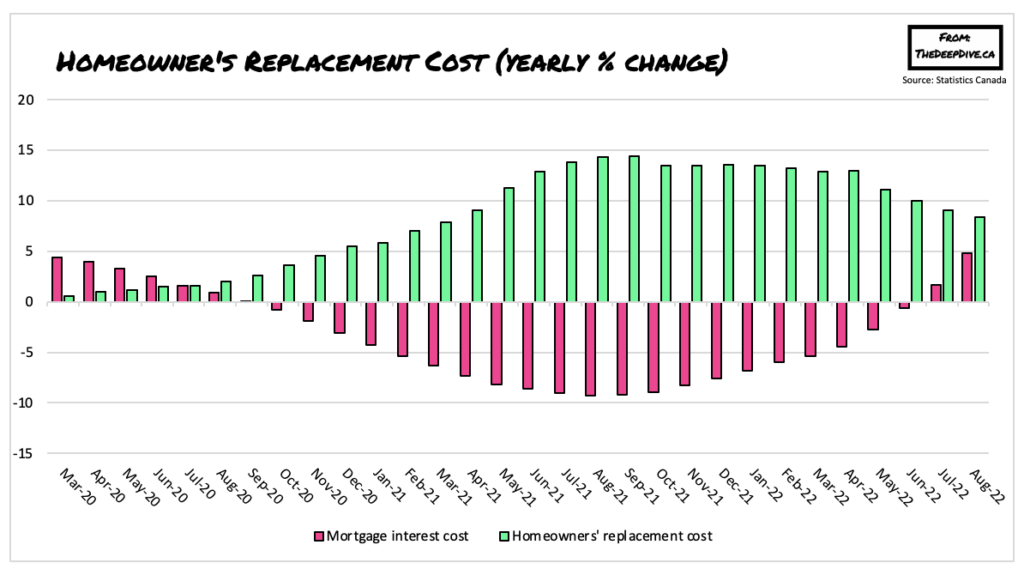

Thanks to tightening monetary policy by the Bank of Canada, the year-over-year growth in shelter prices slowed to 6.6% in August, while owned accommodation expenses, such as commissions on the sale of real estate, decelerated from 9.7% in July to 7.4%. Likewise, the homeowners’ replacement cost index also slowed to 8.4% last month. On the other hand, though, the mortgage interest cost index rose from 1.7% in July to 4.8%, coinciding with inflated bond yields and rising mortgage rates.

Higher interest rates are rapidly cooling Canada’s housing market, and with that, homeowners are grappling with rising mortgages, which is eroding away at disposable income that otherwise could have been spent on other goods and services. Following an increase of 7% in July, price growth for durable goods decelerated to 6% in August. Household appliances, such as refrigerators, freezers, and laundry and dishwashing appliances rose 9%, compared to a 11.5% gain in the month prior, thanks to lower consumer demand.

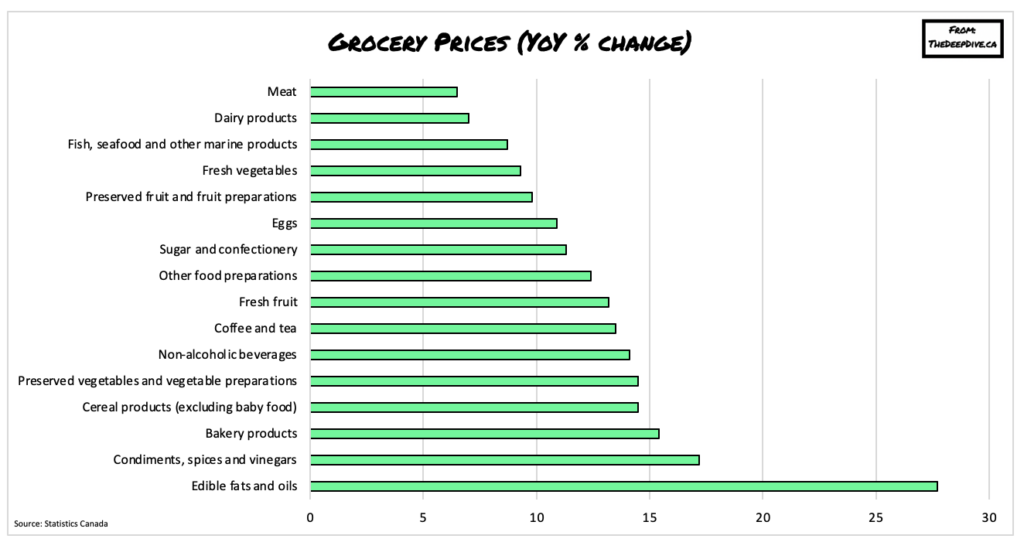

But, the most ominous indication that the Bank of Canada still has a long and tough road ahead in taming consumer prices is the continued rapid acceleration in food costs. Statistics Canada reported that prices for food purchased from stores rose from an annualized 10.8% in July to 11.9% last month, marking the sharpest increase since 1981. Rising food prices were broad-based, as Canadians paid 6.5% more for meat compared to August 2021, 7% more for dairy products, and 15.4% more for bakery products. Seafood was up 8.7%, Fresh fruit rose 13.2%, sugar and confectionary was up by 11.3%, condiments, spices, and vinegars rose 17.2%, and alcoholic beverages jumped 14.1%.

Information for this briefing was found via Statistics Canada. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.