President Donald Trump’s latest pronouncement on a possible 25% tariff on copper imports has roiled global metals markets, fueling an intensifying price surge on the New York Comex and driving a wedge between US futures and global benchmarks in London and Shanghai.

“I have also imposed a 25% tariff on foreign aluminum, copper and steel. Tariffs are about making America rich again. It is happening and it will happen rather quickly,” Trump told Congress despite no formal confirmation that the measure will take effect.

Trump needs to be very careful now—reckless moves like this risk seriously damaging his economy. No strategy, just raw emotion and strongman greed.#copper pic.twitter.com/oO8eMvuqfr

— Alexander Stahel 🌻 (@BurggrabenH) March 5, 2025

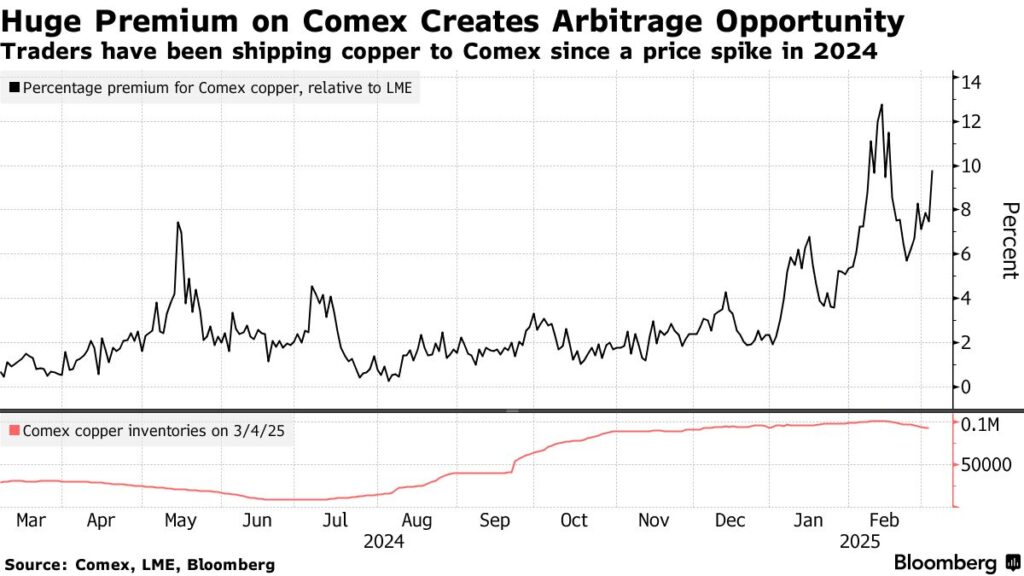

Market watchers note that Comex copper has been trading at a premium to the London Metal Exchange and Shanghai Futures Exchange for months, but Trump’s comments have significantly widened that gap. After the president’s remarks, prices on the Comex vaulted above $10,000 a ton, while London and Shanghai trailed by several hundred dollars.

This arbitrage window has prompted a rush to secure copper in overseas markets and ship it stateside before any tariffs materialize. Warehouse data show rising requests to withdraw metal from LME facilities, alongside dwindling inventories in Comex-registered warehouses.

Skeptics of Trump’s plan argue that copper, more so than steel or aluminum, is deeply enmeshed in a range of critical manufacturing sectors—including electronics, automobiles, and construction—and that any levies could stifle US businesses rather than protect them.

Adding to the uncertainty is the timeline for the Commerce Department’s investigation into copper imports, launched under Section 232 of the Trade Expansion Act. That inquiry has only just begun, so formal action could take months—unless the White House moves unilaterally, as Trump implied in his speech. Market participants recall a similar path with steel and aluminum, where the administration imposed tariffs under the national security guise, then swiftly tightened those measures without providing significant exemptions.

READ: Make Copper Great Again? Trump Admin Mulls Tariffs On Copper

Commerce Secretary Howard Lutnick said that the initiative is pitched as a national security measure to “bring production back” to America.

“It’s time for copper to come home,” Lutnick said.

Data compiled by LSEG show that around half of US copper demand is met by imports, predominantly from Chile, Canada, and Peru. American smelters have long struggled under higher labor costs and stricter environmental regulations, causing the domestic industry to shrink dramatically since its heyday in the mid-20th century.

Should the tariffs push through, significant hurdles remain in reviving domestic production. Industry experts note it can take 10+ years and over $5 billion to develop a new copper mine from scratch.

Information for this story was found via Bloomberg and the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.