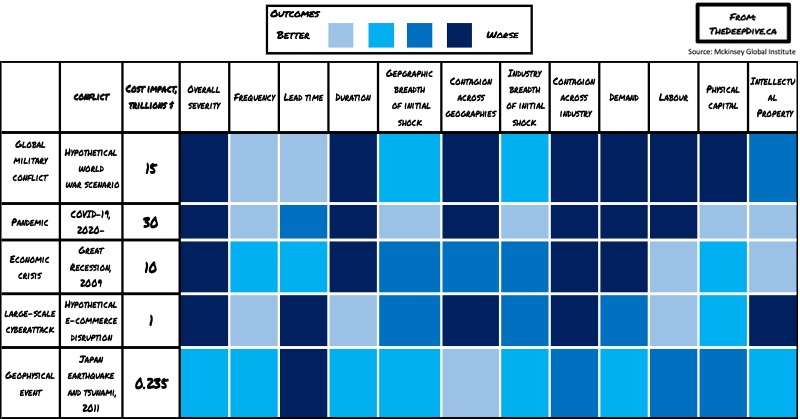

If production disruptions last for a span of at least 100 days amid the coronavirus pandemic, it could cost the global economy a total of $30 trillion. This alarming projection was released by the McKinsey Global Institute, which researched various hypothetical global catastrophic scenarios, such as military conflicts, cyber attacks, and trade rows.

The US consulting firm hypothetically analyzed a wide range of possible scenarios, and their implications on the overall global economy. It turns out that a world war conflict could amount to approximately $15 trillion in economic damages; however, the coronavirus pandemic could amount to a staggering $30 trillion, double the amount of damage. Meanwhile, the cost of the Great Recession is estimated to amount to $10 trillion, making the coronavirus three times as more detrimental.

After analyzing the financial situations of 325 companies across a total of 13 industries, the McKinsey Global Institute also found that disruptions to value chains could amount to over 40% of profits each decade. However, a single event as severe as the coronavirus pandemic lasting for more than 100 days could wipe out up to a full year’s worth of earnings for some industries.

The report rates labour-intensive value chains to be the most susceptible to the implications stemming from a pandemic, especially for those companies focused on the production of apparel. Currently, apparel production accounts for the largest portion of employment, which provides over 25 million jobs across the globe.

Information for this briefing was found via the McKinsey Global Institute. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.